Reviews

Capital One Quicksilver Secured Cash Rewards Card: check out how to apply!

Learn how to apply without hurting your credit score to a card that rewards you as you build credit to jump to an unsecured card!

Advertisement

Capital One Quicksilver Secured Cash Rewards Card: a card that combines build credit and a $0 annuity fee

Indeed, if you are looking for a card to build credit, here is an excellent option. Apply to the Capital One Quicksilver Secured Cash Rewards Card and get 1.5% unlimited cashback on all purchases.

Below, learn about some of the basic prerequisites to apply for this card:

- Live in the US or in a US military zone;

- Be over 18 years of age and have a Social Security Number or Individual Taxpayer Identification Number;

- Not having an unpaid bankruptcy;

- No pending issues with Capital One;

- Not having applied for any Capital One card 3 times or more in the last 45 days.

Do you have what it takes? So, here’s how to apply for the Capital One Quicksilver Secured Cash Rewards Card:

How to apply on the website

To apply, simply visit the Capital One Quicksilver Secured Cash Rewards Card official website. On the first page, click the “See if I’m pre-approved” button.

You will then have access to a pre-qualification form. This option allows you to know if the card will be accepted before validating your application.

The big advantage here is that this feature does not harm your credit. In addition, Capital One consults more than one card together.

So you can know which of the cards from that agency are available to you. In this process, you must provide personal data, address, and income.

At the end of the pre-submission, you will know which Capital One cards you are eligible for. Then, you must confirm all information to complete your application.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

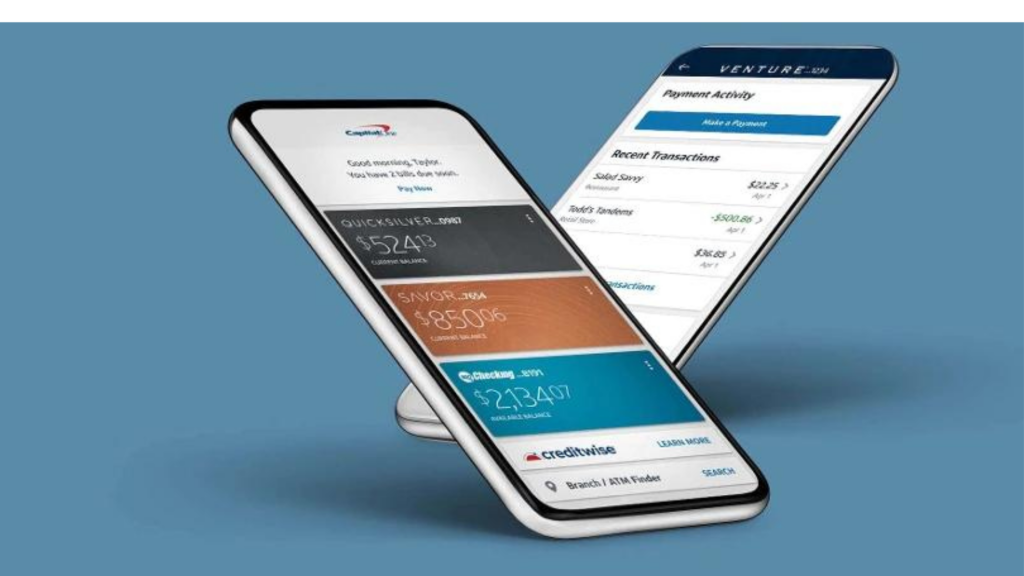

How to apply using a mobile app

Capital One customers can manage their cards from their cell phones. To do this, simply download the “Capital One Mobile” application for free.

This app allows for payments, account management, and checking your credit score. However, this app does not support apps. Therefore, to apply, you must access the official website of this Capital One.

Capital One Quicksilver Secured Cash Rewards vs. GO2bank™ Secured Visa®: choose which one is best for you

We have selected two secured cards available on the market so that you can learn about other available options. So, look at the table below and compare them to decide which one is most interesting for you:

| Capital One Quicksilver Secured Cash Rewards | GO2bank™ Secured Visa® | |

| Credit Score | Fair (between 580 and 669) | Bad |

| Annual Fee | $0 | $0 |

| Regular APR | 26.99% (variable for puchases) | 22.99% (fixed) |

| Welcome bonus | None | None |

| Rewards | 1.5% unlimited cash back on all other purchases (while your account is open) | None |

Does GO2bank™ Secured Visa® sound like a good option? Find out how to apply for this card in our post below!

GO2bank™ Secured Visa® Card: check out how to apply!

Here is a great credit product for anyone who needs to build credit with the advantage of no annual fee. Apply for the GO2bank™ Secured Visa® Card to get these benefits.

Trending Topics

MoneyLion Loans Review: Unlock Easy Credit Building

Learn how you can boost your credit score and have access to exclusive perks – including cash back – with our MoneyLion Loans review.

Keep Reading

Tarjeta Wells Fargo Active Cash®: ¿Cómo es?

La Tarjeta Wells Fargo Active Cash® te da 2% de recompensas en efectivo por todas tus compras. Además, tiene regalos de bienvenida ¡Conócela!

Keep Reading

Wells Fargo Reflect℠ Card full review: should you get it?

The Wells Fargo Reflect℠ Card has $0 annual fees and offers many benefits to its cardholders, such as insurance and more! Learn all about it!

Keep ReadingYou may also like

Flexible financing: Edfinancial Student Loan Refinance Review

Discover how Edfinancial Student Loan Refinance can help you break free from the shackles of student debt with our full review!

Keep Reading

Student BMO CashBack® Mastercard® credit card full review: should you get it?

A student card that feels premium: meet the Student BMO CashBack® Mastercard® credit card. Enjoy rewards without worrying about an annual fee!

Keep Reading

Citrus Loans: find out how to apply!

Apply to Citrus Loans and find several lenders who are willing to offer loans regardless of your credit score. Read to learn how to apply!

Keep Reading