Loans

How to apply for MoneyLion Loans: Simple Steps, Big Rewards

Ready to transform your financial health? Apply for MoneyLion Loans to enjoy easy credit building and unique benefits. Start your journey today!

Advertisement

Achieve financial freedom with MoneyLion’s seamless loan application process

Looking to apply for MoneyLion Loans? This opportunity might be your financial game-changer, offering a unique blend of features and accessibility.

Curious about the next steps? Our detailed article unveils the simplified process. So dive in to discover how MoneyLion can empower your financial journey!

Online application

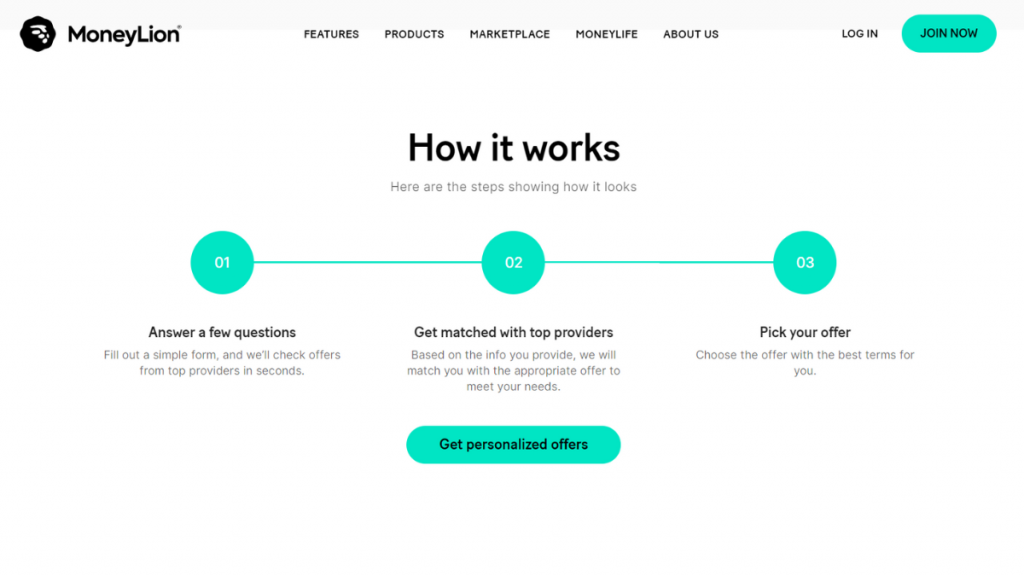

To apply for MoneyLion Loans, start by heading to their website. Before you can proceed, you’ll need to create a new account.

After setting up your account, explore the site to understand what’s available. This is undoubtedly your financial toolkit, waiting to be unlocked and put to good use.

Navigate to the ‘Loans’ section to uncover the specifics of what MoneyLion offers. It’s more than borrowing – it’s an opportunity for financial growth.

When ready, hit ‘Apply Now.’ Moreover, you’ll need to be logged in, ensuring a secure process. Your new account is your portal to these financial solutions.

Finally, complete the application with honest, clear details. Then, after submission, await MoneyLion’s response. Your path to financial health is now set in motion!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

In order to apply for MoneyLion Loans, you need to meet some standard requirements, which are:

- Must be at least 18 years old, a legal adult in most states.

- U.S. citizenship or permanent residency is mandatory.

- A valid Social Security number is non-negotiable.

- Proof of stable income ensures you can handle repayment.

- An active bank account, open for 60 days or more, with a solid transaction history.

- Also, the account must be in good standing – no overdrafts or negative balances.

- No hard credit check is required, welcome low scores.

- Availability varies; not offered in some states (e.g., Indiana, Iowa, Montana).

Apply on the app

You can also apply for MoneyLion Loans via mobile app. Start by downloading the MoneyLion app from Google Play or the App Store.

Easy navigation awaits you for a hassle-free loan journey.

Hit ‘Sign Up’ and enter basic details. Accuracy is key to a smooth, personalized MoneyLion experience, setting the stage for financial success.

Navigate to loans, pick your amount, review the terms, and submit! A few taps on your phone and financial support could be heading your way.

Compare the MoneyLion Loans to other options: OppLoans Personal Loans

Without a doubt, MoneyLion Loans has carved a niche for itself, offering tailored solutions for diverse financial needs.

However, another notable contender is OppLoans Personal Loans, which presents an equally compelling suite of financial products.

Indeed, with OppLoans, borrowers can anticipate flexible terms and a user-friendly approach, reshaping the lending experience.

| MoneyLion Loans | OppLoans Personal Loans | |

| APR | Depending on your existing credit status, you could see rates anywhere from 5.99% to 29.99% | A steep fixed rate at 160%. |

| Loan Purpose | Establish and strengthen your credit score, but you can use available funds for whatever need you may have. | Any purpose you may have. |

| Loan Amounts | Borrowers can apply for a maximum of $1,000 in funds. | Loan amounts between $500 and $4,000 are available. |

| Credit Needed | There are no minimum requirements since there are no credit checks. | All credit levels are welcome to apply. |

| Origination Fee | None. | None. |

| Late Fee | Does not apply. | There are no late fees attached to OppLoans. |

| Early Payoff Penalty | None. | You can repay your loan anytime without extra charges. |

Intrigued by OppLoans? Then delve deeper into their offerings. Further, explore more and discover how to apply in the link below.

How to apply for OppLoans Personal Loans

Ready to uplift your finances? Apply for the OppLoans Personal Loans for swift funds and transparent terms with no hard credit checks.

Trending Topics

Empower Your Education: Select from the Best Student Loans

Select one of the best student loans to make higher education accessible and discover key insights for navigating the borrowing process.

Keep Reading

Affordable options: Aidvantage Student Loan Refinance Review

Find out why Aidvantage Student Loan Refinance is the ideal solution for managing your loan payments with this full review.

Keep Reading

Buy cheap Allegiant Air flights: easy step by step

Find out how to buy cheap tickets for flights on Allegiant Air, an option consolidated as one of the most economical on the market.

Keep ReadingYou may also like

Capital One Platinum Secured credit card full review: should you get it?

Capital One Platinum Secured credit card is an excellent tool to build credit with excellent perks like a $1,000 limit. Find out here!

Keep Reading

Calculating Your Retirement Savings: How Much Money Do You Need?

Do you wonder how much money do you need for retirement? If so, we can help you find out and get the best retirement!

Keep Reading

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Keep Reading