Reviews

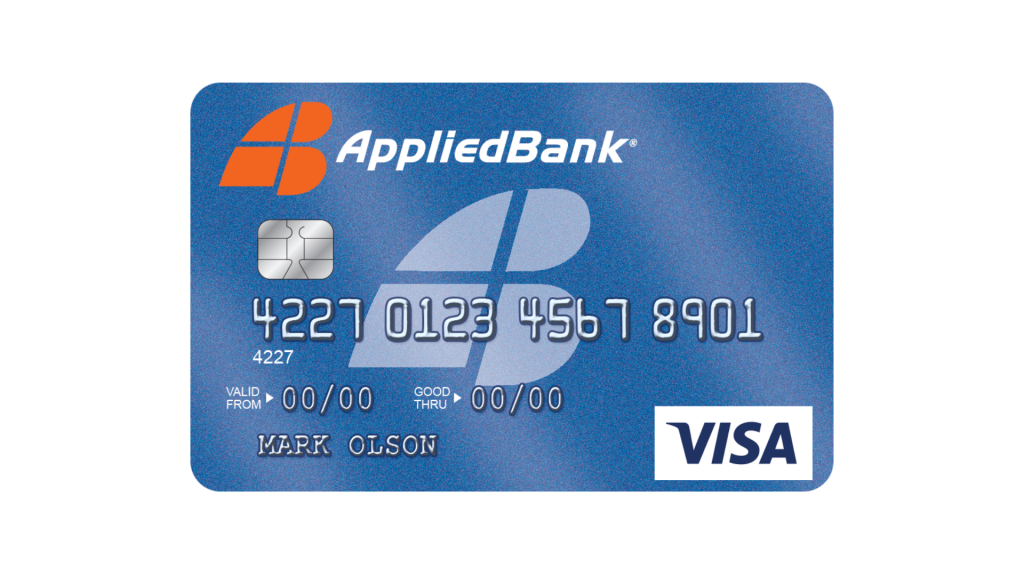

Applied Bank® Unsecured Classic Visa® credit card full review: should you get it?

Complete review of the Applied Bank® Unsecured Classic Visa®, an excellent card option for anyone who needs to build or rebuild credit to earn the trust of card issuing agencies.

Advertisement

Applied Bank® Unsecured Classic Visa® credit card: a helping hand to build your credit in difficult times

In fact, anyone who has bad credit or hasn’t started building it knows how hard it is to find a credit card. However, there are cards that are experts at getting you out of a situation like this. Undoubtedly, one of the main ones is the Applied Bank® Unsecured Classic Visa® credit card. Is this card the help you need?

Find out today: read this full review and analyze this credit option in depth.

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Build your credit with monthly reports for the 3 largest credit agencies in the country and have a limit of up to R$ 300 at your disposal! Learn how to get the Applied Bank® Unsecured Classic Visa® card.

| Credit Score | From bad to excellent (300-850) |

| Annual Fee | $75 for the first year. Then $45 in subsequent years |

| Regular APR | 29.99% (fixed) |

| Welcome bonus | None |

| Rewards | None |

Applied Bank® Unsecured Classic Visa® credit card: learn more about this financial product

A card that automatically has an entry limit of $300. Indeed, this is one of the main signs of the trust that the Applied Bank® Unsecured Classic Visa® card has in its customers. Also, you don’t need to make an initial deposit to access your account.

Thus, this is another great advantage, especially for those who do not have reservations to make a deposit as required on Secured cards. In addition, with this card, you have monthly payment reports for the main credit agencies in the country.

That way, it’s easy to build (or rebuild) your credit much faster. The Applied Bank® Unsecured Classic Visa® card also offers a pre-qualification service.

That way, you will be able to know if you will be approved for this card before you formalize your order. In fact, this is a great measure to protect your credit from queries that can further hurt your score.

This card also offers a 3% foreign transfer fee, which is the market average. Finally, you can still bring balance from other cards by paying $10 or 5%.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Applied Bank® Unsecured Classic Visa® credit card features

In fact, you can only make a good decision when you know the advantages and disadvantages of a choice.

That’s why we’ve separated here the pros and cons of having an Applied Bank® Unsecured Classic Visa® card in your wallet. Is this the best option for you? Check out the lists below.

What are the benefits?

- Responds to the three major credit bureaus on monthly reports, which can build your credit faster;

- Accepts people with any credit score (including those who don’t);

- Offers an initial limit of up to $300;

- Pre-qualify before applying to avoid difficult inquiries, which can lower your credit score.

What are the drawbacks?

- Starting in the second year, you pay a monthly fee of $6.25;

- Charges an account opening fee of $89 if you are approved;

- There is no grace period, automatically after the purchase the value already incurs interest;

- It does not offer any rewards program.

What credit score do you need to get the Applied Bank® Unsecured Classic Visa® credit card?

An adjective that characterizes the Applied Bank® Unsecured Classic Visa® card very well is affordable. In effect, any score can be approved in the submission process.

That way, it doesn’t matter if your credit score is bad or excellent. Most likely you can have this card with ease. However, this one is more recommended for people with bad credit.

How does the Applied Bank® Unsecured Classic Visa® card application process work?

In fact, this credit card gives you the option to apply completely online. That way, you can sign up without leaving your home, cell phone or computer. So, if you want to know more about the application process, click on the following link:

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Build your credit with monthly reports for the 3 largest credit agencies in the country and have a limit of up to R$ 300 at your disposal! Learn how to get the Applied Bank® Unsecured Classic Visa® card.

Trending Topics

Chime Visa® debit card: check out how to apply!

Apply for the Chime Visa® debit card and get a fee-free debit card that allows you to control your financial life from your cell phone.

Keep Reading

Government food benefits: get the help you need

Government food benefits can be a chance to put food on the table without paying anything. Read on to learn more about these benefits!

Keep Reading

Get the best personal loans: Best Egg Loan review

Do you need a loan to meet your personal needs with good terms up to $50,000? If so, read our Best Egg Loan review to learn more!

Keep ReadingYou may also like

The three types of income: learn more about them

Get to know the main types of income and understand why diversifying your income sources is so important. Read on to learn more!

Keep Reading

Secured Sable ONE Credit Card full review: should you get it?

Meet a revolutionary card called the Secured Sable ONE Credit Card: accelerated credit building with no annual fee. Read on to learn more!

Keep Reading

Sallie Mae Student Loan review: for students with low credit

!Sallie Mae Student Loan is your opportunity to get 100% funding for your studies with relatively low APRs. Learn more about this service

Keep Reading