Loans

Financial freedom: Apply for Citizens Bank Student Loan Refinance

Take charge of your student debt with Citizens Bank Student Loan Refinance: Enjoy lower rates and smart repayment plans!

Advertisement

Simplify Your Student Loan Refinancing: Apply with Citizens Bank

If you’re eager to reduce your monthly payments and secure better interest rates to pay off your student debt, apply for Citizens Bank Student Loan Refinance!

Following, we’ll walk you through the step-by-step process of applying for Citizens Bank Student Loan Refinance to save money and get peace of mind.

Online application

When you apply for Citizens Bank Student Loan Refinance, it can lead to significant savings and streamlined loan management. This is how you do it:

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

1. Create an Account on the Citizens Bank Website

Firstly, visit the Citizens Bank website and create an account. Then, you’ll create a login and choose a password to access their online platform.

2. Prequalify with No Impact on Credit Score to Check Rates

Citizens Bank offers a convenient prequalification tool. Thus, you can check your eligibility and potential interest rates without affecting your credit score.

3. Fill Out the Official Application Form

Once you’ve prequalified and reviewed the rates, proceed to the official application form. Eventually, this form will require more detailed information about you.

4. Receive the Final Offer

Subsequently, after submitting your application, the Citizens Bank team will review your information and credit history.

Overall, this process typically takes a few business days.

Once the review is complete, you’ll receive a final loan offer with the specific rates, terms, and repayment options tailored to your financial profile.

Finally, take the time to carefully review the loan offer and see if it fits your goals and your budget.

5. Provide Additional Documentation and Close the Deal

As soon as you accept the loan offer, you may be required to submit additional documentation to finalize the refinancing process.

So, follow the instructions provided by Citizens Bank to ensure a smooth and efficient completion of the process.

6. Citizens Bank Pays Your Previous Student Loans

Once your application is approved and all required documents are verified, Citizens Bank will pay off your previous student loans on your behalf.

With your old loans paid off, you’ll begin making monthly payments on your new loan with Citizens Bank.

What are the requirements?

To qualify for refinancing, applicants typically need a mid-to-high 600s or above credit score, demonstrating a solid credit history and responsible financial habits.

Moreover, stable employment and a steady source of income are crucial to showcase your ability to repay the new loan.

Also, the refinanced loan must be an eligible federal or private student loan. Once you meet these eligibility criteria, you can confidently proceed with the application.

Compare the Citizens Bank Student Loan Refinance to other options: Discover Student Loan Refinance

Two prominent names to consider if you’re looking for the best student loan refinancing options are Citizens Bank and Discover.

Both financial institutions offer competitive refinancing solutions tailored to your unique needs.

| Citizens Bank Student Loan Refinance | Discover Student Loan Refinance | |

| APR | From 6.80% up to 12,17%, you can opt for fixed rates or variable rates; | Between 5.99% and 11.37%; |

| Terms | 5 to 20 years; | 10 to 20 years; |

| Loan Amounts | A minimum of $10,000 and a maximum of $750,000 – it depends on the type of student loan you’re refinancing; | Minimum of $5,000 and up to the total amount of your student loan; |

| Credit Needed | Good or Excellent; | Good or Excellent credit score; |

| Origination Fee | Citizens Bank charges no origination or initiation fee; | No origination fee; |

| Late Fee | You must pay a 5% fee if you delay your monthly payment; | No late fees will be charged; |

| Early Payoff Penalty | No prepayment fee. | You can pay your loan earlier with no penalty. |

If you’re interested in learning about Discover Student Loan Refinance service, you can click on the link below to read our full review about it!

Apply for Discover Student Loan Refinance

Ready to conquer student debt? Learn how to apply for Discover Student Loan Refinance and pave the way to stress relief!

Trending Topics

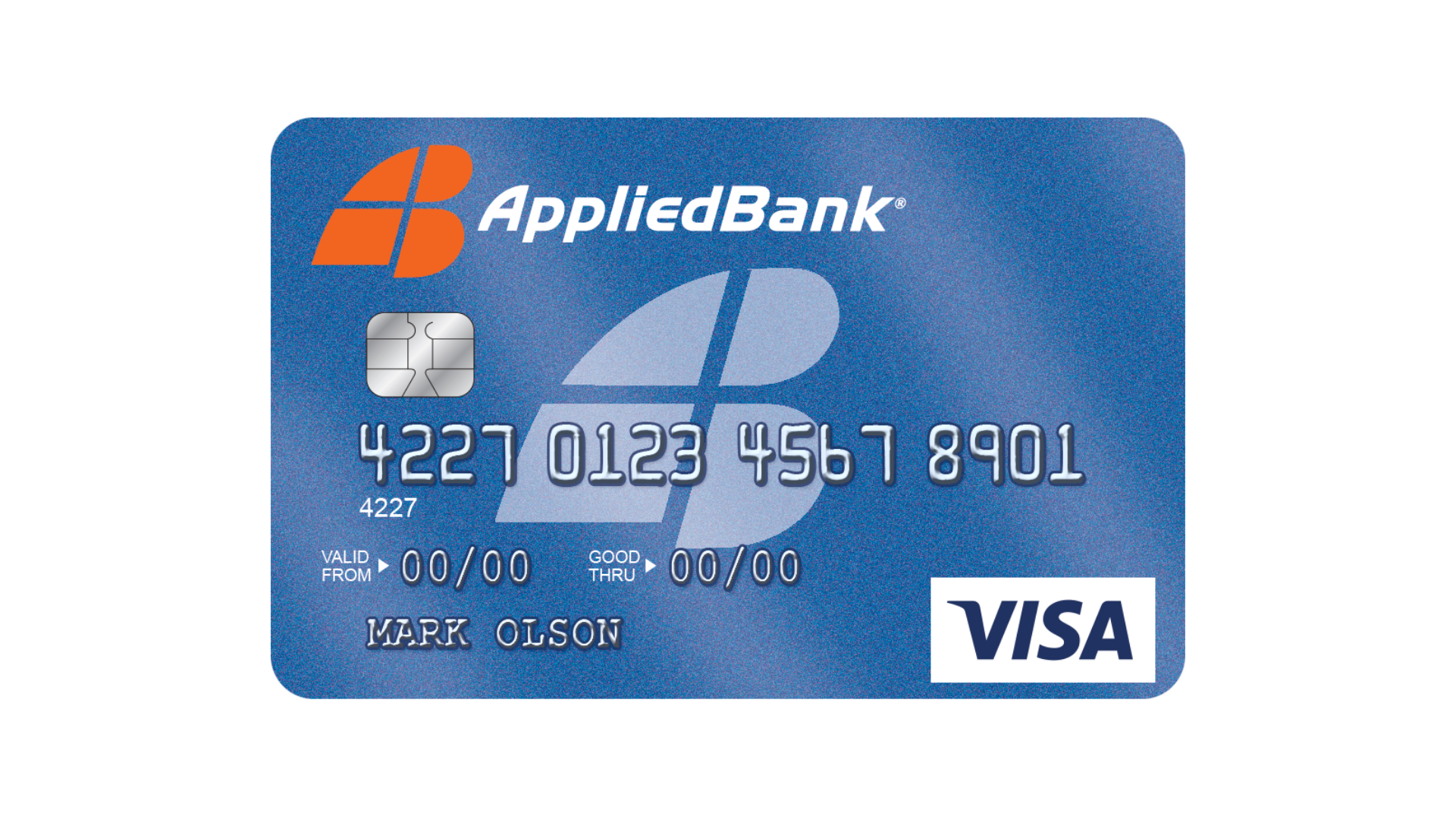

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Find out if you can have your Applied Bank® Unsecured Classic Visa® card in only 60 seconds without damaging your credit: learn how to apply.

Keep Reading

Apply for Pheabs Loans: Fast Cash for Urgent Needs

Learn how to apply for Pheabs Loans and get quick, easy access to funds with flexible repayment options, ideal for any financial need.

Keep Reading

Upstart Loan review: Up to $50,000!

Are you looking for a loan of up to $50,000 with competitive rates and good terms? If so, you can read our Upstart Loan review to learn more!

Keep ReadingYou may also like

Citi® Secured Mastercard®: check out how to apply!

Apply for a Citi® Secured Mastercard® and you'll have a great tool to build your credit without paying an annual fee. Learn more!

Keep Reading

Apply for CashNetUSA: Swift, Easy Loan Access

Learn how to easily apply for CashNetUSA with our guidance for quick, user-friendly loan processing and responsive customer support.

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card full review: should you get it?

Petal® 1 "No Annual Fee" Visa® Credit Card offers up to a $5,000 limit and 10% cash back for people with bad credit. Learn more here!

Keep Reading