Loans

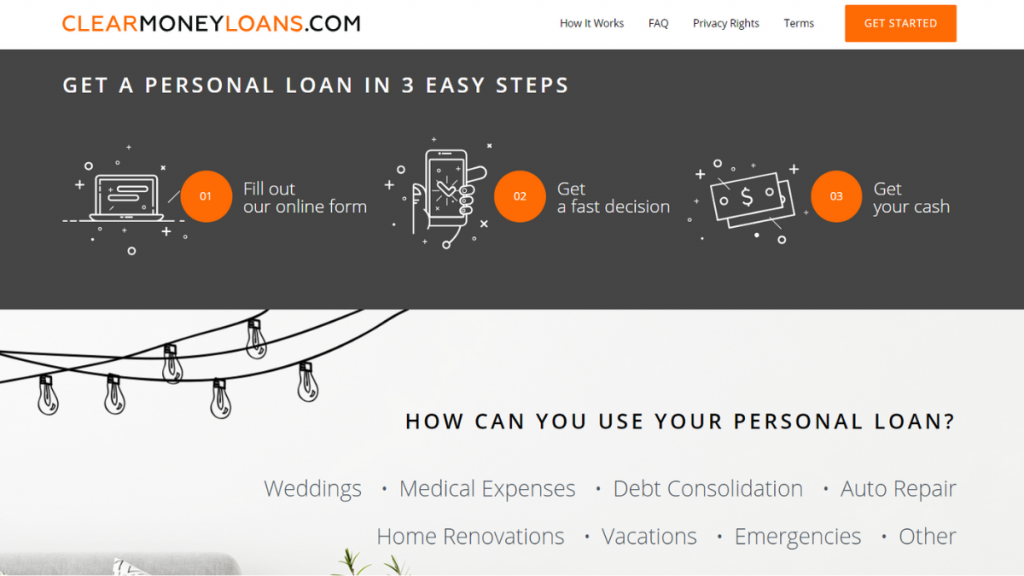

Apply for the Clear Money Loans: Quick Cash Access

Whether you're consolidating debt or financing a big purchase, see how their inclusive credit approach can help you secure up to $35,000.

Advertisement

Seamless loan process for all credits — get funds fast with Clear Money Loans

Embarking on the path to financial stability begins when you apply for the Clear Money Loans. With our detailed guide, you’ll navigate the application process with ease.

Curious about each step? Our article below walks you through them, ensuring you have all the knowledge you need to proceed with confidence.

Online application

Firstly, visit the Clear Money Loans website and initiate your application. Then, click on ‘Get Started’ to apply for the Clear Money Loans and enter a world of possibilities.

Detail your financial situation by selecting the appropriate loan amount and term. Clear Money Loans tailors options to fit your specific financial strategy.

Then, provide your personal and financial information in the application form. Accuracy is crucial for Clear Money Loans to match you with the right lender.

Moreover, take a moment to review all the loan terms Clear Money Loans offers. Understanding your repayment plan is essential for a comfortable financial future.

Submit your application and anticipate a prompt reply. Clear Money Loans streamlines the process in order to quickly connect you with potential lenders.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Get ready to provide proof of income to validate your ability to repay the loan.

- You’ll need an active bank account for the loan deposit and repayment transactions.

- Applicants must be at least 18 years old and legal residents or citizens of the U.S.

- A government-issued ID will be necessary to confirm your identity during the process.

- A reasonable debt-to-income ratio may be required to ensure you can manage the loan repayments.

- Stable employment or a consistent income source is crucial for approval.

Apply on the app

You can’t apply for the Clear Money Loans through a mobile app; they haven’t developed one yet. But their process isn’t slowed down by this at all.

Instead, their website is fully optimized for mobile devices. It ensures a seamless experience when you want to check on your loan options on the go.

This mobile-friendly design means that anywhere you are, you can navigate the site with ease to apply for Clear Money Loans efficiently.

Compare the Clear Money Loans to other options: Oportun Personal Loans

Clear Money Loans stands out with its flexible credit requirements and quick funding, perfect for immediate financial needs.

However, if Clear Money Loans doesn’t match your criteria, there are other options.

Oportun Personal Loans offer an alternative with competitive rates and inclusive lending policies.

Oportun Personal Loans are known for their no-credit-history necessity and a potential for lower-than-average APRs, making them accessible to many.

| Clear Money Loans | Oportun Personal Loans | |

| APR | The APR for Clear Money Loans can vary widely, with rates ranging from as low as 3.09% to as high as 35.99% | Between 29.00% – 35.95%. |

| Loan Purpose | Clear Money Loans can be used for a variety of purposes, including weddings, medical expenses, vacations, and more. | Medical bills, unexpected expenses, home improvement, car repairs, and more. |

| Loan Amounts | You can apply for loan amounts ranging from $1,000 to $35,000, providing flexibility for all financial needs. | Borrowers can request funds between $300 and $10,000 with unsecured loans. $2,525 to $18,500 with a vehicle as collateral. |

| Credit Needed | Clear Money Loans accepts applications from people with all credit scores, making it an accessible option for many. | There are no minimum requirements. |

| Origination Fee | The origination fee for Clear Money Loans depends on the lender you are matched with through their service. | Between 0% and 8%. |

| Late Fee | Similarly, the late fee is also dependent on the lender and will be specified in the loan terms upon approval. | Between $5 and $15. |

| Early Payoff Penalty | Whether there is an early payoff penalty or not will again depend on the individual lender’s terms. | None. You can settle your loan anytime. |

So, ready to discover the ins and outs of Oportun Personal Loans and understand their application process? Then check the link below for a comprehensive guide.

Apply for the Oportun Personal Loans: Fast Approvals

Ready to elevate your finances? Learn how to apply for the Oportun Personal Loans for tailored rates and a smooth borrowing experience!

Trending Topics

KOHO Visa Prepaid Card: check out how to apply!

Choose your credit limit and get 0.5% cashback on all your purchases. Click here to learn how to apply for the KOHO Visa Prepaid Card.

Keep Reading

Tackle Your Debt: SoFi Student Loan Refinance Review

Worried about student loan interest? A SoFi Student Loan Refinance option could be the answer you've been seeking in this review!

Keep Reading

Choose the best flight deal for your next trip

The internet is full of tools for anyone looking to find the best flight deal. Learn how to use them to fly even for free!

Keep ReadingYou may also like

Don’t make these 7 common budgeting mistakes

Some budgeting mistakes can stand in the way of you and your financial goals. Read on to learn how to identify and fight them!

Keep Reading

Supplemental Security Income (SSI): see if you meet the requirements

Supplemental Security Income (SSI) is one of the programs that generate a better quality of life for people in need. Learn all about it here!

Keep Reading

Capital One Platinum Secured card: check out how to apply!

Apply for the Capital One Platinum Secured and get a card designed to help you build credit without paying an annual fee. Learn more here!

Keep Reading