Loans

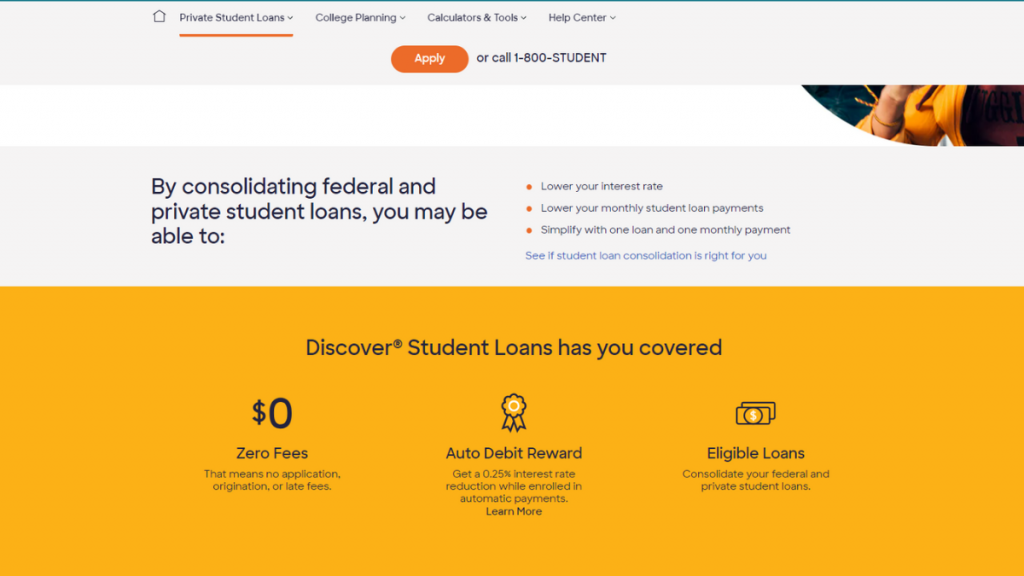

Get Debt-Free: Apply for Discover Student Loan Refinance

Take charge of your financial destiny - apply for Discover Student Loan Refinance and transform your student debt journey. Low rates and more!

Advertisement

Don’t Let Debt Hold You Back: Apply for Discover Student Loan Refinance Today

Are you ready to conquer your student debt? So apply for Discover Student Loan Refinance – it might be the transformative step you’ve been waiting for.

From lower rates to simplified repayment plans, this refinancing option offers numerous perks for borrowers seeking relief. Hence, learn how to apply online for it!

Online application: apply online for Discover Student Loan Refinance

Applying for a loan is easier than ever with online application processes. Similarly, Discover is no different!

Next, check our application guide and apply from the comfort of your home:

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

1. Gather Your Financial Information

To begin applying for this student loan refinance, gather all the essential financial documents.

Collect your Social Security number, employment details, monthly income, and specific details of your existing student loans.

2. Access Discover’s Official Website

Once you have all your financial documents, access their official website.

Then, navigate to the student loan refinancing section by clicking the “Apply Now” button.

3. Complete the Application Form

Once you are on the application page, fill in all your details, such as your name, address, contact information, and date of birth.

4. Provide Employment and Income Details

Further, furnish your current employment status, employer details, and monthly income.

Indeed, these particulars play a vital role in assessing your capacity to manage the refinanced loan.

5. Enter Your Loan Information

Next, enter the necessary details for each student loan you wish to refinance with Discover.

Moreover, include loan account numbers, outstanding balances, and current interest rates for a comprehensive assessment.

6. Choose Your Ideal Loan Terms

Finally, it’s time to select your preferred repayment length and monthly payment amount.

Consider your financial goals and capacity to ensure the most suitable terms for your needs.

Completing the process

If your application is approved, you will receive notification of the loan terms, including the interest rate and repayment plan. So take the time to review the terms.

Upon accepting the loan terms, you may be required to sign the loan agreement electronically. So, review it thoroughly to understand your responsibilities.

Finally, after completing all the necessary steps, the loan funds will be disbursed.

It will use the funds to pay off your existing loans, and you’ll begin making payments on your new Student Loan Refinance.

What are the requirements?

To be eligible for this lender, applicants typically need a good credit history, a stable income, U.S. citizenship, permanent residency, or a valid visa status.

Also, completing their degree programs is often required, and borrowers must know that refinancing federal loans may result in losing federal loan benefits.

In addition, each applicant’s creditworthiness and financial profile will be evaluated to determine eligibility, and specific terms may vary based on Discover’s criteria and policies.

Apply on the app

You can apply for the Discover Student Loan Refinance on their website or by calling 1-800-STUDENT.

Compare the Discover Student Loan Refinance to other options: Aspire Student Loan Refinance

Both lenders are reliable options for managing student debt.

Discover refinances federal and private loans with competitive rates, but you may lose federal benefits.

On the other hand, Aspire focuses on refinancing federal loans, offering flexible options and personalized service. The right choice depends on individual needs and eligibility.

| Discover Student Loan Refinance | Aspire Student Loan Refinance | |

| APR | Between 5.99% and 11.37%; | Interest rates can vary between 5.3% to 7.18%, based on your loan provider and creditworthiness; |

| Terms | 10 to 20 years; | Up to 20 years; |

| Loan Amounts | Minimum $5,000 and up to the total amount of your student loan; | From $5,000 up to $250,000; |

| Credit Needed | Good or Excellent credit score; | Good credit score; |

| Origination Fee | No origination fee; | No origination fee; |

| Late Fee | No late fees will be charged; | N/A; |

| Early Payoff Penalty | You can pay your loan earlier with no penalty. | N/A. |

Check our full review on the following link and get every information you need about Aspire Student Loan Refinance!

Lower Rates: Apply for Aspire Student Loan Refinance!

Ready to break free from student debt stress? Learning how to apply for Aspire Student Loan Refinance can lighten your load.

Trending Topics

The three types of income: learn more about them

Get to know the main types of income and understand why diversifying your income sources is so important. Read on to learn more!

Keep Reading

How Many Mortgages Can You Have? Diversify Your Investments

Explore the limits and factors affecting how many mortgages you can have. Dive into expert insights and make informed property decisions.

Keep Reading

Earned Income Tax Credit (EITC): see if you qualify for the program

There is a federal program that allows you to recover your taxes. Click here to learn more about the Earned Income Tax Credit (EITC).

Keep ReadingYou may also like

Mission Money™ debit card full review: should you get it?

The Mission Money™ is a great no-fee debit card. Find out how this card can save you money and provide you with many benefits!

Keep Reading

Citi® Secured Mastercard® full review: should you get it?

The Citi® Secured Mastercard® is a credit-building option you need to know about: monthly reports to credit bureaus and no annual fee!

Keep Reading

BMO CashBack® Mastercard® card: check out how to apply!

Learn how to apply for BMO CashBack® Mastercard®, the no-fee card chosen among the best cashback programs of 2021 according to experts.

Keep Reading