Loans

How to apply for OppLoans Personal Loans: No score impact!

Take control of your financial future - apply for OppLoans Personal Loans. Experience fast funding, clear-cut conditions to strengthen your credit.

Advertisement

Get the money you need fast, and without hurting your credit

Deciding to apply for OppLoans Personal Loans is the first step towards financial ease. The process is straightforward, and the immediate advantages are plenty.

The application opens doors to more than cash — it’s a step toward financial empowerment. So, are you intrigued? Then read on to discover the full story below!

Online application

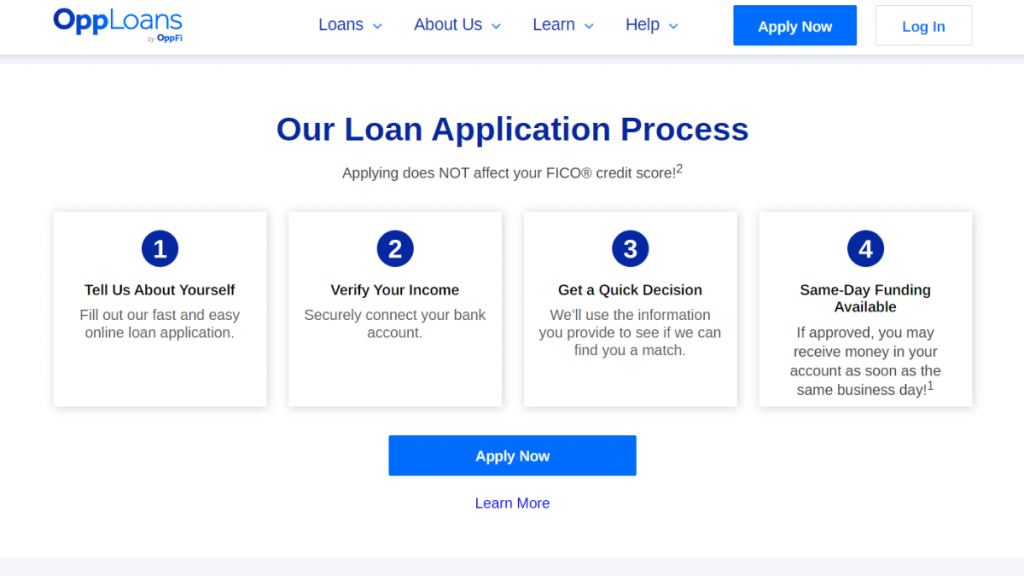

Firstly, to apply for the OppLoans Personal Loans, visit their website, where simplicity and guidance meet. There, you’ll begin your path to financial well-being with confidence.

Your first step involves creating an account. This step isn’t just administrative; it’s your personal portal for accessing OppLoans and monitoring your progress.

The application requires providing essential personal, employment, and financial information. Moreover, OppLoans prioritizes security, ensuring your privacy at every step.

Applying for OppLoans Personal Loans is more than just filling out forms; the process is designed to be streamlined, respecting your time and effort.

Quick feedback is a hallmark of OppLoans, so you won’t be left waiting in suspense. Fast responses allow you to plan ahead, knowing the funds you need will be available.

Once approved, your funds are often available in your account on the same day.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Age: All Opploans potential applicants must be at least 18 years old.

- Bank account: You need an active bank account, either checking or savings.

- State residency: You must reside in one of the states where OppLoans offers its services.

- Income source: You must have a dependable income source, such as employment or benefits like Social Security or Disability.

- Direct deposit: Your income should be received via direct deposit, ensuring a consistent flow of funds.

Apply on the app

Unfortunately, you cannot use an app to apply for the OppLoans Personal Loans because they don’t have one available. Their process is entirely web-based.

However, rest assured that their website is optimized for mobile use, making it accessible on various devices for your convenience.

Compare OppLoans Personal Loans to other options: Oportun Personal Loans

OppLoans Personal Loans is a quick funding option with flexible terms. It’s especially viable for those who’ve had credit challenges in the past.

But they’re not the only option! If you want to shop around first, consider Oportun Personal Loans. They also offer accessible loans to help with your financial needs.

Oportun is committed to providing affordable loans with clear terms, focusing on financial inclusion.

Moreover, they don’t have minimum score requirements, and you can use collateral.

| OppLoans Personal Loans | Oportun Personal Loans | |

| APR | A steep fixed rate of 160%. | Between 29.00% – 35.95%. |

| Loan Purpose | Any purpose you may have. | Medical bills, unexpected expenses, home improvement, car repairs, and more. |

| Loan Amounts | Loan amounts between $500 and $4,000 are available. | Borrowers can request funds between $300 and $10,000 with unsecured loans. $2,525 to $18,500 with a vehicle as collateral. |

| Credit Needed | All credit levels are welcome to apply. | There are no minimum requirements. |

| Origination Fee | None. | Between 0% and 8%. |

| Late Fee | There are no late fees attached to OppLoans. | Between $5 and $15. |

| Early Payoff Penalty | You can repay your loan anytime without extra charges. | None. You can settle your loan anytime. |

Interested in exploring loans with Oportun? Learn how to apply and explore your financial possibilities by following the link below.

Your journey to financial stability is waiting!

Apply for the Oportun Personal Loans: Fast Approvals

Ready to elevate your finances? Learn how to apply for the Oportun Personal Loans for tailored rates and a smooth borrowing experience!

Trending Topics

Enjoy a low APR: apply for the PNC Bank Student Loan

Your gateway to educational financing: Learn how to apply for PNC Bank student loan and pave the way to your educational dreams.

Keep Reading

Affordable options: Aidvantage Student Loan Refinance Review

Find out why Aidvantage Student Loan Refinance is the ideal solution for managing your loan payments with this full review.

Keep Reading

Shopify is laying off workers: understand why the stock price is sinking

A failed bet caused Shopify's CEO to lay off 10% of his employee, which brought down the Shopify stock price. Understand the case:

Keep ReadingYou may also like

VA Construction Loan: Your 101 Guide

Discover the VA construction loan, a special financing option for veterans. Learn what it is and how it works for building your dream home.

Keep Reading

Allegiant Air: cheap flights and offers

Allegiant Air is ideal for those looking for cheap flights. See this review and find out how to hire travel packages with 40% off!

Keep Reading

The debt snowball method: get your finances back on track

The debt snowball method can get you out of debt extremely quickly. Understand how the method I used to pay off my debts works.

Keep Reading