Loans

Apply for a Rocket Personal Loan: Simple process

Read on, and let's dive into the world of Rocket Personal Loans and unlock the financial possibilities that await you! Up to $45,000 quickly!

Advertisement

Apply for a Rocket Personal Loan: Check your options with no credit impact!

Are you in need of extra funds to achieve your financial goals? Learning how to apply for a Rocket Personal Loan could be the solution you’ve been searching for.

Therefore, read on to find out more about how this loan works and if you meet the requirements to apply!

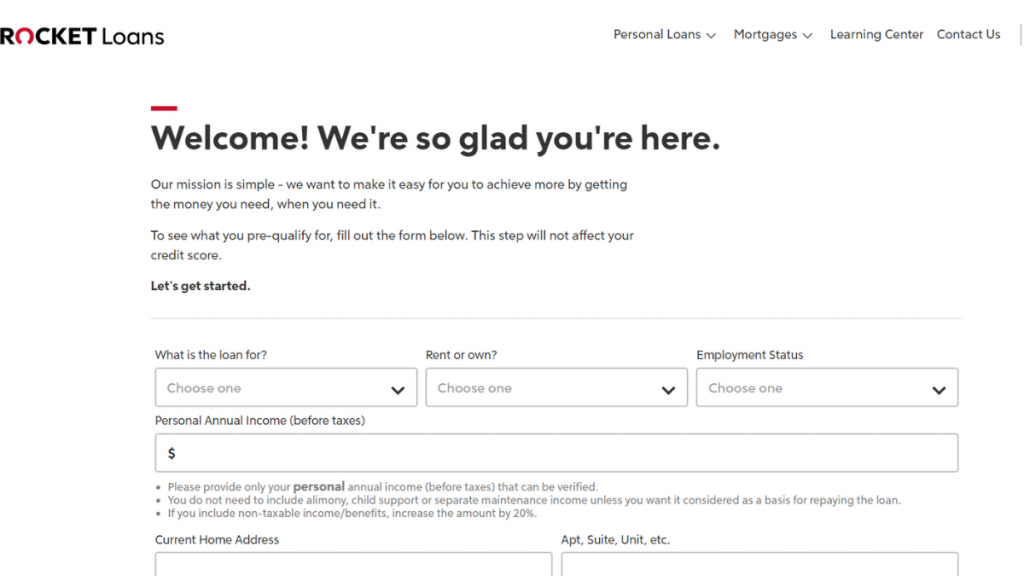

Online application

You’ll be able to apply online through the official website at any time.

Moreover, you’ll only need to provide the personal information required, read the terms, and wait for a response.

Also, you’ll be able to have a quick check at your loan options with only a soft credit check before the hard check on the official application!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

Before you apply for a loan through this lender, you’ll need to at least see if you meet the basic requirements.

Therefore, here is a list of some of the basic requirements for this lender:

- You’ll need a minimum credit score of at least 640;

- Your payment history needs to be good with other financial products;

- You’ll need to have a good annual income to cover your needs.

Apply on the app

Indeed, you can easily download the Rocket Loans mobile app on Google Play or the App Store.

Also, you’ll be able to use this app to manage your loan needs and your finances from anywhere you are.

Moreover, you’ll be able to download the app and follow the easy instructions on the screen to help you provide the personal info required and complete your application.

Compare Rocket Personal Loan to other options: Best Egg Loan

If you want to look for other options besides Rocket Personal Loans, you can try applying for Best Egg Loans!

Also, with this lender, you’ll be able to get loan amounts of up to $50,000 for other personal uses!

Moreover, this lender can have good terms and low origination fees.

Therefore, check out our comparison table below to learn more about these lenders and see which is the best option for your needs!

| Rocket Personal Loan | Best Egg Loan | |

| APR | From 9.116% to 29.99% variable APR, depending on the credit profile and if you have autopay discount; | From 8.99% to 35.99% variable APR; |

| Loan Purpose | Debt consolidation, home improvement, solar use, and many other personal loan uses; | Debt consolidation, credit card refinancing, home improvements, moving expenses, major purchases, special occasions, vacation loans, secured personal loans, and other personal loan purposes; |

| Loan Amounts | From $2,000 to $45,000, depending on your finances; | You can get loan amounts from $2,000 to $50,000; |

| Credit Needed | You’ll need a minimum of a 640 credit score to have a chance of qualifying; | You’ll need a 700 FICO Score minimum to get the lowest APR; |

| Origination Fee | Up to 9% origination fee for each loan; | From 0.99% to 8.99% variable origination fee; |

| Late Fee | There will be a late fee if you don’t make your loan payments on time; | There can be a late fee if you miss any loan repayments from this lender; |

| Early Payoff Penalty | You won’t need to pay any prepayment penalties. | Also, there are no early payoff penalties for this lender. |

So, if you are more interested in learning about Best Egg Loans, you can check out our blog post below to learn more about it and find out how the application process works!

Apply for a Best Egg Loan

Looking for the best loan for your personal needs? If so, you can learn how to apply for a Best Egg Loan with amounts of up to $50,000!

Trending Topics

Home prices in Canada have the first drop in 2 years

After 2 years, home prices finally dropped in Canada. Understand how this happened and whether it's really a good idea to buy your home now.

Keep Reading

Is a 650 Credit Score Good Enough?

Is a 650 credit score adequate? Learn facts, impact on loans, and tips to improve your rating. Navigate your financial path with confidence!

Keep Reading

Hawaiian Airlines: cheap flights and offers

Hawaiian Airlines is the best way to find cheap flights to Hawaii. Meet this company that offers discounts of up to 20% and much more!

Keep ReadingYou may also like

Apply for the Zippyloan Personal Loans: Borrow Up to $15,000!

Learn to apply for Zippyloan Personal Loans easily with our guide and borrow up to $15,000. Quick solutions for diverse financial needs!

Keep Reading

Simple process: Apply for Aidvantage Student Loan Refinance now

Simplify your federal student loans: Apply for Aidvantage Student Loan Refinance with confidence with this application guide!

Keep Reading

8 Different Types of Credit Cards

Find your ideal match with our comprehensive overview of the different types of credit cards, designed for all needs and spending habits.

Keep Reading