Loans

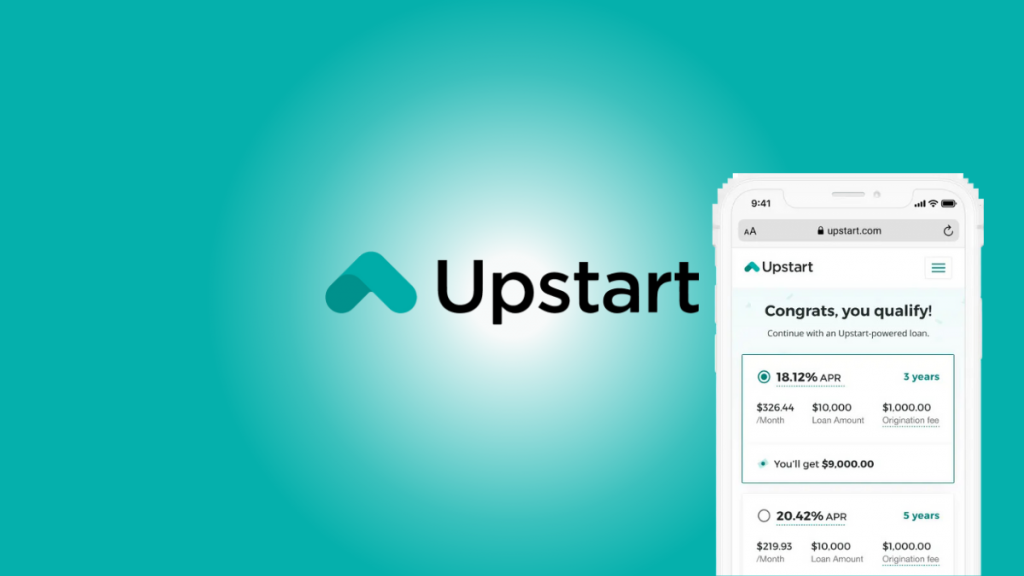

Upstart Loan review: Up to $50,000!

If you need to get a loan of up to $50,000 with good features, you can read our Upstart Loan review to see its pros and cons!

Advertisement

Upstart Loan Review: A Game-Changer in Modern Lending

Are you looking for a smarter way to get loans of up to $50,000? If so, look no further than our Upstart Loan review!

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Moreover, in a world where traditional lending institutions often rely on outdated criteria, Upstart brings a breath of fresh air. So read on to learn more about it!

| APR | From 5.2% to 35.99% variable APR; |

| Loan Purpose | Personal loans of all types and car refinance loans; |

| Loan Amounts | From $1,000 to $50,000; |

| Credit Needed | There is no minimum credit score to get your loan with this lender; |

| Origination Fee | There can be an origination fee depending on your loan (ranging from 0% to 12%); |

| Late Fee | You’ll need to pay a late fee if you don’t make your loan payments on time (either 5% of the late amount or $15, whichever is greater); |

| Early Payoff Penalty | You won’t have to pay any early payoff penalties. |

Is the Upstart Loan a good option?

Upstart is revolutionizing the lending industry by using cutting-edge artificial intelligence and machine learning algorithms to assess borrowers’ creditworthiness.

Moreover, unlike traditional lenders, which rely heavily on FICO scores and credit history, Upstart takes a more holistic approach.

Thus, it considers various factors to offer competitive interest rates and loan terms.

Also, whether you have a limited credit history, a unique financial situation, or simply want a faster application process, Upstart may be the solution for you.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of the Upstart Loan

This lender can offer incredible perks to its borrowers, including pre-qualification and fixed rates with good terms.

However, there can also be some downsides as with any other lender or company.

Therefore, you can read our pros and cons list below to see if this can be the best option for your money needs!

Advantages

- You can make your loan repayments in up to 5 years;

- You’ll be able to get your loan funds in as little as one business day, depending on your finances;

- Get loans of up to $50,000;

- You’ll find fixed rates and terms.

Disadvantages

- You’ll need to pay origination fees;

- There are no good mobile app features;

- You’ll be able to choose between only two loan repayment options;

- There are no co-sign or secured loan options.

What credit score do you need to apply?

There is no information about a minimum credit score to get a loan through this lender.

However, we recommend that you have a higher or at least a good credit score before you apply for any financial product.

This is because you may get higher rates and fees if you have no credit score or a low score. Also, we recommend that you check if you can pay for the fees and others.

Upstart Loan application process

You can apply for a loan with this lender with no problem through the official website. Also, your credit score won’t get an impact during the pre-qualification process.

So, you can read our post below to find out more about this lender and how to apply for it!

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Trending Topics

Citi® Double Cash Card full review: should you get it?

Looking for a cashback credit card? Discover the Citi® Double Cash Card. 2% cashback on all purchases and no annual fee, it's hard to beat!

Keep Reading

Chase Freedom Flex℠ credit card full review: should you get it?

Mentioned in the best card lists, the Chase Freedom Flex℠ credit card goes far beyond 5% cashback. Learn more about it in this review!

Keep Reading

Enjoy a low APR: apply for the PNC Bank Student Loan

Your gateway to educational financing: Learn how to apply for PNC Bank student loan and pave the way to your educational dreams.

Keep ReadingYou may also like

Mercury® Mastercard® credit card full review: should you get it?

Meet the Mercury® Mastercard®, the card for anyone looking to build credit while accumulating rewards in a solid cashback program.

Keep Reading

Truist Future credit card full review: should you get it?

Truist Future credit card is an excellent opportunity to avoid interest: 15 months of 0% APR for purchases and balance transfers. Know more!

Keep Reading

Capital One Quicksilver Secured Cash Rewards Card: check out how to apply!

Learn how to apply for the Capital One Quicksilver Secured Cash Rewards Card, the credit-building card that gives unlimited rewards.

Keep Reading