Loans

Apply for SpeedyNetLoan: Tailored Loans for Your Needs

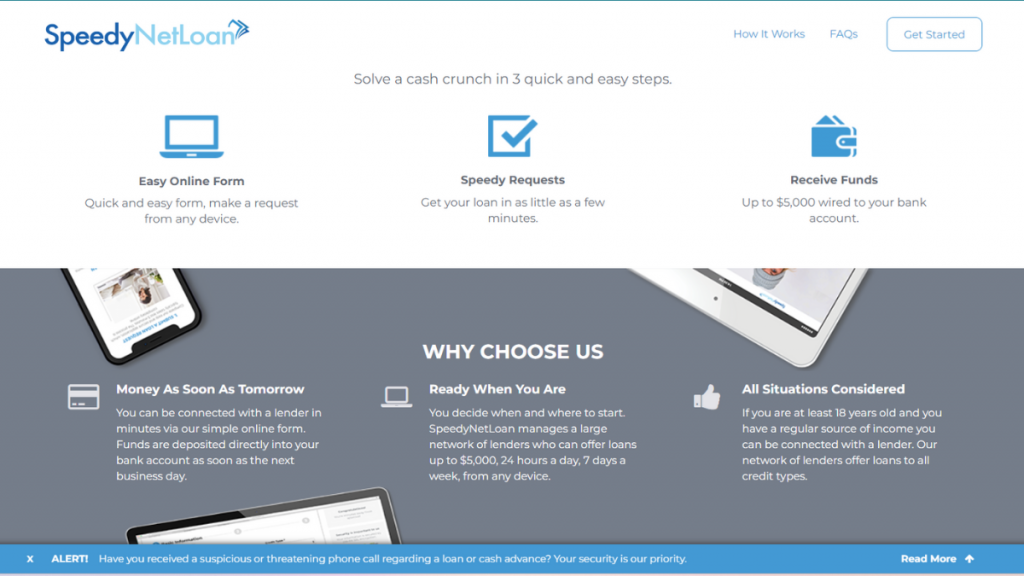

Our article guides you through applying for SpeedyNetLoan, highlighting its simplicity and speed. Learn about flexible terms and fast approvals to meet your financial needs.

Advertisement

Experience seamless borrowing with competitive rates and flexible terms at SpeedyNetLoan

Looking to apply for SpeedyNetLoan? You’ve come to the right place! In our guide below, we’ll walk you through the straightforward process step-by-step.

Discover how to secure the financial support you need and borrow up to $5,000 with flexible terms and competitive APRs. Read on to learn how you can get funds fast for your needs!

Online application

To apply for SpeedyNetLoan, start by visiting their official website. Firstly, you’ll find a user-friendly platform designed to guide you through the loan process seamlessly.

Secondly, once on the website, locate the application form. It’s the crucial first step in your journey. Provide accurate and honest information about yourself and your financial situation.

Afterward, after completing the application, hit the submit button. Your request will be swiftly processed by SpeedyNetLoan’s algorithm, which matches you with potential lenders.

Subsequently, once matched, you’ll receive loan offers from various lenders. So take your time to review these offers carefully. Pay close attention to the loan amounts, rates, and terms.

Lastly, after reviewing the offers, select the one that aligns best with your financial goals and preferences. Then, wait for disbursement directly into your bank account.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- You must be of legal age, typically 18 or older, to qualify for their service.

- Furthermore, you’ll need to provide proof of a stable income source.

- Additionally, you’ll be required to have an active bank account.

- You must also be a US citizen or legal resident.

- You have to provide a valid government-issued ID to verify your identity.

- Ensure you have a valid email address and phone number for communication.

- Finally, be ready to specify the purpose of the loan.

Apply on the app

Unfortunately, you cannot apply for SpeedyNetLoan via a dedicated mobile app because they don’t have one.

Nevertheless, their website provides a mobile-friendly experience.

You can still navigate their website effortlessly using your phone or tablet’s browser. It offers a user-friendly interface for on-the-go access.

Compare SpeedyNetLoan to other options: Quick Capital Cash Loan

In conclusion, SpeedyNetLoan offers efficient service with quick approvals. It’s a reliable choice for those needing tailored financial solutions.

Also, Quick Capital Cash Loan provides a complementary option. It stands out with unique features catering to a diverse range of borrowers.

Moreover, Quick Capital Cash Loan excels in offering fast funding and flexible terms. Its user-friendly platform makes managing finances easier.

| SpeedyNetLoan | Quick Capital Cash Loan | |

| APR | Starting from 5.99% for high-credit borrowers, varies by lender. | Ranges from 200% to 1386%, varying by lender and state laws. |

| Loan Purpose | Diverse needs, from debt consolidation to personal expenses. | Versatile, including auto repairs, debt consolidation, medical expenses, and more. |

| Loan Amounts | Varies based on lender terms and borrower’s eligibility. You can borrow from $100 to $5,000. | Short-term loans up to $1,000; installment loans up to $5,000. |

| Credit Needed | Accommodates a wide range of credit scores. | Flexible, caters to various credit profiles. |

| Origination Fee | Depends on the lender, disclosed in loan terms. | Depends on the lender; varies among lending partners. |

| Late Fee | Determined by the lender, specified in loan agreement. | Determined by individual lenders; varies based on loan agreement. |

| Early Payoff Penalty | Varies by lender; details provided in loan terms. | Specific to lender terms; not universally applicable. |

Additionally, to explore these benefits in detail, visit the link below. So discover how Quick Capital Cash Loan can meet your financial needs with ease.

Apply for Quick Capital Cash Loan: Quick Access to Cash

Learn how to apply for Quick Capital Cash Loan in a few simple steps and get up to $5,000 in funds quickly with minimal paperwork.

Trending Topics

How to choose a bank: know the best option for your finances

Not knowing how to choose a bank can cost you a lot of money and good opportunities. To learn more about this, read on!

Keep Reading

The US Economy: why growing fears of a recession are justified

Will the US enter an economic recession? Understand what economists say on the subject and how to prepare your pocket for the future.

Keep Reading

BMO CashBack® Mastercard® credit card full review: should you get it?

Cashback that covers all your purchases, especial discounts and zero liability. Meet the BMO CashBack® Mastercard® credit card.

Keep ReadingYou may also like

Happy Money Personal Loans review: Up to $40,000!

Looking for ways to consolidate credit card debt with good terms? If so, read our Happy Money Personal Loans review! Affordable conditions!

Keep Reading

Truist Enjoy Cash Credit Card: check out how to apply!

Learn how to apply for the Truist Enjoy Cash Credit Card, which multiplies rewards, subtracts fees, and offers a 0% intro APR!

Keep Reading

BMO eclipse Visa Infinite card: check out how to apply!

Learn how to apply for the BMO eclipse Visa Infinite card and gain access to one of Canada's best credit card reward programs.

Keep Reading