Reviews

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Check out this step-by-step guide on how to request your Upgrade Triple Cash Rewards Visa®, and enjoy unlimited cashback and an easy credit program whenever you need it.

Advertisement

Upgrade Triple Cash Rewards Visa®: Get 3% unlimited cash back on must-have purchases every month

If you want to apply for the Upgrade Triple Cash Rewards Visa®, you should know that it is an easy and non-bureaucratic process. Indeed, it is possible to do the whole process without leaving home. Below, learn how to secure your Upgrade family gray card.

How to apply on the website

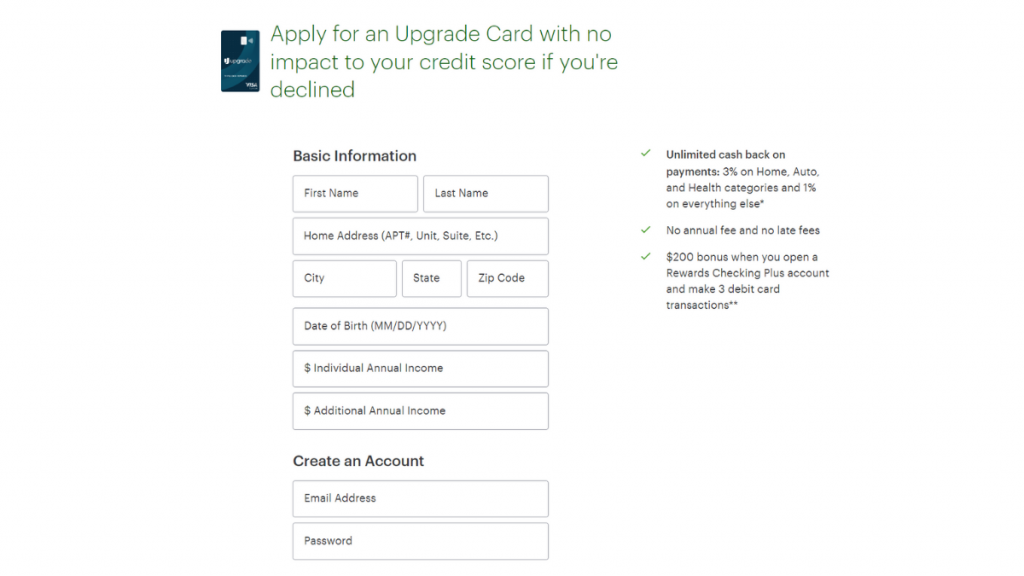

The Upgrade family credit card application process has been simplified as much as possible. So, you probably won’t have any problems during this process. Upon entering the Upgrade Triple Cash Rewards official website, click “Get start”.

Fill in all information fields. Therefore, do not forget to provide an email address that you have access to and an easy-to-remember password. At the end of the form, confirm that you know and accept the terms of use and click “Get pre-approved”.

In a short time, you will know if your application has been approved and what your APR rate will be. Normally, this information will be sent to the email you provided. There, you will also receive information to finalize your request.

In addition, you should know, before applying, that this card is not available in DC, IA, WV, WI, GA and MA.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

The official website is the only way to apply for the Upgrade Triple Cash Rewards Visa®. Therefore, the “Upgrade” application does not offer this service. However, it will be very useful for as long as you have this card.

Through this app, you can check debts, cashback program rewards and your credit score.

Upgrade Triple Cash Rewards Visa® vs. Citi® Double Cash Card: choose which one is best for you

Is the Upgrade Triple Cash Rewards Visa® the best option for you? To help you answer that question, we’ve compared the benefits of this and other similar credit cards. Which one got the best?

See the summary of this comparison in the table below:

| Upgrade Triple Cash Rewards Visa® | Citi® Double Cash | |

| Credit Score | 620+ | 690-850 (good or excellent) |

| Annual Fee | $0 | $0 |

| Regular APR | From 14.99% to 29.99% variable APR | 0% APR for the first 18 months. From 18.49% – 28.49% in the following months |

| Welcome bonus | $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*. | N/A. |

| Rewards | Cash back unlimited; 3% in the categories home, automobiles and health, 1% in the others | 2%: 1% on purchase and 1% on payment (unlimited program) |

Citi® Double Cash Card: check out how to apply!

Looking for a great cash back credit card? Check out the Citi® Double Cash Card. You'll get 2% cash back on every purchase, plus anti-fraud protection and 0% APR in the first 18 months of use.

Welcome Bonus Disclosure: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Preferred account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Preferred account within 60 days of the date the Rewards Checking Preferred account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Preferred account as part of this application process, you are not eligible for this welcome bonus offer.

Your Upgrade Card and Rewards Checking Preferred account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Preferred account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

Trending Topics

Fund all of your education costs: PNC Bank Student Loan review

Seeking financial support for higher education? Read our review of PNC Bank Student Loan and see why they got awarded!

Keep Reading

Getting started with investing: 6 best tips for beginners

Start investing in the stock market the right way: read on and get some very important tips for beginners in the investment world.

Keep Reading

The Best Student Loan Refinance Solutions: Explore Your Options

See how student loan refinance can turn the weight of student loans into a chance for financial growth, providing relief and renewed optimism.

Keep ReadingYou may also like

The unemployment rate in Canada has reached an all-time low

The unemployment rate in Canada has reached a historic low! Understand why lenders are hiring and why this should change in the future.

Keep Reading

H&R Block Emerald Prepaid Mastercard®: check out how to apply!

Apply to H&R Block Emerald Prepaid Mastercard® and get access to a debit card to save money and get refunds easily. Learn more!

Keep Reading

First Progress Platinum Select Mastercard® Secured card: apply now!

Apply for a First Progress Platinum Select Mastercard® Secured card and have the chance to build your credit. Learn how to apply!

Keep Reading