Loans

Up to N5 million: Apply for Zedvance Loans today

Need funds for personal needs or business growth? Then dive into our guide on applying for Zedvance Loans! Low rates and no hidden charges!

Advertisement

Zedvance Loans Made Accessible: Your Guide to a Smooth Application

From covering financial emergencies to funding your dreams. So, apply for Zedvance Loans with our step-by-step guide to boost your finances and achieve your goals.

Following, you’ll find out how easy it is to get up to N5 million to cover your expenses, all from the comfort of your home. So keep reading and don’t waste any more time!

Online application

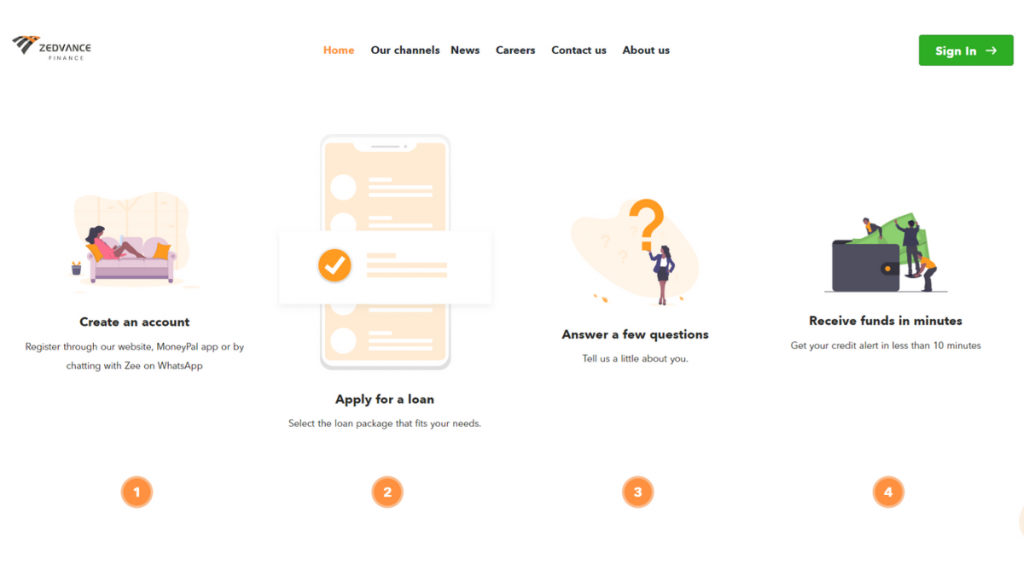

When it comes to securing financial assistance with Zedvance Loans, the process to apply is seamless and user-friendly.

So here’s how to apply through different channels:

You will be redirected to another website

Apply Online on Zedvance Loans Website

To begin your application on Zedvance’s official website, start by creating your account.

Choose the loan type that aligns with your financial needs, whether for personal emergencies, education financing, or business expansion.

Complete the application form by providing accurate information about your personal details, employment, and financial situation.

Then, after submitting your application, Zedvance’s team will review it, and upon approval, the loan amount will be disbursed directly into your specified account.

You’ll also receive a linking card for autopay to ensure convenient repayments, making your borrowing experience stress-free.

Talking Directly on WhatsApp with the Virtual Assistant Zee

For a more personalized experience, reach out to Zedvance via WhatsApp at the number 09095017151.

Initiate the conversation by expressing your interest in applying for a loan. Zedvance’s virtual assistant, Zee, will guide you through the process.

Share the necessary information as requested during the conversation, including your preferred loan type and other relevant details.

Upon approval, Zedvance will disburse the loan amount to your account and provide autopay instructions via a linking card for hassle-free repayments.

Whichever channel you apply through, you can rest assured that Zedvance Loans is committed to providing a straightforward borrowing experience.

Apply on the app

Download the Zedvance mobile app from your app store for a mobile-friendly approach. Upon installation, create your account within the app.

Then, explore the various loan offerings and select the one that aligns with your financial goals.

Finally, complete the application form within the app by providing accurate and up-to-date information.

After your application is reviewed and approved, Zedvance will fund the loan directly into your account.

As part of their user-centric approach, they will also provide you with autopay instructions via a linking card, ensuring your repayments are seamlessly managed.

Compare Zedvance Loans to other options: Aella Loans

Both Zedvance Loans and Aella Loans have emerged as great options for individuals and businesses seeking financial assistance.

While Zedvance focuses on providing accessible and affordable loan options, Aella also emphasizes financial inclusion and empowerment.

| Zedvance Loans | Aella Loans | |

| Interest Rate | From 12% to 45%; | 6% to 20% |

| Loan Purpose | Loans for business and personal purposes; | Personal loans and Business Loans |

| Loan Amounts | Up to N5,000,000 for business, and up to N100,000 for personal use; | From N1,500 up to N1,000,000 |

| Repayment Terms | You must repay your loan in 15 days or up to 90 days; | 1 to 3 months |

| Collateral | There is no need for collateral. | No collateral is required! |

Read our Aella Loans full review to see all the benefits this online lender offers!

Apply for Aella Loans Stress-Free and get Rewards!

Avoid the stress of traditional loans. Aella Loans' digital platform offers a hassle-free experience to apply in minutes.

Trending Topics

Aella Loans Review: Get cashback on your loan!

If you need extra money, this Aella Loans review is what you’re looking for. Borrow up to N1 million for multiple purposes!

Keep Reading

Easy and simple: Apply for Fidelity Visa Classic Credit Card

Learn how to apply for the Fidelity Visa Classic Credit Card and take control of your finances like never before. 45 interest-free days!

Keep Reading

First Bank Visa Gold Credit Card review: international travel benefits!

Looking for a credit card to satisfy your travel needs? Read this comprehensive review of the First Bank Visa Gold Credit card.

Keep ReadingYou may also like

Apply for Zenith Bank Gold Credit Card: A world of benefits

Apply for the Zenith Bank Gold Credit Card and open doors to premium perks, flexibility, and unparalleled convenience.

Keep Reading

Apply for Aella Loans Stress-Free and get Rewards!

Avoid the stress of traditional loans. Aella Loans' digital platform offers a hassle-free experience to apply in minutes.

Keep Reading

Apply for the Aella Card and pay no fees for transactions!

If you want to explore the features of the Aella Card with no transaction fees, you can read on to learn how to apply for the Aella Card!

Keep Reading