Drowning in Student Debt? Find Relief with Nelnet Refinancing Options

Nelnet Student Loan Refinance: Lighten the Load for Financial Freedom

Advertisement

With student loan refinancing, you can break free from the shackles of high interest rates and customize your repayment journey to fit your financial goals. Imagine the joy of saving thousands of dollars over the life of your loan, having a simplified payment plan, and the freedom to pursue your dreams without the constant worry of debt. Don’t let your student loans hold you back any longer.

With student loan refinancing, you can break free from the shackles of high interest rates and customize your repayment journey to fit your financial goals. Imagine the joy of saving thousands of dollars over the life of your loan, having a simplified payment plan, and the freedom to pursue your dreams without the constant worry of debt. Don’t let your student loans hold you back any longer.

You will remain in the same website

Many people struggle with their student loans. But there is a solution! You’ll get many benefits in refinancing. Check a few of them:

You will remain in the same website

Yes, you can refinance a private undergraduate student loan with Nelnet. Nelnet offers student loan refinancing options for both federal and private student loans, including undergraduate loans. By refinancing your private undergraduate student loan with Nelnet, you may be able to secure a lower interest rate, reduce your monthly payments, or adjust your repayment terms.

Whether Nelnet Student Loan Refinance requires a co-signer depends on your individual financial situation and creditworthiness. In some cases, having a co-signer with a strong credit history and income can increase your chances of being approved. However, if you meet Nelnet’s credit and income requirements on your own, a co-signer may not be necessary.

The duration of the Nelnet refinancing application process can vary depending on several factors, including the completeness of your application, the verification process, and the responsiveness of all parties involved. Typically, completing the initial application should take around 15-30 minutes. Once you’ve submitted your application, it may take a few business days for Nelnet to review and make a decision on your refinancing request.

Nelnet offers refinancing options for both consolidated and individual student loans. Whether you have a single consolidated loan or multiple individual loans, you can still apply for refinancing with Nelnet to potentially secure a lower interest rate, adjust your repayment terms, or simplify your repayment by combining them into a single loan.

Hassle-free: Apply for Nelnet Student Loan Refinance Today!

Looking to lower your monthly payments? Find out how to apply for Nelnet Student Loan Refinance online and get the best rates.

If you’re shopping for refinancing options, it is recommendable to check at least three options. We’ll give you the second one: NaviRefi Student Loan Refinance.

To learn about its rates and how it works, read the following content. Our full review covers everything you need to know to make an informed decision.

Transform Your Debt: Apply for NaviRefi Student Loan Refinance

Ready to take the next step? Learn how to apply for NaviRefi Student Loan Refinance and save money on your student loans.

Trending Topics

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Keep Reading

Buy cheap Allegiant Air flights: easy step by step

Find out how to buy cheap tickets for flights on Allegiant Air, an option consolidated as one of the most economical on the market.

Keep Reading

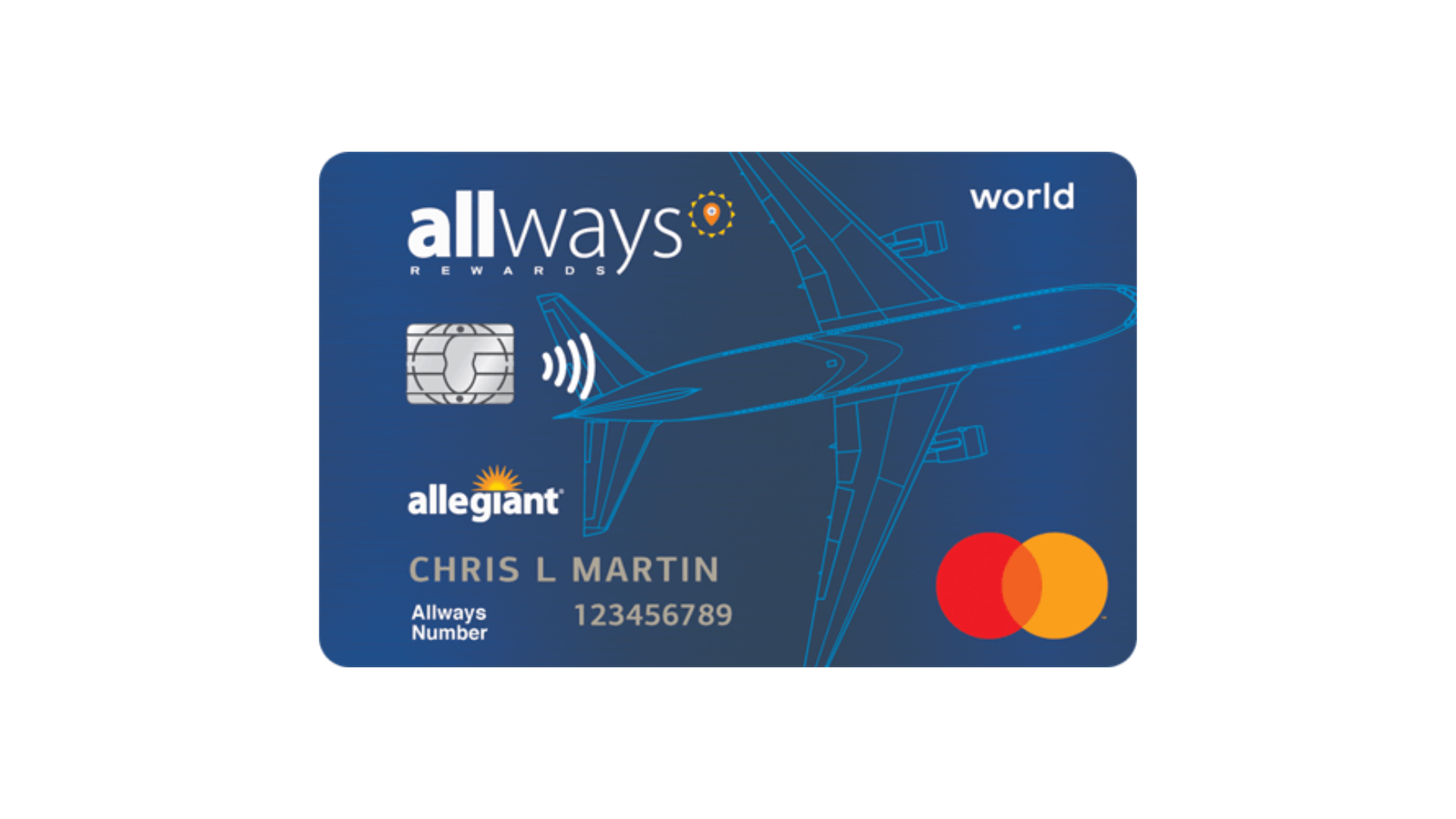

Allegiant World Mastercard®: check out how to apply!

Apply to Allegiant World Mastercard® and gain access to a rewards program that will give you free airline tickets. Know more!

Keep ReadingYou may also like

Government food benefits: get the help you need

Government food benefits can be a chance to put food on the table without paying anything. Read on to learn more about these benefits!

Keep Reading

American Express Cash Magnet® card: check out how to apply!

Apply for the American Express Cash Magnet® card to get a great rewards program and introductory bonus. Click and find out how.

Keep Reading

Personify personal loan review: money in two days!

Personify personal loan is an opportunity for people with bad credit to access a loan of up to $15,000. Read our post to learn more!

Keep Reading