Loans

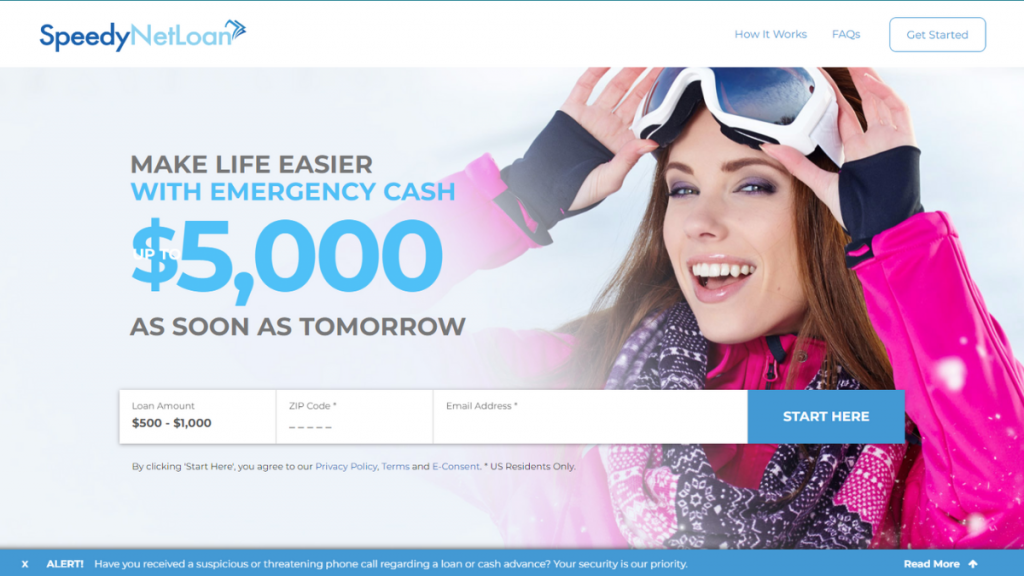

SpeedyNetLoan Review: Simple Process, Diverse Choices

Read our SpeedyNetLoan review to explore flexible repayment options and competitive APRs. Find out how their free, user-friendly service connects you with the ideal lender.

Advertisement

Experience quick loan matching and transparent terms with SpeedyNetLoan

In this SpeedyNetLoan review, we delve into the features that set it apart in the lending market. So discover why it’s a popular choice for borrowers.

Apply for SpeedyNetLoan: Tailored Loans for Your Needs

Learn how to apply for up to $5,000 with SpeedyNetLoan with our guidance. Enjoy a quick, hassle-free process with diverse loan options.

Furthermore, our comprehensive analysis highlights key aspects of their service. Keep reading to learn more about what SpeedyNetLoan offers.

| APR | Starting from 5.99% for high-credit borrowers varies by lender. |

| Loan Purpose | Diverse needs, from debt consolidation to personal expenses. |

| Loan Amounts | Varies based on lender terms and borrower’s eligibility. You can borrow from $100 to $5,000. |

| Credit Needed | Accommodates a wide range of credit scores. |

| Origination Fee | Depends on the lender, disclosed in loan terms. |

| Late Fee | Determined by the lender, specified in the loan agreement. |

| Early Payoff Penalty | Varies by the lender; details provided in loan terms. |

Is SpeedyNetLoan a good option?

Firstly, SpeedyNetLoan stands out for its flexibility in loan amounts. Secondly, they offer plenty of options to suit different situations.

Moreover, terms range from 6 months to 5 years. So SpeedyNetLoan provides repayment schedules that can comfortably fit your budget.

Concerning fees, SpeedyNetLoan is transparent. While they offer a free matching service, individual lender fees are clearly outlined in loan terms.

Furthermore, their application process is simple and user-friendly. It’s designed to connect you swiftly with lenders without impacting your credit score.

Finally, SpeedyNetLoan has a wide acceptance of credit scores. This means that more people have access to loans, making it a versatile option for many.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of SpeedyNetLoan

Below is our SpeedyNetLoan review, we’ll explore both the perks and drawbacks of this lending service.

So read on to learn whether or not this is the right fit for your financial needs.

Advantages

- Quick approval for all financial needs.

- Low APRs for creditworthy borrowers, starting at 5.99%.

- Flexible repayment options ranging from 6 months to 5 years.

- Wide range of lenders, offering many loan options.

- Accommodates various credit scores, increasing accessibility.

- Transparent loan terms, with clear disclosure of fees.

- Easy online application, making the process convenient.

Disadvantages

- APRs can vary greatly, creating uncertainty.

- Potentially high fees depending on individual lenders.

- Limited control over the terms offered by lenders.

- Geographic restrictions may limit availability in some areas.

- Overwhelming choices due to a multitude of lenders.

- Post-match issues to be resolved with the lender directly.

What credit score do you need to apply?

SpeedyNetLoan caters to almost all credit scores, which makes it accessible for many. This inclusivity is key to their wide appeal.

Furthermore, while exact score requirements vary, they often accommodate those with lower scores, offering financial solutions to a diverse clientele.

SpeedyNetLoan application process

In conclusion, our SpeedyNetLoan review sheds light on its features. Indeed, from rates to fees, we’re here to assist you in making informed financial decisions.

So, ready to take the next step? Then explore our article below to learn how to apply for SpeedyNetLoan and navigate your way to financial solutions.

Apply for SpeedyNetLoan: Tailored Loans for Your Needs

Learn how to apply for up to $5,000 with SpeedyNetLoan with our guidance. Enjoy a quick, hassle-free process with diverse loan options.

Trending Topics

How to apply for OppLoans Personal Loans: No score impact!

Ready to uplift your finances? Apply for the OppLoans Personal Loans for swift funds and transparent terms with no hard credit checks.

Keep Reading

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Keep Reading

Apply for Rescue One Financial: Ease Your Debt Today!

Learn how to apply for Rescue One Financial. Simple steps for debt relief, expert guidance, and a solution toward achieving your goals.

Keep ReadingYou may also like

Apply for a Rocket Personal Loan: Simple process

Discover the hassle-free way to apply for the Rocket Personal Loan with our step-by-step guide. Ensure up to $45,000 quickly!

Keep Reading

Apply for the Oportun Personal Loans: Fast Approvals

Ready to elevate your finances? Learn how to apply for the Oportun Personal Loans for tailored rates and a smooth borrowing experience!

Keep Reading

Tangerine World Mastercard® credit card full review: should you get it?

Discover the Tangerine World Mastercard®, the credit card that combines up to 2% cash back and exclusive benefits that cannot be purchased.

Keep Reading