Loans

247LoanPros Review: Fast Loans for All Credit Types

Explore our 247LoanPros review. Get loans from $100 to $35K and a fast, secure online application process. All credit types accepted and funds available as soon as the next business day.

Advertisement

Discover quick, secure, and simplified loans up to $35,000 with 247LoanPros!

This 247LoanPros review offers an insightful look into a dynamic lending platform. Uncover the details that make it a standout choice in the financial market.

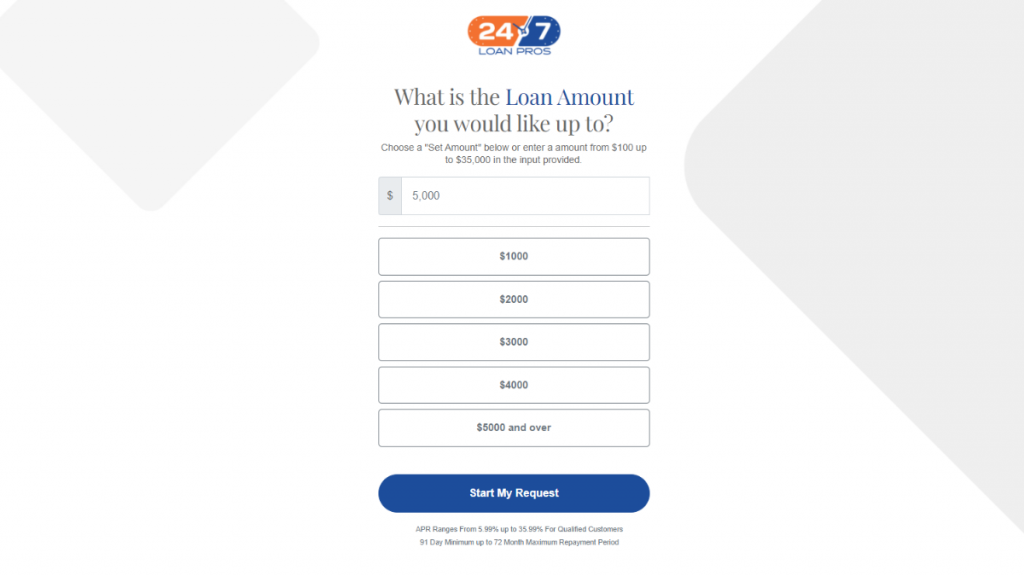

Apply for 247LoanPros: Quick Approval, Easy Process

Find out how to easily apply for up to $35k with 247LoanPros and get flexible loan options, speedy approval, and secure online processing.

Dive deep into the specifics of 247LoanPros below. Our review sheds light on its unique features, guiding you to understand its full potential in meeting your financial needs.

| APR | Competitive rates start at 5.99%, ensuring your loan is as affordable as possible. |

| Loan Purpose | From emergency expenses to dream projects, use your loan for any purpose. |

| Loan Amounts | Choose from a wide range, from $100 to $35,000, to perfectly fit your financial needs. |

| Credit Needed | All credit types are welcome, making it a versatile choice for diverse financial histories. |

| Origination Fee | It depends on the lender. |

| Late Fee | It varies according to the lender. |

| Early Payoff Penalty | It depends on the lender you choose. |

Is 247LoanPros a good option?

Firstly, 247LoanPros offers a vast range of loan amounts, from $100 to $35K. This flexibility caters to diverse financial needs, from small emergencies to significant expenses.

Secondly, interest rates with 247LoanPros are competitive, starting at 5.99% and up to 35.99%. This ensures your loan is both manageable and affordable.

Also, Loan terms are designed for convenience, ranging from a short 91 days to a more extended 72 months. So you can tailor your repayment plan to suit you.

Being a platform, 247LoanPros itself doesn’t charge origination fees. However, lender-specific fees may apply, so it’s important to review your loan offer carefully.

Also, late fees depend on the individual lender’s policies. 247LoanPros encourages borrowers to understand these potential charges to maintain a healthy financial plan.

Early payoff policies can vary among 247LoanPros’ network of lenders. Some may allow penalty-free early repayments, while others might have charges, adding a layer to consider.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of 247LoanPros

Further in our 247LoanPros review, we’ll explore the pros and cons of using their lending platform. So read on to gain a balanced view of what they offer.

Advantages

- Wide range of loan amounts ($100 to $35,000), catering to various financial needs.

- Competitive interest rates, starting as low as 5.99%, are suitable for all budgets.

- Flexible repayment terms, ranging from 91 days to 72 months.

- Inclusive for all credit types, from poor to excellent, offering accessibility.

- Quick application process and fast funding, ideal for urgent financial requirements.

Disadvantages

- Rates and fees vary by lender so it could lead to higher costs for some borrowers.

- Late fees and early payoff penalties depend on individual lender policies.

- Reliance on third-party lenders means less consistency in loan terms.

- Potential for higher interest rates for applicants with lower credit scores.

What credit score do you need to apply?

Further, no specific credit score is required to apply with 247LoanPros. They welcome all credit types, from poor to excellent, making it accessible to a wide range of borrowers.

Additionally, 247LoanPros’ inclusive approach means your credit score isn’t a barrier.

Whether you’re building or repairing credit, they offer options tailored to your financial history.

247LoanPros application process

247LoanPros offers a flexible and inclusive lending solution. With varied loan amounts and terms, it caters to a wide range of financial needs and credit backgrounds.

So, are you eager to apply for a loan with 247LoanPros after this review?

Further, check out the article below for a step-by-step guide on navigating their application process and getting your loan.

Apply for 247LoanPros: Quick Approval, Easy Process

Find out how to easily apply for up to $35k with 247LoanPros and get flexible loan options, speedy approval, and secure online processing.

Trending Topics

Sun Country Airlines: cheap flights and offers

Sun Country Airlines is a company that offers cheap (and free!) and non-stop flights to national and international destinations. Learn more!

Keep Reading

Apply for Universal Credit Loan: No prepayment fees!

Do you need ways to get the best loan options with good terms? If so, you can read on to learn how to apply for Universal Credit Loan!

Keep Reading

Credit cards for bad credit: compare the best options

If you have a bad credit score, don't worry. We've compiled a list of the best credit cards for people in your situation.

Keep ReadingYou may also like

Achieve your goals: Nelnet Student Loan Refinance Review

Learn how Nelnet Student Loan Refinance can help you reduce your monthly payments and achieve financial freedom in our in-depth review.

Keep Reading

WestJet: cheap flights and offers

Learn how to find WestJet cheap flights and save tons on your next trip. Find flights from $49.99 to several destinations! Keep reading!

Keep Reading

Fortiva® credit card full review: should you get it?

A card for anyone looking to boost their credit score. Click here and learn about all the advantages of the Fortiva® credit card.

Keep Reading