Reviews

Fortiva® credit card full review: should you get it?

Complete review of one of the essential cards for anyone who wants to build credit and doesn't have the down payment required by secured cards. Meet Fortiva®.

Advertisement

Fortiva® credit card: the card that can be the watershed of your financial life

There are actually two ways to react to a not-so-good credit score. The first is to complain. The second is to search the market for options that get you out of this situation as soon as possible. If you are in the second group, you need to know about the Fortiva® credit card, the card made to increase your credit score and your financial life.

In this article, learn all the details you need to know to decide whether or not this card is for you.

Fortiva® card: check out how to apply!

Learn to build your credit with a credit card without having to file and report to the largest credit agencies in the country. See how to get the Fortiva® card!

| Credit Score | Bad (below 630) |

| Annual Fee | From $49 to $175 in the first year. In the sequence, from $0 to $49 |

| Regular APR | From 22.74% to 36% |

| Welcome bonus | None |

| Rewards | None |

Fortiva® credit card: learn more about this financial product

In fact, most credit cards for low scorers require a cash deposit when opening the account. For many who don’t have a reserve to cover that cost, having a card like this is impossible.

Fortunately, there are cards that trust you enough to offer credit without requiring a deposit. So a good example of this is the Fortiva® credit card. This is a credit card designed for those who want to change their financial life, starting with credit.

Fortiva® reports its payments to the main credit agencies in the country. That way, just make your payments on time to see your credit build up little by little. This card also gives you the opportunity to follow this process for free from your mobile phone.

Incidentally, the Fortiva® credit card offers an application to check your credit score. Also, for your security, the card with two very important types of protection. The first of these concerns the exemption of customers from liability in the event of fraud.

In cases of unauthorized purchases, you will not have to pay anything. In addition, the card has Chip EMV technology, which practically reduces the chances of counterfeiting to zero.

The Fortiva® credit card even allows you to add authorized users to your card for an annual fee of $25. Finally, you can transfer your balance by paying a 3% fee after the first year.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Fortiva® credit card features

Choosing a good credit card is a key step in improving your credit score. In fact, a not-so-good choice can make your walk difficult.

So, clear your doubts about the Fortiva® card by comparing the main advantages and disadvantages of this product:

What are the benefits?

- Accepts candidates with bad grades;

- No advance payment is required;

- Reports to the main credit agencies in the country;

- Liability of $0 on unrecognized purchases.

What are the drawbacks?

- Monthly maintenance fee charged from $5 to $12.50 after the first year of account;

- Pay 3% on foreign transfers;

- Relatively high APR range;

- No welcome bonus.

What credit score do you need to get the Fortiva® credit card?

The Fortiva® credit card is a card for anyone who needs a little help to improve their credit score.

For that reason, this product accepts requests from people with bad credit scores without any issues. Therefore, scores below 630 are likely to be welcome.

How does the Fortiva® credit card application process work?

Until recently, no one could apply for the Fortiva® card. Also, some of the people who have this card have never signed up. “How is this possible?” maybe you are asking yourself this now. Well, we will explain this in the following article.

Click on the link below and understand how you can have this card in your wallet.

Fortiva® card: check out how to apply!

Learn to build your credit with a credit card without having to file and report to the largest credit agencies in the country. See how to get the Fortiva® card!

Trending Topics

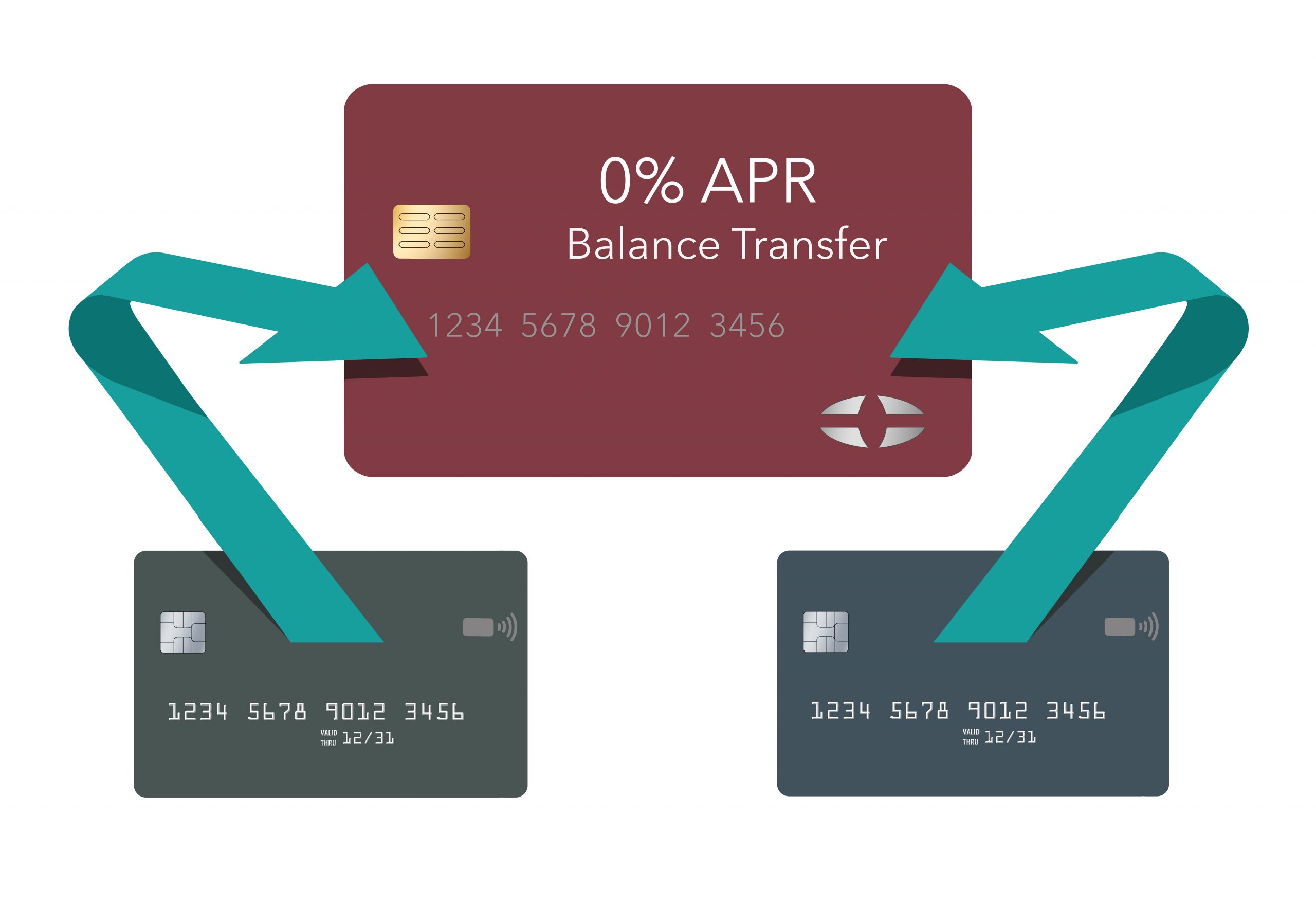

How to do a balance transfer on credit cards: 3 easy steps

There is a feature within the law that allows you to reduce card debts. Learn how to do a balance transfer on credit cards in 3 simple steps!

Keep Reading

Discover it® Secured card: check out how to apply!

Apply for the Discover it® Secured card and build your credit score with no annual fee and double your earned rewards. Learn more here!

Keep Reading

Citi Simplicity® Card full review: should you get it?

To avoid interest, count on the Citi Simplicity® Card. This card offers almost two years of 0% intro APR for balance transfers. Learn more!

Keep ReadingYou may also like

Alaska Airlines Visa® Credit Card: check out how to apply!

Apply to Alaska Airlines Visa® Credit Card and get access to an excellent rewards program and exclusive flight benefits. Understand more!

Keep Reading

Red Arrow Loans: find out how to apply!

Apply to Red Arrow Loans and, within seconds, have access to lenders available to offer loans for you to choose from. Read on!

Keep Reading

Apply for the Discover Personal Loans: Get Swift Funding

Apply for the Discover Personal Loans and start your journey towards financial freedom with quick approval and flexible loan amounts.

Keep Reading