Loans

Apply for the Alliant Credit Union Personal Loans: Fast Funding!

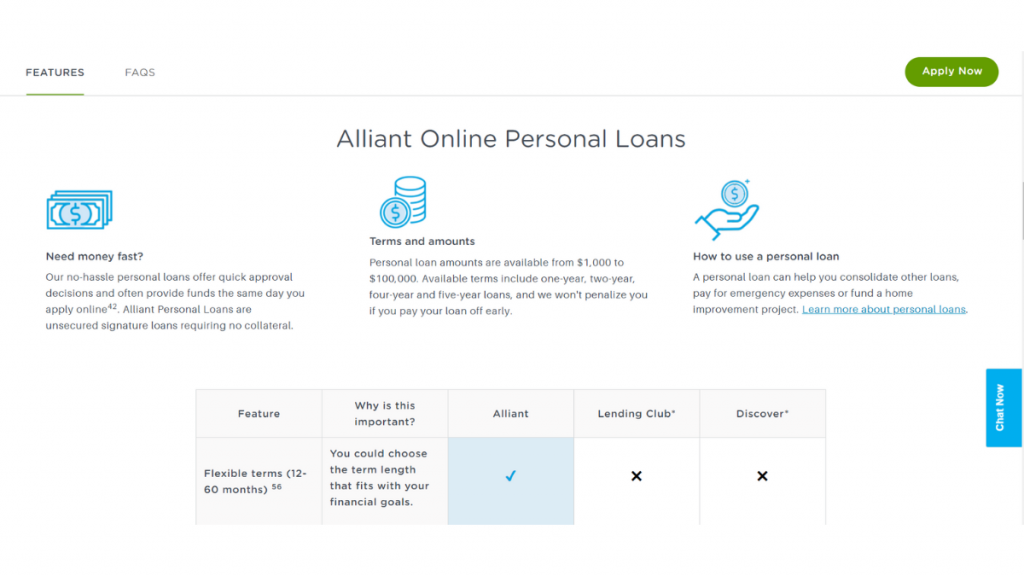

When you apply for Alliant Credit Union Personal Loans, you'll experience the convenience of same-day funding and access to a wide loan range.

Advertisement

Experience lightning-fast funds and flexible repayment terms for your every need

Interested in securing financial flexibility? You can easily apply for the Alliant Credit Union Personal Loans online, and we’re going to show you how.

Discover the easy steps to secure your funds quickly and efficiently. Dive into the full article below for a complete walkthrough of the process and get your money fast!

Online application

Firstly, visit Alliant’s website. Hover over “Borrow” and then click on “Personal Loans”. Next, take a few minutes to familiarize yourself with their lending solution.

So, ready to commit? Then hit “Apply Now.” Existing members can simply log in, while potential newcomers can use the guest option. You can choose to join after.

Now, it’s time to apply fully. Share basic info like name, income, and loan amount. It’s simple and designed for a stress-free experience.

Done filling out? Then pause and review your data. Accuracy is key to avoiding delays or issues. Confirm all is correct, from personal details to loan specifics.

Then, click “Submit” and wait for a response. Alliant works behind the scenes, evaluating your eligibility for the financial leap you’re aiming for.

If approved, as a member, you’ll have the funds available to you fast. As a newcomer, you need to follow the steps to become an Alliant member before disbursement.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

Alliant maintains a bit of mystery around its borrower requirements. However, it’s clear that decisions on loan approvals consider your credit score and ability to pay back.

Moreover, if you’re eyeing a personal loan with Alliant, there’s a need to have a few things in order.

You should be an existing member of the Alliant Credit Union for at least three months.

You also need to be ready to provide your Social Security number. Also, your gross income details per month and current employment information.

Apply on the app

In the age of digital banking, it might come as a surprise that you can’t apply for Alliant Credit Union Personal Loans through their mobile app.

Moreover, the credit union prefers the website for loan applications to ensure a secure, comprehensive process that mobile interfaces can sometimes limit.

So, if you’re considering taking this financial step, it’s best to apply for Alliant Credit Union Personal Loans directly on their official website using the steps on the topic above.

Compare the Alliant Credit Union Personal Loans to other options: Navy Federal Personal Loans

Alliant Credit Union Personal Loans are great financial tools. They offer flexibility and solid rates, aiding your monetary needs efficiently.

However, Navy Federal Personal Loans emerged as a strong alternative. With competitive aspects, they promise financial ease and reliable support.

| Alliant Credit Union Personal Loans | Navy Federal Personal Loans | |

| APR | Expect rates between 10.49 and 29.49%; | Depending on your credit profile, rates range from 7.99% to 18.00%; |

| Loan Purpose | Debt consolidation, home improvement, medical emergencies, and much more; | The loan accommodates various borrowing needs such as home improvement, debt consolidation, and more; |

| Loan Amounts | Funds between $1,000 and $100,000 are available; | Loan amounts available from $250 up to $50,000; |

| Credit Needed | There is no minimum requirement set; | No set minimum standard; |

| Origination Fee | There are none; | Not applicable; |

| Late Fee | Not disclosed; | A small fee of $29 for tardiness; |

| Early Payoff Penalty | Settle your loan anytime without extra charges. | Settling your loan early comes with zero penalties. |

So, are you curious about the Navy Federal offerings? Then discover more and find out how to apply through the link below. A world of financial opportunity awaits!

Apply for the Navy Federal Personal Loans

Find out how to apply for Navy Federal Personal Loans. Step into a world of low rates and flexible loan amounts tailored to your needs.

Trending Topics

Discover it® Secured credit card full review: should you get it?

Discover it® Secured card is unanimous among credit building cards: one of the few that offers 2% cash back. Learn more about its benefits!

Keep Reading

BOOST Platinum Card full review: should you get it?

The BOOST Platinum Card is a credit card with exclusive benefits such as 0% APR and a good credit limit! So, read our review to learn more!

Keep Reading

Annual fee: everything you need to know about

Wondering what an annual fee is? How it works? Whether you should pay for one? How to avoid it? This article has everything you need to know!

Keep ReadingYou may also like

Is Foster the Money safe?

Security and reliability are two of the most important aspects of a personal finance website. Find out if Foster the Money is up to par.

Keep Reading

Buy cheap Alaska Airlines flights: easy step by step

Buy cheap tickets for flights on Alaska Airlines with just a $50 bill. Learn how to take advantage of "secret" deals and save big.

Keep Reading

The effects of the euro crisis on tourism: understand the consequences

One of the effects of the euro crisis is the stimulus to tourism. This might be the best time to go to Europe! Read on to understand.

Keep Reading