Loans

Apply for Buy on Trust: Fast, Flexible Leasing

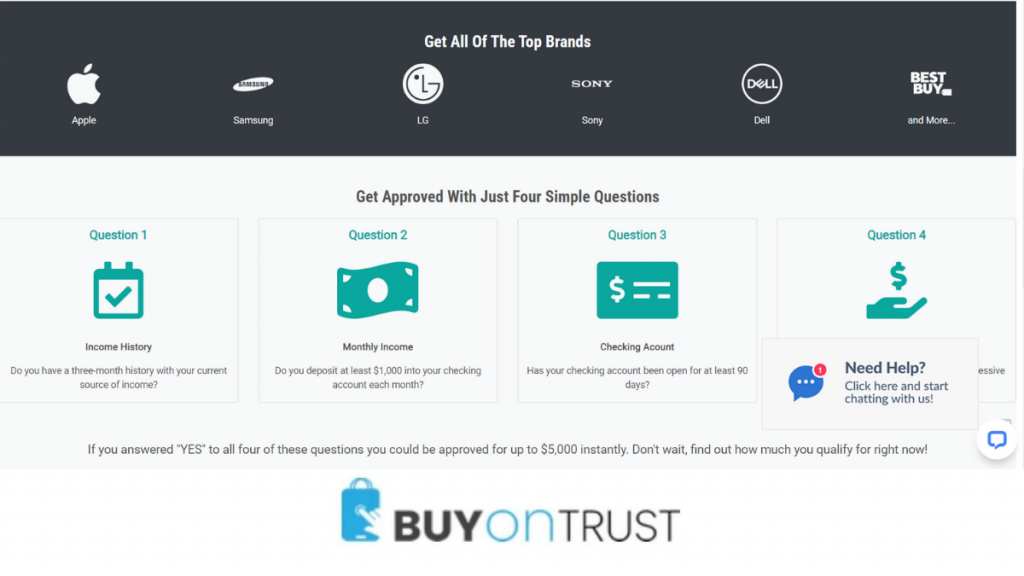

Discover how to apply for Buy on Trust and streamline your tech leasing with instant approval and flexible payment options. Experience easy processing and access to a vast range of top brands.

Advertisement

Step into the future of electronics leasing with swift approvals and adaptable plans

Do you want to learn how you can apply for Buy on Trust? It’s straightforward and caters to a diverse audience. Discover the ease of the application process right here.

Curious about the details? Continue reading our comprehensive guide to understand the simple steps for a full application and take advantage of this opportunity.

Online application

Firstly, to apply for Buy on Trust, visit their official website. Start by entering basic personal information like your name, address, email, and phone number.

Next, you’ll need to verify your mobile number. After submitting your initial details, you’ll receive a text message with a confirmation link for verification.

Following mobile verification, the next step involves financial details. You’ll be required to input your social security number and provide proof of income.

Subsequently, ensure your checking account meets its criteria. It should be active for at least 90 days with no excessive overdrafts or negative balances.

Finally, once all information is reviewed and approved, you’ll receive a credit decision. If approved, you can immediately start shopping with your credit line.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What are the requirements?

- Initially, provide your name, address, email, and phone number on their website.

- Next, verify your identity through a text message confirmation link.

- Then, enter your social security number for financial verification.

- Also, submit proof of consistent income for at least three months.

- Ensure your checking account has been active for 90 days minimum.

- Lastly, confirm your account is free from excessive overdrafts or negative balances.

Apply on the app

While Buy on Trust doesn’t offer a dedicated mobile app, this isn’t a barrier to applying. It’s important to note that their platform isn’t confined to traditional desktop access.

Instead, the Buy on Trust website is fully mobile-responsive. This means you can easily apply using your smartphone or tablet, enjoying the same functionality as on a computer.

Therefore, the absence of an app doesn’t hinder your ability to apply. With their mobile-optimized site, applying for Buy on Trust remains convenient and accessible.

Compare Buy on Trust to other options: Electro Finance

Buy on Trust seamlessly blends quick approval and a rich selection of brands for your tech leasing needs. Its services are an ideal choice to try before you buy.

Meanwhile, Electro Finance offers an alternative path, providing a wide range of electronics with adaptable lease terms to suit different preferences.

Additionally, Electro Finance distinguishes itself with user-friendly leasing, flexible payment options, and a no-impact approach to your credit score, ensuring a stress-free experience.

| Buy on Trust | Electro Finance | |

| APR | Not specified, as this is not a traditional loan service. | Not applicable as this is a lease-to-own program, not a traditional loan. |

| Loan Purpose | To lease electronics and home goods with an option to own. | To lease and eventually purchase electronic devices. |

| Loan Amounts | Offers up to $5,000 in credit for leasing products. | Credit limits up to $5,000 for leasing electronics. |

| Credit Needed | No credit history required; suitable for poor, limited, or no credit applicants. | Available to various credit types, including those with bad credit. |

| Origination Fee | A small initial payment ($50) is required. | Information on this is not explicitly provided. |

| Late Fee | Details on late fees are not prominently specified. | Specific late fee details are not clearly outlined. |

| Early Payoff Penalty | Option to pay off within 90 days with a $10 fee, otherwise no specific early payoff penalty noted. | No penalty for early payoff, but availability varies by state. |

Lastly, to explore Electro Finance further and understand their application process, follow the link below. Step into a simplified world of technology leasing tailored just for you.

Apply for Electro Finance: Swift Access to Tech

Learn how to apply for Electro Finance for instant electronic access and same-day pickup at Best Buy, simplifying your tech purchases.

Trending Topics

Up to $36,500: LendingPoint Personal Loans review

Consolidate debt smoothly - read our LendingPoint Personal Loans review! Enjoy a simplified process and affordable conditions!

Keep Reading

Find out how to apply for a Best Egg Loan: up to $50K quickly

Looking for the best loan for your personal needs? If so, you can learn how to apply for a Best Egg Loan with amounts of up to $50,000!

Keep Reading

Citi® Secured Mastercard® full review: should you get it?

The Citi® Secured Mastercard® is a credit-building option you need to know about: monthly reports to credit bureaus and no annual fee!

Keep ReadingYou may also like

The unemployment rate in Canada has reached an all-time low

The unemployment rate in Canada has reached a historic low! Understand why lenders are hiring and why this should change in the future.

Keep Reading

Allegiant World Mastercard® full review: should you get it?

Allegiant World Mastercard® is a card that will give you access to a rewards program that will guarantee you free air travel! Know more!

Keep Reading

Regions Explore Visa® Credit Card: check out how to apply!

Apply to Regions Explore Visa® Credit Card and build or rebuild your credit with excellent benefits. Find out how here!

Keep Reading