Loans

Apply for CashNetUSA: Swift, Easy Loan Access

Applying for CashNetUSA is straightforward, offering quick loan approvals and excellent customer service.

Advertisement

Experience fast approvals and top-notch customer support with CashNetUSA

Looking to apply for CashNetUSA? Our comprehensive guide breaks down the process into simple steps. From easy application to swift approval, we cover it all.

So keep reading to get a complete understanding. We’ll take you through the entire process so you can get the money you need, making your experience hassle-free.

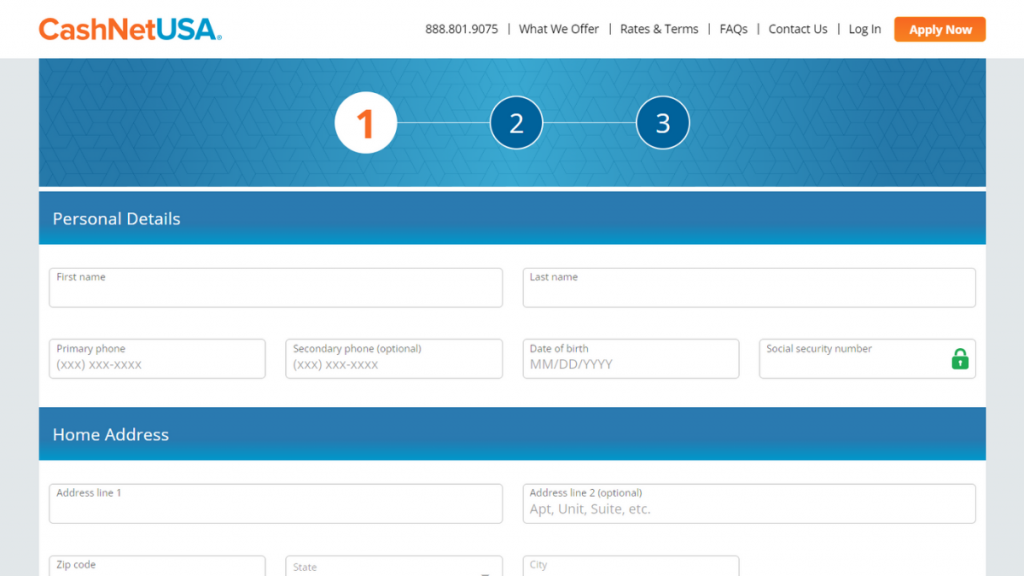

Online application

Firstly, visit CashNetUSA’s website to apply for CashNetUSA. Then, select your state. This step is important because it determines the loan types and amounts available in your region.

Secondly, once your state is selected, you’ll see the specific loan options they offer there. So review these carefully to understand what financial solutions suit your needs best.

Then, choose the amount you want to borrow. CashNetUSA’s website guides you through this, making sure you make an informed decision based on your financial situation.

Following this, fill out the application form. Provide accurate personal and financial details. This step is vital for CashNetUSA to check your loan eligibility.

Lastly, submit your application and wait for a decision. CashNetUSA often provides quick responses, making it convenient for those in need of urgent financial assistance.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- To apply for CashNetUSA, you need a regular source of income.

- Active bank account.

- US citizen or permanent resident.

- Legal age of majority in your state.

- Valid contact information (phone and email).

Apply on the app

It’s important to note when looking to apply for CashNetUSA, they currently don’t have a mobile app. However, this isn’t a setback, as their focus is their comprehensive website.

The good news is that CashNetUSA’s website is fully mobile-friendly. You can easily navigate and apply using your phone or tablet, ensuring convenience on-the-go.

So, even without a dedicated app, applying online through CashNetUSA’s website is easy. Their optimized mobile site makes it seamless to manage your loan application.

Compare CashNetUSA to other options: LoanPionner

In summary, CashNetUSA offers quick loans with flexible credit requirements, and you can easily apply for them. While convenient, it’s crucial to consider their high APR and state availability.

So LoanPioneer comes as a viable option. It caters to those seeking different loan types and terms with more favorable conditions.

Also, LoanPioneer stands out with its broad network of lenders and personalized loan options. Indeed, their approach caters to diverse financial needs and credit situations.

| CashNetUSA | LoanPionner | |

| APR | On the high end, ranging from 201.32% to 1,140.63% | Varies from 5.99% to 35.99%, fitting different loan types. |

| Loan Purpose | Emergency funds or personal expenses. | Flexible, covering everything from emergencies to home improvements. |

| Loan Amounts | $100 to $3,000, depending on which state you live in. | Up to $5,000, catering to a range of financial needs. |

| Credit Needed | Broad acceptance, including subprime credit. | Minimum FICO score of 500, considering other financial factors. |

| Origination Fee | Varies, based on state laws. | Depends on the lender within LoanPioneer’s network. |

| Late Fee | Specific to loan terms and state guidelines. | Set by individual lenders; check terms for specifics. |

| Early Payoff Penalty | It varies according to the state you reside in. | Varies; review lender terms for details. |

Interested in exploring LoanPioneer? Then follow our detailed guide below to learn more and understand how to apply for LoanPioneer, opening doors to different loan opportunities.

Trending Topics

Tangerine World Mastercard® card: check out how to apply!

Apply for the Tangerine World Mastercard® card and get up to 2% cash back in categories of your choice and a 1.95% intro balance transfer fee.

Keep Reading

Millennials and retirement: are they getting behind when it comes to saving?

Millennials are not very prepared for retirement. Understand what is happening and how you can financially prevent yourself for your old age.

Keep Reading

Regions Life Visa® Credit Card: check out how to apply!

Want to apply for Regions Life Visa® Credit Card? Great. Read on and learn how to enjoy this product. Including 0% intro APR.

Keep ReadingYou may also like

Your Gateway to Higher Education: Apply for Ascent Student Loan

Apply for Ascent Student Loan and turn your academic dreams into reality. Streamlined applications make accessing financial support a breeze.

Keep Reading

Applied Bank® Gold Preferred® Secured Visa® credit card full review: should you get it?

The Applied Bank® Gold Preferred® Secured Visa® credit card is a tool that combines credit building and a low APR. Learn more!

Keep Reading

What credit score do you need to lease a car?

Are you wondering what is the minimum credit score to lease a car? Wonder no longer! Keep reading and discover next! Let's go!

Keep Reading