Reviews

First Progress Platinum Elite Mastercard® Secured credit card review

Here is an excellent tool for anyone looking to build or rebuild their credit. Discover the First Progress Platinum Elite Mastercard® Secured credit card and its main advantages.

Advertisement

This credit card has been deactivated by the issuer. This article is purely for information purposes.

Excellent limit and an annual fee below the market average

A little boat sailing in the calm waters of the sea. In fact, this image represents the peace of mind of owning a First Progress Platinum Elite Mastercard® Secured credit card.

First Progress Platinum Elite Mastercard® Secured card: check out how to apply!

Learn how to apply for the First Progress Platinum Elite Mastercard® Secured card, a great tool for building credit up to $2,000.

With this card, you build credit without generating new debt. Learn more about this credit product in this article:

| Credit Score | Any score |

| Annual Fee | $29 |

| APR | 25.24% (V) for Purchases; 30.24% (V) for Cash Advances |

| Welcome bonus | None |

| Rewards | None |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

First Progress Platinum Elite Mastercard® Secured credit card: learn more about this financial product

At some point in life, everyone has needed to build credit. If that’s your goal, using the First Progress Platinum Elite can be a great option. In fact, this is a secured card.

This means that you will be limited to the amount of money you deposit in advance. This model accepts deposits from $200 up to $2,000. That way, you will have a good limit when building your credit.

In addition, this card issues reports to the three largest credit bureaus in the country. That way, your score will grow with each payment made on time.

When applying for this card, you will not go through inquiries or credit history.

So, if you still don’t have a good score, it won’t be a problem. Even a bankruptcy settled on your record would not get you rejected. To activate your card, simply make a minimum deposit of $200.

First Progress Platinum Elite Mastercard® Secured card features

Before applying for this card, check the lists below. In these, you will learn about the main advantages and disadvantages of this credit product:

What are the benefits?

- Choose your own credit line – $200 to $2000 – based on your security deposit.

- Build your credit score.¹ Reports to all 3 credit bureaus.

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

- Pay 6-months-on-time and apply to get a second credit card!

- Secured Cards are a great way to start establishing credit for people with low/no credit scores¹.

- Get a fresh start! A discharged bankruptcy in your credit file will not cause you to be declined.

- Past credit issues shouldn’t prevent you from getting a credit card with great benefits & rewards!

- See your VantageScore®+. Easy, Free Access to Credit.

- Education in the First Progress Card Mobile App!

- Receive your card more quickly with the new expedited processing option.

- User-friendly Mobile App.

- Accepted throughout the U.S. and online.

- Accepted wherever Mastercard® is accepted.

And what are the drawbacks?

- This card offers a relatively high APR;

- If you apply for cash advance, you will have to pay high fees of $10 or 3% per withdrawal (whichever is greater);

- Pay an annual fee of $29 and 3% on foreign transfers;

- Via telephone, you can request agility in your payments. However, you must pay a $10 fee for each expedited payment.

What score do you need to get the First Progress Platinum Elite Mastercard® Secured credit card?

During the application process, there will be no consultation of your score. So even with a bad credit score, you can still have this card.

How does the First Progress Platinum Elite Mastercard® Secured credit card application process work?

You can apply for this card without leaving your home! To do so, check out our post below and read the full review on how to apply for this card!

First Progress Platinum Elite Mastercard® Secured card: check out how to apply!

Learn how to apply for the First Progress Platinum Elite Mastercard® Secured card, a great tool for building credit up to $2,000.

Trending Topics

How do student loans work?

Understanding how student loans work can be the difference between smooth adult life and living in a "swamp" of debt! Know more!

Keep Reading

Straightforward process: apply for Funding U Student Loan

Ready to apply for Funding U Student Loan? Explore flexible student financing options and start your application hassle-free.

Keep Reading

Allegiant Air: cheap flights and offers

Allegiant Air is ideal for those looking for cheap flights. See this review and find out how to hire travel packages with 40% off!

Keep ReadingYou may also like

Earned Income Tax Credit (EITC): see if you qualify for the program

There is a federal program that allows you to recover your taxes. Click here to learn more about the Earned Income Tax Credit (EITC).

Keep Reading

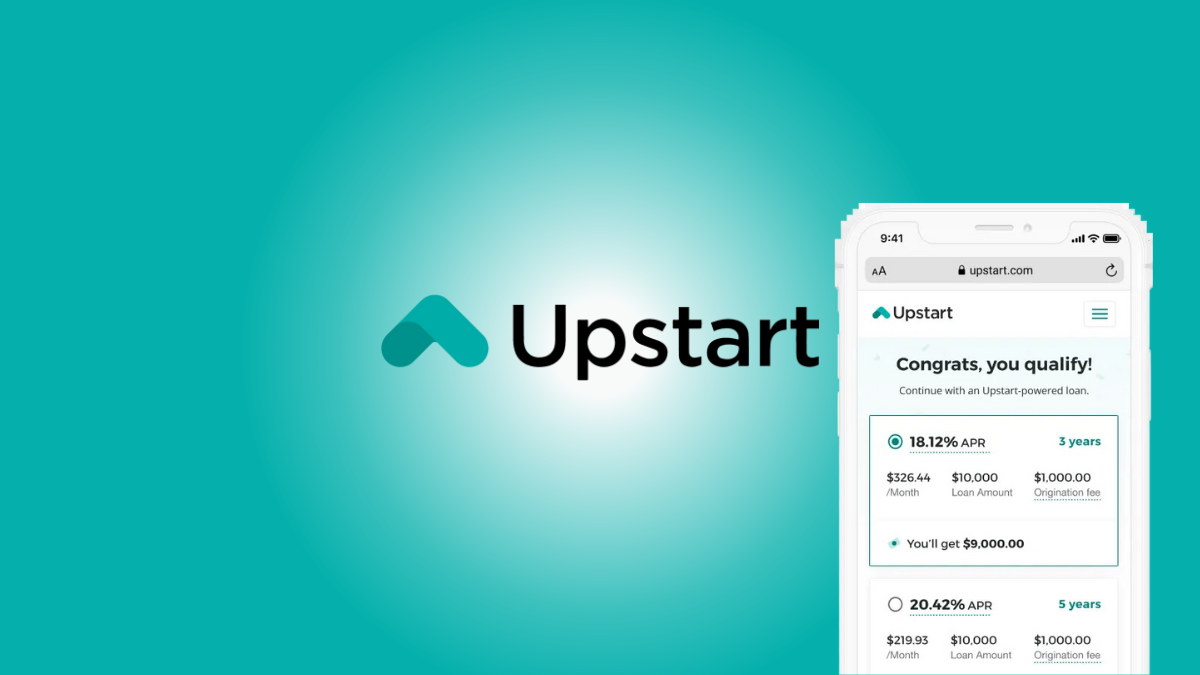

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Keep Reading

Best banks for students in 2022: 6 options

Students need specific bank accounts to avoid problems and worries. Read on to get to know the best banks for students!

Keep Reading