Loans

Apply for CreditFresh: No Hidden Charges

Applying for CreditFresh is hassle-free, offering rapid approval and no hidden costs. Benefit from a line of credit with a wide range of $500 to $5,000 with adaptable repayment options.

Advertisement

Enjoy loans from $500 to $5,000 with straightforward repayment plans

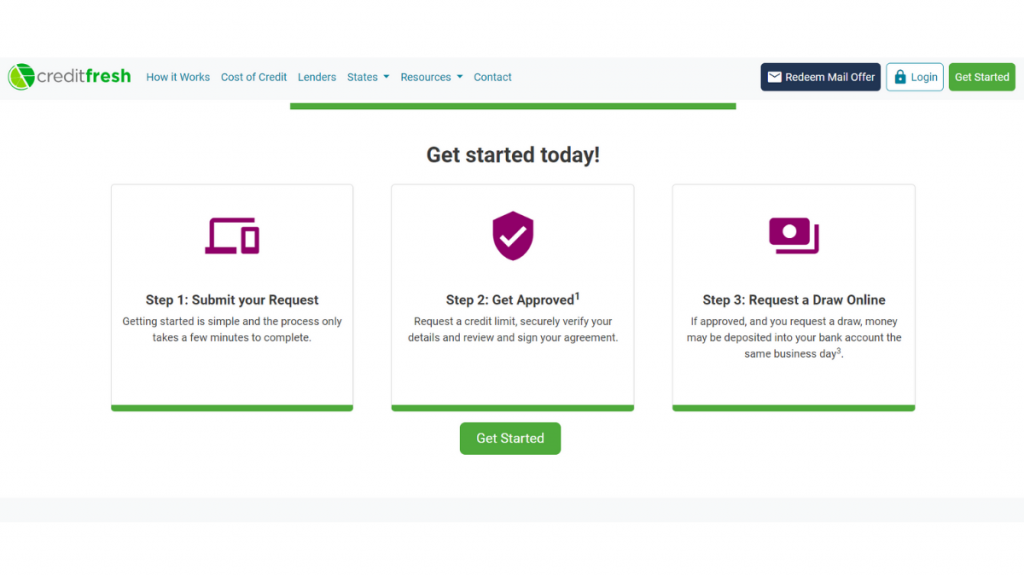

Looking for a reliable way to get fast cash? Starting your journey to apply for CreditFresh is straightforward and user-friendly. Their online process simplifies access to funds.

Stay tuned for a step-by-step guide on how to apply below, ensuring a seamless experience. Check the full article to embark on your CreditFresh journey right away!

Online application

Firstly, navigate to the CreditFresh website. Here, you’ll easily find the option to initiate your application, guiding you smoothly to the necessary form.

Subsequently, the form requires your basic personal information, such as your name, address, and Social Security number. Accuracy is key for a smooth process.

Then, you’re prompted to enter financial details, including income and employment. This step is crucial for CreditFresh to evaluate your loan suitability.

Following your submission, CreditFresh does a swift review. This process is typically quick in order to provide decisions promptly.

Finally, upon approval, you’ll be presented with a credit offer. It’s important to thoroughly review and understand the terms before accepting to complete the process.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Firstly, you must be of legal age in your state of residence to apply.

- Additionally, applicants need to be either U.S. citizens or permanent residents.

- Also, having an active bank account is a requirement.

- Moreover, a consistent source of income is required for eligibility.

- Furthermore, offering a valid contact number and email address is essential.

- CreditFresh does not specify a minimum credit score but looks at your creditworthiness.

Apply on the app

When looking to apply for CreditFresh, note that they do not offer a mobile app for the application. However, this isn’t a setback.

Instead, their website is designed for mobile use. This means you can comfortably apply for CreditFresh directly from your smartphone or tablet.

Furthermore, the mobile-friendly website provides a seamless and user-friendly experience, making the application process efficient and straightforward.

Compare CreditFresh to other options: SpeedyNetLoan

CreditFresh stands out with its loan options and transparent fee structure, catering well to all kinds of financial needs. It’s a solid choice for accessible lending.

Alternatively, if you’re exploring other options, SpeedyNetLoan is as a noteworthy choice. It offers a different approach to lending services.

Moreover, SpeedyNetLoan is known for its quick approval process and a large data of lender options. It tailors services to individual financial circumstances.

| CreditFresh | SpeedyNetLoan | |

| APR | Starting at 65%, suitable for a wide range of credit backgrounds. | Starting from 5.99% for high-credit borrowers varies by lender. |

| Loan Purpose | From emergencies to personal projects. | From debt consolidation to personal expenses. |

| Loan Amounts | Broad range, $500 to $5,000, to fit your specific needs. | Varies based on lender terms and borrower’s eligibility. You can borrow from $100 to $5,000. |

| Credit Needed | Flexible, welcoming scores from poor to excellent. | Available to a wide range of credit scores. |

| Origination Fee | Zero, making it more cost-effective to start. | Depends on the lender, disclosed in loan terms. |

| Late Fee | Designed to be fair while encouraging on-time payments. | Determined by the lender, specified in the loan agreement. |

| Early Payoff Penalty | None, offering freedom to repay early without extra costs. | Varies by a lender; details provided in loan terms. |

Finally, to dive into what SpeedyNetLoan offers and to understand its application process, check the link below. Discover how it can meet your financial needs.

Apply for SpeedyNetLoan: Tailored Loans for Your Needs

Learn how to apply for up to $5,000 with SpeedyNetLoan with our guidance. Enjoy a quick, hassle-free process with diverse loan options.

Trending Topics

Get the best conditions: Apply for the Happy Money Personal Loans

Do you need to consolidate your debt and be free from abusive interest? Then read on to apply for Happy Money Personal Loans - up to $40K!

Keep Reading

Discover it® Miles Credit Card: check out how to apply!

Apply to Discover it® Miles Credit Card to earn miles for every dollar spent and see your rewards multiplied by 2x at the end of the year!

Keep Reading

Upgrade Triple Cash Rewards Card or Upgrade Cash Rewards Card: discover your best fit

Upgrade Triple Cash Rewards or Upgrade Cash Rewards Card? Check out the comparison and find out which cash back program is the best for you.

Keep ReadingYou may also like

BMO CashBack® Mastercard® credit card full review: should you get it?

Cashback that covers all your purchases, especial discounts and zero liability. Meet the BMO CashBack® Mastercard® credit card.

Keep Reading

How to choose a bank: know the best option for your finances

Not knowing how to choose a bank can cost you a lot of money and good opportunities. To learn more about this, read on!

Keep Reading

Red Arrow Loans: find out how to apply!

Apply to Red Arrow Loans and, within seconds, have access to lenders available to offer loans for you to choose from. Read on!

Keep Reading