Loans

Apply for the Discover Personal Loans: Get Swift Funding

Applying for Discover Personal Loans is streamlined and user-friendly. Experience swift approvals and receive funds fast. Keep reading and learn more!

Advertisement

Streamlined application, fast funding, and no hidden costs to kickstart your financial plans

Discover the steps to apply for the Discover Personal Loans with our concise guide. Indeed, it’s your first move toward a savvy financial decision.

So, let’s navigate the path to apply for the Discover Personal Loans. Furthermore, our article below lays out the journey to your next big life milestone.

Online application

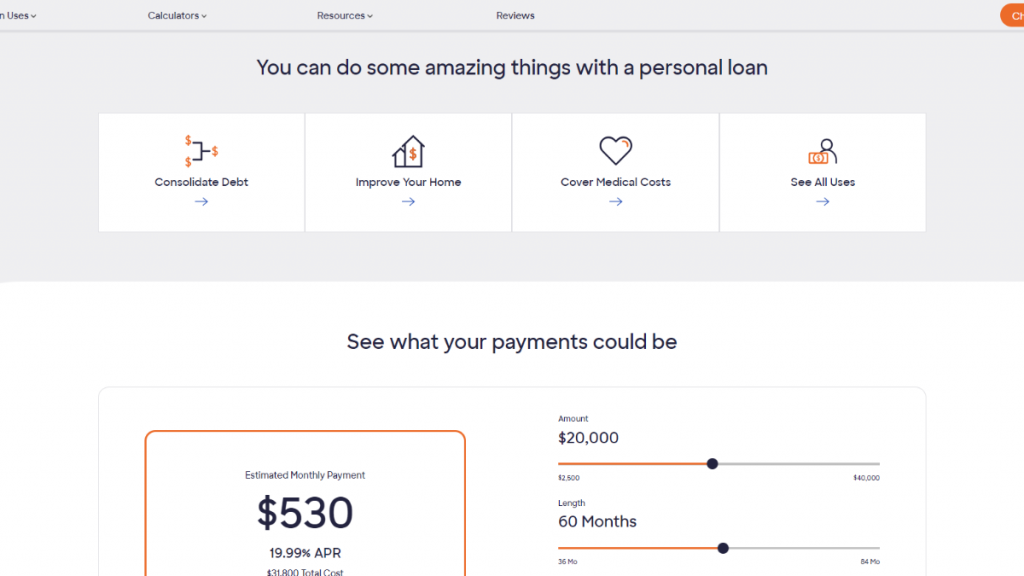

The process to apply for Discover Personal Loans is simple. Firstly, take advantage of their online pre-qualification, which offers a sneak peek at rates with no credit damage.

Then, move to the actual application by filling out a detailed form. You’ll need to provide personal and financial info, which helps Discover personalize your loan options.

After you input your details, Discover will showcase a range of loans for you. So review the rates, terms, and monthly payments to understand what fits your financial plan best.

You’ll then finalize your choice and proceed to submit your application. So at this stage, be ready to upload any necessary documents that verify your income and employment.

So upon approval, which can be as quick as one business day, the funds are deposited directly into your account. You can then manage your loan!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Applicants should have a credit score above 660 for consideration;

- Documentation to confirm stable earnings is required;

- Consistent employment or a regular income source is necessary;

- A government-issued identification card must be presented;

- Possession of a functioning checking or savings account;

- Applicants need to be 18 or older.

- Must be a legal U.S. resident or citizen.

- A favorable debt-to-income ratio ensures loan affordability;

- A credit history that reflects responsible borrowing and payment habits.

Apply on the app

Although the Discover mobile app provides robust account management tools, it’s not yet equipped for initiating personal loan applications.

Indeed, to apply for Discover Personal Loans, the website is the designated platform, offering a secure and comprehensive application process.

Once your loan is approved, the Discover app becomes a valuable tool for monitoring your loan’s progress, complementing the web-based application experience.

Compare the Discover Personal Loans to other options: Prosper Loans

Indeed, Discover Personal Loans offers a transparent lending experience with its easy online application and no hidden fees, ideal for borrowers with good credit.

But if Discover doesn’t fit your needs, Prosper Loans may be a viable alternative, offering peer-to-peer lending with competitive terms.

Furthermore, Prosper’s competitive rates and straightforward application process make it an attractive option for those who value community-driven financial services.

| Discover Personal Loans | Prosper Loans | |

| APR | Expect rates between 7.99% and 24.99%. | Rates range from 6.99% to 35.99% for borrowers. |

| Loan Purpose | Suitable for a variety of personal needs. | Suitable for home makeovers, medical urgencies, wedding events, travel, and more. |

| Loan Amounts | Eligible individuals can secure loans ranging from $2,500 to $40,000. | Borrowers can opt for amounts ranging from $2,000 to $50,000. |

| Credit Needed | The minimum threshold is 660. | A minimum score of 560 is required. |

| Origination Fee | No origination fee is applied. | Charges vary from 1% to 5% based on credit assessment. |

| Late Fee | A charge of $39 is levied for late payments. | The greater of 5% or $15 of the monthly due. |

| Early Payoff Penalty | There is no penalty for early loan repayment. | Not applicable. |

Curious about Prosper Loans? Then explore the link below to explore their offerings and understand the application process in our comprehensive guide.

Apply for the Prosper Loans: Generous Borrowing Limits

Check our step-by-step guide on how to apply for the Prosper Loans, learn the process with ease and secure your financial needs efficiently.

Trending Topics

How to budget for international travel: 5 best tips

With a good international travel budget and the right tips, you can even travel for free! Find out how here and make the trip of your dreams.

Keep Reading

Capital One Quicksilver Secured Cash Rewards Card: check out how to apply!

Learn how to apply for the Capital One Quicksilver Secured Cash Rewards Card, the credit-building card that gives unlimited rewards.

Keep Reading

Debt elimination plan: the best way to get rid of your debt

A debt elimination plan is what you need to eliminate your debts once and for all. Read on to learn how to use this tool quickly and easily!

Keep ReadingYou may also like

FIT™ Platinum Mastercard®: check out how to apply!

Revolutionize your financial life with a card made to build credit and earn up to a $400 limit. Apply for the FIT™ Platinum Mastercard®!

Keep Reading

Aspire® Cash Back Reward credit card full review: should you get it?

Meet the Aspire® Cash Back Reward credit card, one of the few cards that offer cashback for people with bad credit. Learn all about it!

Keep Reading

MoneyLion Loans Review: Unlock Easy Credit Building

Learn how you can boost your credit score and have access to exclusive perks – including cash back – with our MoneyLion Loans review.

Keep Reading