Reviews

Merrick Bank Secured Credit Card full review: should you get it?

If you're looking for a card to build credit with a good credit limit, read our Merrick Bank Secured Credit Card review to learn more!

Advertisement

Merrick Bank Secured Credit Card: build your credit

The Merrick Bank Secured Credit Card is a product designed for anyone who needs to build or rebuild their own credit.

Merrick Bank Secured Card: check out how to apply!

Apply for the Merrick Bank Secured Card to get a high credit line of up to $3,000 and start building your credit score!

In fact, while you see your credit score growing, you can count on many advantages. Learn more about this card below:

| Credit Score | Low |

| Annual Fee | $36 paid in one go for the first year. Next, $3 per month |

| Regular APR | 20.45% variable APR for purchases and 25.45% variable APR for cash advances |

| Welcome bonus | None |

| Rewards | None |

Merrick Bank Secured Card: learn more about this financial product

Indeed, this card is designed for people who need to build or rebuild credit. Therefore, it has all the essential basic services for this purpose.

With this card, your payments are reported to the three largest credit agencies in the country. Plus, your security deposit must be between $200 to $3,000.

Also, this is a Mastercard card, accepted almost anywhere in the country.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Merrick Bank Secured Credit Card features

Indeed, this is a very popular card among people looking to boost their credit scores.

However, compared to other options on the market for the same purpose, we find the following advantages and disadvantages. See below!

What are the benefits?

- Great for building credit: reporter At the top 3 credit bureaus in the country;

- Accepts applicants with bad credit scores for credit building or rebuilding;

- Review of your credit limit.

And what are the drawbacks?

- Annual fee collection;

- 2% foreign transfer fee;

- Requires a security deposit;

- No welcome bonus or reward program;

- You won’t get an automatic credit limit increase.

What credit score do you need to get the Merrick Bank Secured Credit Card?

Indeed, this card is designed for anyone who needs to build or rebuild credit. For this reason, we recommend it to people with bad credit. However, there is no set minimum score.

How does the Merrick Bank Secured Credit Card application process work?

Learn how to apply for this card without queueing or leaving your house. So, read our post below to learn about this card’s application process!

Merrick Bank Secured Card: check out how to apply!

Apply for the Merrick Bank Secured Card to get a high credit line of up to $3,000 and start building your credit score!

Trending Topics

BMO eclipse Visa Infinite card: check out how to apply!

Learn how to apply for the BMO eclipse Visa Infinite card and gain access to one of Canada's best credit card reward programs.

Keep Reading

Apply for the Single Family Housing Guaranteed Loan Program: find out how

Apply to Single Family Housing Guaranteed Loan Program and build your own home paying low interest on a government-guaranteed loan.

Keep Reading

Earnest Student Loan: find out how to apply!

Apply to Earnest Student Loan and get access to student loans free of most fees charged by other companies in the field. Find out more here!

Keep ReadingYou may also like

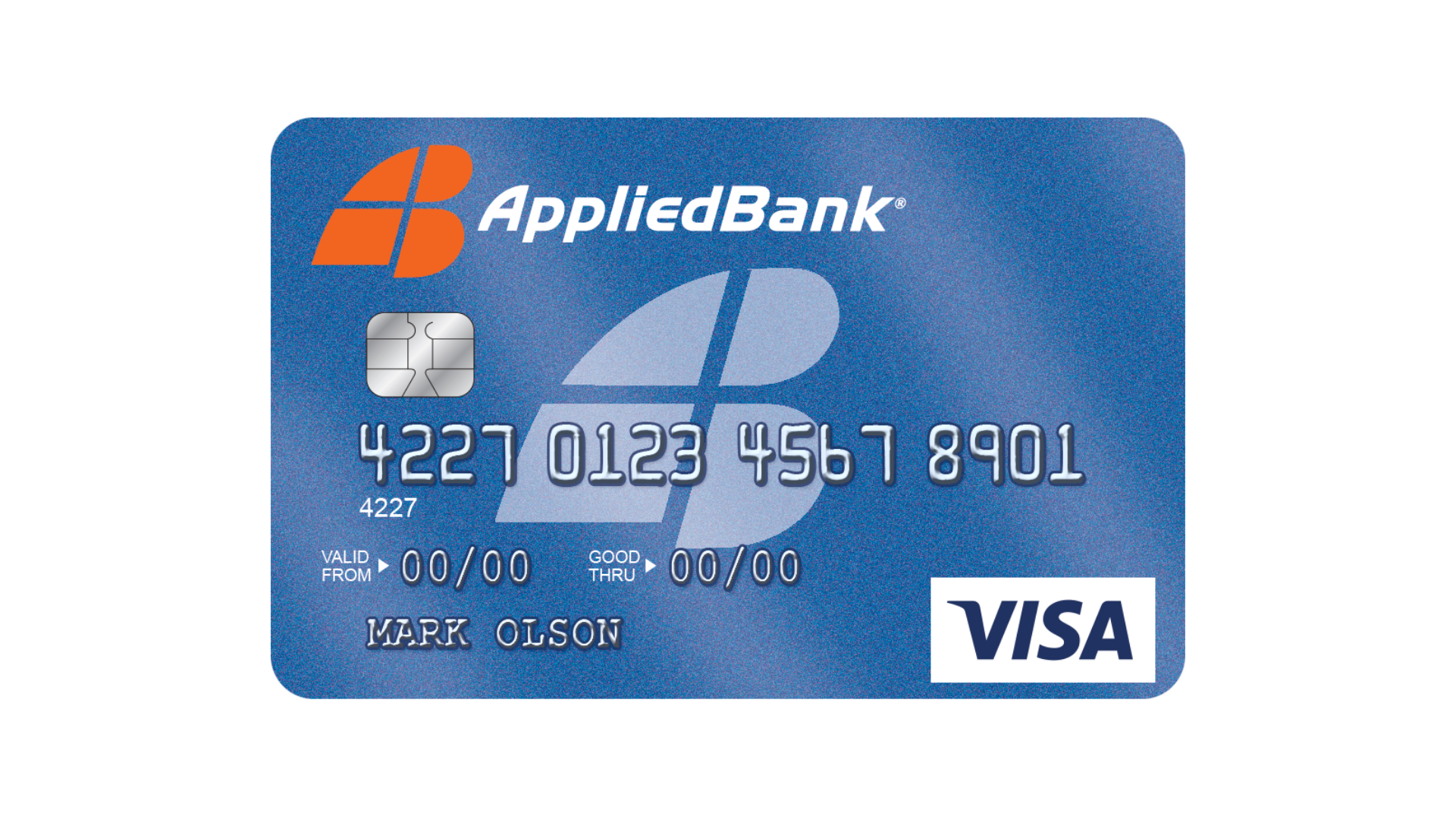

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Find out if you can have your Applied Bank® Unsecured Classic Visa® card in only 60 seconds without damaging your credit: learn how to apply.

Keep Reading

10 best travel apps for every type of traveler

Make your trips much better for free. See the list of the best travel apps and find out what you missed by not downloading them sooner!

Keep Reading

First Digital Mastercard® full review: should you get it?

Meet the First Digital Mastercard®, a $300 limit card and everything you need to build your credit. Learn all about it here!

Keep Reading