Loans

Apply for the Possible Finance Loans: Get Fast Cash Access

Learn how to easily apply for Possible Finance Loans and access quick funding with an easy online application and no credit check! Read on!

Advertisement

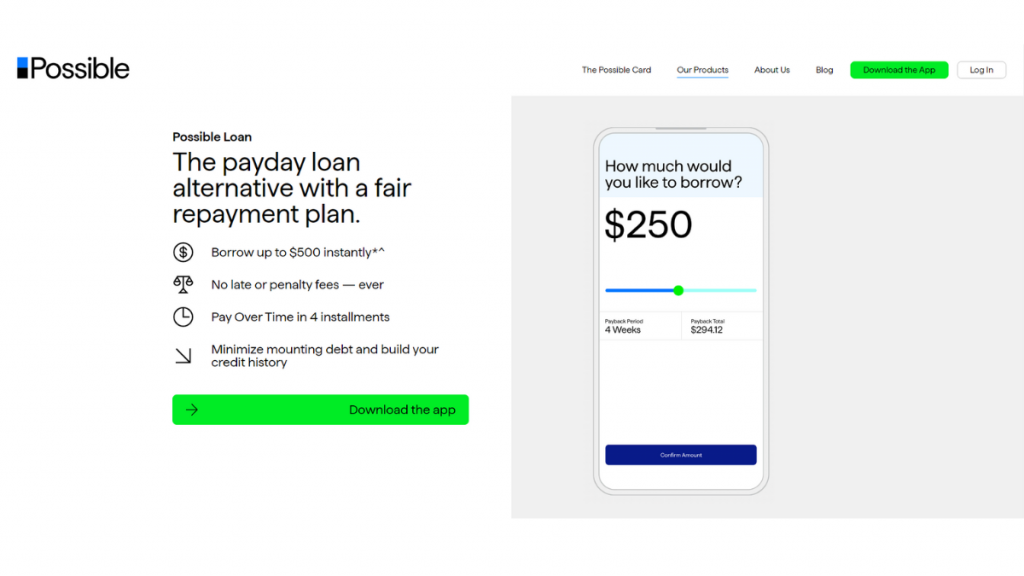

Unlock quick funding with simple terms, building credit while you borrow!

Looking to apply for Possible Finance Loans? This quick, no-credit-check solution could be your answer to unexpected expenses or short-term financial needs.

With just a few steps, you can secure the funds you need. Below, we’ll lay out everything you need to know. So get the insider tips and make your application shine!

Online application

The journey to apply for Possible Finance Loans comes with a twist: you won’t be clicking “submit” on their website.

Unlike traditional methods, you can’t apply via a web browser.

Instead, you must use the Possible Finance app. Still, there’s no need for a complicated search; so their website features a QR code, making downloading the app a breeze.

Additionally, the site is a goldmine of information.

Before applying, you can understand every detail about the loan, ensuring a confident and informed decision-making process.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

Indeed, you can easily apply for Possible Finance Loans via a mobile app, and the requirements are few. So all you need is:

- A checking account compatible with Plaid, linking your bank with financial apps.

- A bank account history showing consistent deposits and a positive balance.

- A valid SSN, driving license, identification, or passport.

Apply on the app

Starting your Possible Finance Loans journey is easy. First, download their app and create an account using your email. It’s your first step toward monetary peace of mind.

Next, provide your address and Social Security number. This step is essential for identity verification, ensuring a safe and personalized loan process for all users.

The third step involves linking your bank account. This lets Possible Finance review your financial standing, a critical part of determining your loan eligibility.

Once done, you’ll receive a prompt response on approval and how much you can borrow. So it’s direct and transparent, helping you make informed choices quickly.

Accept the loan offer, and the funds will be in your bank account in one to two days. It’s a speedy process, getting the financial support you need without unnecessary delay.

Compare the Possible Finance Loans to other options: Oportun Personal Loans

Indeed, the Possible Finance Loans serve as a quick, convenient option for those needing small, short-term funds.

Moreover, their unique approach offers a tech-savvy route to financial support.

However, Oportun Personal Loans is a strong contender.

Thus, they provide competitive loan options, potentially catering to a broader range of financial needs and circumstances.

| Possible Finance Loans | Oportun Personal Loans | |

| APR | Expect rates from 91.25% to 248.67%, varying by location; | Between 29.00% – 35.95%; |

| Loan Purpose | For any need; | Medical bills, unexpected expenses, home improvement, car repairs, and more; |

| Loan Amounts | Loans from $50 to $500 are available; | Borrowers can request funds between $300 and $10,000 with unsecured loans. $2,525 to $18,500 with a vehicle as collateral; |

| Credit Needed | All credit types can apply; | There are no minimum requirements; |

| Origination Fee | Fees differ by state; some charge $15-$20 per $100, others 25%; | Between 0% and 8%; |

| Late Fee | No extra charges for late payments; | Between $5 and $15; |

| Early Payoff Penalty | Repay whenever with no extra fees. | None. You can settle your loan anytime. |

Curious about what Oportun Personal Loans offer? So explore more about their services and understand their application process in our detailed article below.

Apply for the Oportun Personal Loans: Fast Approvals

Ready to elevate your finances? Learn how to apply for the Oportun Personal Loans for tailored rates and a smooth borrowing experience!

Trending Topics

First Progress Platinum Prestige Mastercard® Secured Credit Card review

Rebuild your credit with a card that offers one of the lowest APR. Meet the First Progress Platinum Prestige Mastercard® Secured credit card.

Keep Reading

United℠ Explorer Card: check out how to apply!

Apply for the United℠ Explorer Card and get access to a rewards miles program that never expires and lets you travel for free!

Keep Reading

Avant Credit Card full review: should you get it?

The Avant Credit Card is one of the best ways to build/rebuild your credit and you can have a limit of up to $3,000. Learn more about it!

Keep ReadingYou may also like

Chase Freedom Flex℠ credit card full review: should you get it?

Mentioned in the best card lists, the Chase Freedom Flex℠ credit card goes far beyond 5% cashback. Learn more about it in this review!

Keep Reading

Wells Fargo Active Cash℠ credit card full review: should you get it?

The Wells Fargo Active Cash℠ received 5 best credit card awards. Meet this financial product and its powerful 2% unlimited cashback program!

Keep Reading

Calculating Your Retirement Savings: How Much Money Do You Need?

Do you wonder how much money do you need for retirement? If so, we can help you find out and get the best retirement!

Keep Reading