Reviews

Avant Credit Card full review: should you get it?

The Avant Credit Card has established itself as an excellent product to build and rebuild credit. Read this article and learn how to get up to a $3,000 limit without having to make any initial deposit.

Advertisement

Avant Credit Card: build your credit quietly by avoiding surprise fees

The Avant Credit Card is an excellent option for those who want to rebuild credit, are starting now or know how to use loans sensibly. In fact, this one fulfills its mission of being a cheap card, with few and good rates.

Below, read a full review of the Avant Card and find out how it can improve your financial life.

Avant Card: check out how to apply!

Learn how to apply for the Avant Credit Card and enjoy the privilege of building/rebuilding your credit with a limit of $3,000 with no surprise fees or initial deposit.

| Credit Score | From fair to good (580-740) |

| Annual Fee | From $0 to $59 |

| Regular APR | 29.24%-35.99% (variable) |

| Welcome bonus | None |

| Rewards | None |

Avant Credit Card: learn more about this financial product

A great starting credit limit and very interesting fees. In fact, the Avant Credit Card combines excellent features for a credit entry/recovery credit card. Right after harpooning, you will have access to a limit of $300 to $3,000. Even if you initially have access to a lower amount, you may see it increase as you use your credit well.

Thus, WebBank, a member of the FDIC, issuer of Avant products, constantly consults to increase credit limits in indefinite terms. In addition, the Avant Credit Card does not create barriers to accessing a credit product. As it is not a secured card, you don’t need to make deposits to start using it.

In fact, this is a great advantage, since not everyone has the financial reserve to invest in cards. The Avant Card fulfills one of its main promises: no surprise fees. In fact, Avant went beyond the process and also zeroed the fee for transfers abroad. Most options on the market tend to keep this rate at 3%.

In addition, with this card, you can count on protection in cases of fraud. If you need cash upfront, you can apply for the Avant Card by paying just $10 or 3% of the amount, whichever is greater. Finally, this card offers special conditions for those who wish to apply for it.

In fact, pre-qualification allows you to see what rates you will have access to even before confirming your application. All this without hurting your credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Avant Credit Card features

In fact, the Avant Credit Card is a solid option for anyone who wants to access credit without difficulty. However, before applying for this card, it is important to compare the advantages and disadvantages. This is the only way to ensure you are making a good choice.

Below, check out a list of the main pros and cons of this card:

What are the benefits?

- Great credit limit: from $300 to $3,000;

- It does not charge a fee for foreign transfers;

- No initial deposit is required to start using it;

- Know in advance what rates you’ll have access to and whether you’ll be approved even if you commit to the card or hurt your credit score.

What are the drawbacks?

- Annual fee charged up to $59 starting in the first year;

- Does not allow balance transfers;

- No reward program or welcome bonus;

- Despite being a build/rebuild credit card, it generally does not accept applicants with poor credit scores.

What credit score do you need to get the Avant Credit Card?

To maximize your chances of being able to count on the Avant Credit Card, we recommend a credit score of at least 580. Therefore, we recommend that you have at least a reasonable credit score.

How does the Avant Credit Card application process work?

Indeed, it is possible to make an inquiry before applying for the Avant Card. That way, you can know what rates you’ll have access to before you even commit to that card or hurt your credit score.

To learn how to count on this resource, click on the link below and read an exclusive article.

Avant Card: check out how to apply!

Learn how to apply for the Avant Credit Card and enjoy the privilege of building/rebuilding your credit with a limit of $3,000 with no surprise fees or initial deposit.

Trending Topics

Avant personal loan: find out how to apply!

Apply for the Avant personal loan and enjoy exclusive advantages: cash in your account in one day, credit building, and much more.

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card full review: should you get it?

Petal® 1 "No Annual Fee" Visa® Credit Card offers up to a $5,000 limit and 10% cash back for people with bad credit. Learn more here!

Keep Reading

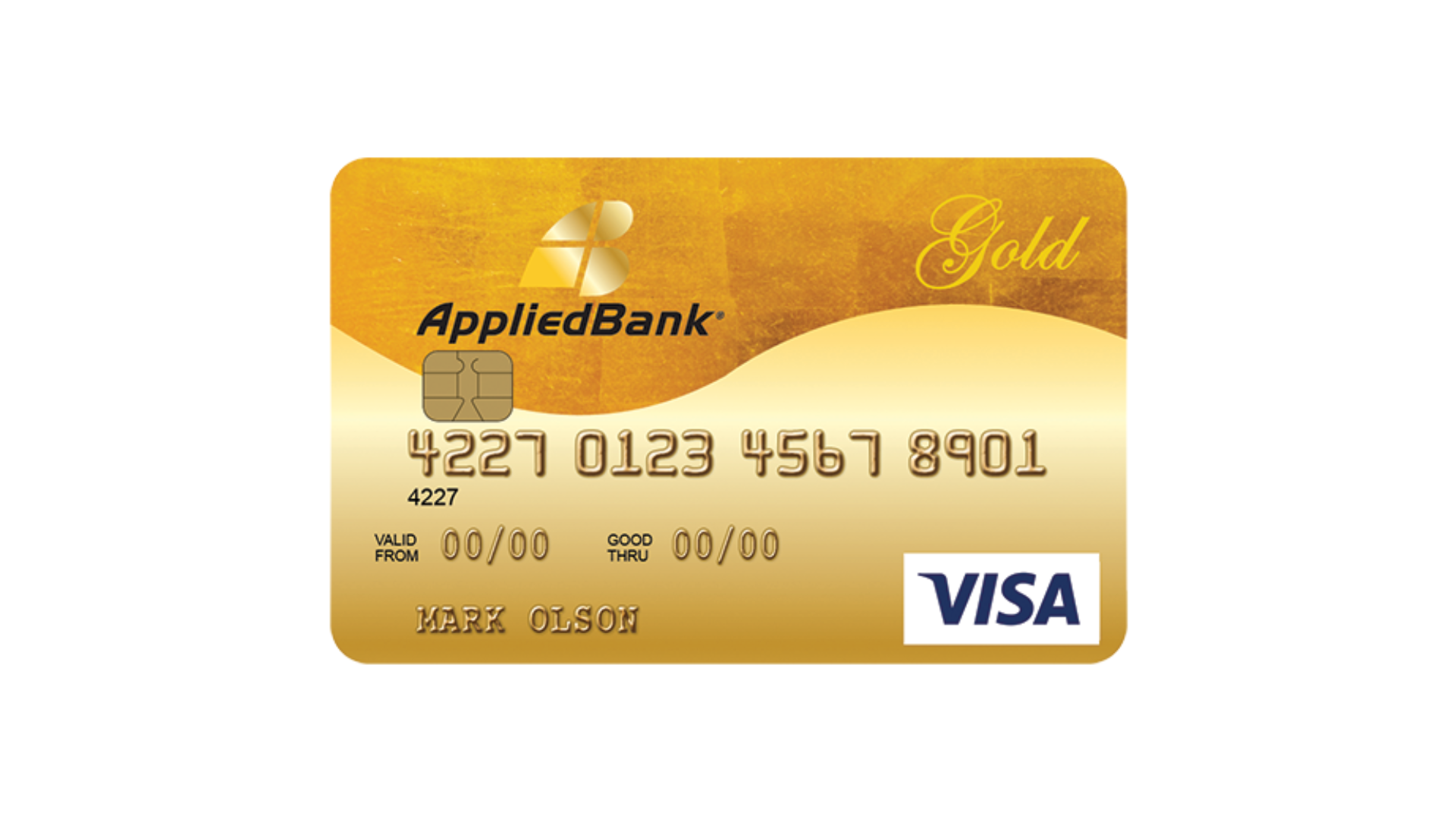

Applied Bank® Gold Preferred® Secured Visa® card: check out how to apply!

Apply for the Applied Bank® Gold Preferred® Secured Visa® card and build your credit with an incredibly low APR. Read on to learn more!

Keep ReadingYou may also like

Apply for Rescue One Financial: Ease Your Debt Today!

Learn how to apply for Rescue One Financial. Simple steps for debt relief, expert guidance, and a solution toward achieving your goals.

Keep Reading

Surge® Platinum Mastercard® review: should you get it?

The Surge® Platinum Mastercard® review is an interesting option for building credit. Check out how to count on up to a $1,000 starting limit!

Keep Reading

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Keep Reading