Loans

Achieve Your Dream: Discover Student Loan Refinance Review

Are you struggling with student debt? Try Refinancing! But before you make a decision, dive into our Discover Student Loan Refinance review!

Advertisement

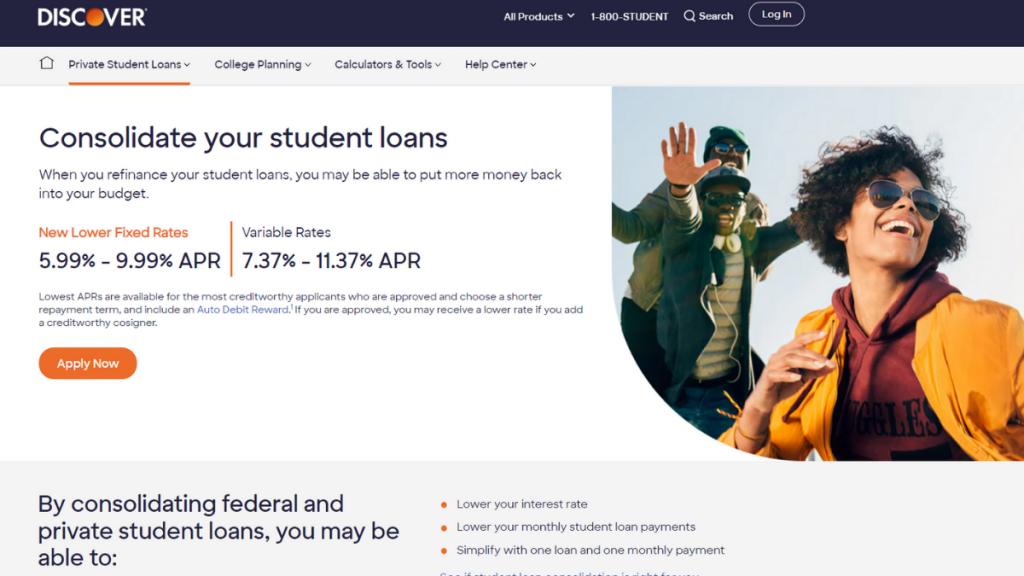

Escape the Student Debt Trap: Discover Student Loan Refinance

Do you find yourself struggling to manage your student loan payments? So, this Discover Student Loan Refinance review may be the answer you’ve been seeking.

Apply for Discover Student Loan Refinance

Ready to conquer student debt? Learn how to apply for Discover Student Loan Refinance and pave the way to stress relief!

Further, we’ll leave no stone unturned as we explore the ins and outs of this refinancing option. So, read on and get your finances back on track!

| APR | Between 5.99% and 11.37%; |

| Terms | 10 to 20 years; |

| Loan Amounts | Minimum $5,000 and up to the total amount of your student loan; |

| Credit Needed | Good or Excellent credit score; |

| Origination Fee | No origination fee; |

| Late Fee | No late fees will be charged; |

| Early Payoff Penalty | You can pay your loan earlier with no penalty. |

Is the Discover Student Loan Refinance a good option?

Discover is a renowned financial institution known for its credit cards, banking services, and student loan products.

Indeed, among its offerings, this lender stands out! It is a potent tool to help borrowers manage and overcome the challenges of repaying debt.

For instance, this service allows eligible borrowers to refinance their existing student loans.

Also, it combines them into a single, more manageable loan with potentially lower interest rates.

Individuals can simplify their finances by taking advantage of their products. You’ll save money on interest and work towards a brighter financial future.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of the Discover Student Loan Refinance

You can make a well-informed decision by knowing this option’s potential pros and cons.

Let’s review the pros and cons of this lender:

Advantages

- Lower Interest Rates: Refinancing with them may lead to reduced interest rates. Thus, potentially saving you money over the life of the loan;

- Potential Savings: Also, lower interest rates and improved terms can result in significant savings on interest payments over time;

- No Origination Fees or Prepayment Penalties: It does not charge origination fees or prepayment penalties, providing borrowers with greater flexibility;

- Cosigner Release Option: After making a specified number of on-time payments, you may be eligible to release your cosigner;

- Consolidation of Federal and Private Loans: It allows you to refinance both federal and private student loans;

- Excellent Customer Service: Finally, it is known for its responsive and helpful customer service, providing support throughout refinancing.

Disadvantages

- Loss of Federal Loan Benefits: Refinancing federal loans with them means losing federal loan benefits, such as loan forgiveness and income-driven repayment plans;

- Credit Impact: Applying for refinancing may temporarily impact your credit score due to a hard credit inquiry;

- Limited Repayment Assistance Programs: It offers fewer repayment assistance options than some federal loan programs, which may disadvantage borrowers experiencing financial challenges.

What credit score do you need to apply?

This lender typically requires a high 600 or above credit score for approval.

However, meeting the minimum requirement does not guarantee acceptance, as other factors like income and debt-to-income ratio are also considered.

Having a mid-to-high 700 or above credit score is generally recommended for the most favorable terms and interest rates.

Discover Student Loan Refinance application process

This Discover Student Loan Refinance review intends to show you all the benefits and possible disadvantages of refinancing to help you make a well-informed decision.

Furthermore, we’ll show you how to apply for it from the comfort of your own home.

So don’t waste any more time, and click on the following link to read our full blog post about it.

Apply for Discover Student Loan Refinance

Ready to conquer student debt? Learn how to apply for Discover Student Loan Refinance and pave the way to stress relief!

Trending Topics

Prosper Loans Review: Fast Funding with Flexible Terms

Dive into our Prosper Loans review, spotlight on low rates, fast approvals and flexible repayment terms. Navigate lending with confidence!

Keep Reading

Apply SoFi Personal Loans: Pre-qualify easily!

Ready to take control of your finances? Learn how to apply for SoFi Personal Loans hassle-free, ensuring your financial goals!

Keep Reading

Apply for CashNetUSA: Swift, Easy Loan Access

Learn how to easily apply for CashNetUSA with our guidance for quick, user-friendly loan processing and responsive customer support.

Keep ReadingYou may also like

6 tips on how to budget: make the most of your money!

Here are six essential pieces of advice for anyone looking to learn how to build a budget that really works. Read on to find out!

Keep Reading

Tackle Your Debt: SoFi Student Loan Refinance Review

Worried about student loan interest? A SoFi Student Loan Refinance option could be the answer you've been seeking in this review!

Keep Reading

The three types of income: learn more about them

Get to know the main types of income and understand why diversifying your income sources is so important. Read on to learn more!

Keep Reading