Loans

Tackle Your Debt: SoFi Student Loan Refinance Review

Is Sofi Student Loan Refinance right for you? Get all the information you need to make an informed decision. Overcome the hurdles of student debt with SoFi!

Advertisement

Simplify Your Finances with Sofi Student Loan Refinance: Lower Interests!

Navigating the post-graduation financial landscape can be daunting. Still, with our Sofi Student Loan Refinance review, there’s a silver lining to the student debt cloud.

Pay no hidden-free: Apply for SoFi Student Loan Refinance

Learn how to tackle your student debt with ease! Apply for SoFi Student Loan Refinance with our application guide.

Indeed, this innovative program presents a fresh perspective on managing your student loans and paving the way to a more stable financial future. So let’s learn more about it!

| APR | 4.99% to 9.99% fixed or variable rates with autopay; |

| Terms | 5 to 10 years; |

| Loan Amounts | No limit. You can borrow the total amount of your loan debt; |

| Credit Needed | SoFi does not specify a minimum income. Yet, they consider everyone and assess the eligibility somewhere else; |

| Origination Fee | None; |

| Late Fee | None; |

| Early Payoff Penalty | SoFi does not charge any fee if you pay off your loan earlier. |

Is the SoFi Student Loan Refinance a good option?

Without a doubt, Sofi Student Loan Refinance can be an excellent option for borrowers facing the challenges of student loan debt.

To clarify, it offers a range of benefits that can help you save money, manage your loans more effectively, and potentially pay off your debt faster.

However, whether it’s the right choice for you depends on your individual financial situation, goals, and preferences.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

The pros and cons of the SoFi Student Loan Refinance

Sofi Student Loan Refinance can be an excellent option for borrowers facing the challenges of student loan debt.

Thus, it offers a range of benefits that can help you save money, manage your loans more easily, and potentially pay off your debt faster.

But are there any cons among its pros? Our SoFi Student Loan Refinance review will give you the full scoop about it:

Advantages

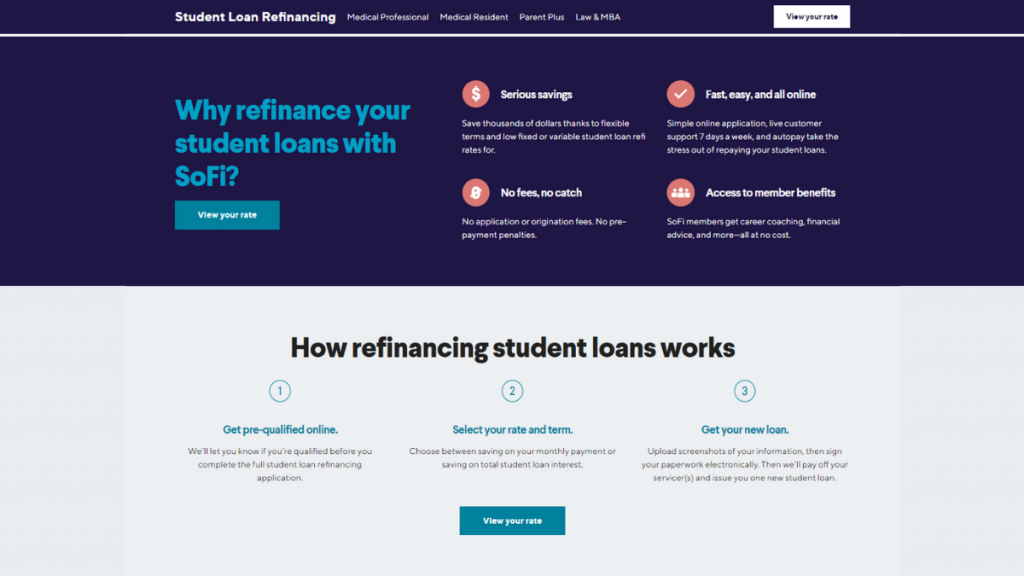

- Streamline Your Repayment: Embrace the convenience of consolidating multiple loans into one. Moreover, you’ll get a more manageable monthly payment, simplifying your debt management;

- Exclusive Membership Perks: As a valued Sofi member, access an array of unique benefits. Therefore, you’ll get personalized career counseling and comprehensive financial planning;

- Zero Application or Origination Fees: Rest easy knowing that Sofi refrains from imposing any additional costs during the application process. All in all, you’ll save money right from the get-go;

- Attractive Interest Rates: Additionally, SoFi consistently presents competitive interest rates, potentially resulting in substantial savings over the entire loan term;

- Flexible Terms Tailored to You: Also, you can craft your repayment journey, selecting from an assortment of thoughtfully provided loan terms.

Disadvantages

- Loss of Federal Benefits: If you refinance federal student loans with Sofi, you may lose certain federal benefits like loan forgiveness and income-driven repayment plans;

- Strict Eligibility Criteria: Also, not everyone will qualify for Sofi’s refinancing, as it typically requires a good credit score and steady income;

- Potential Impact on Credit Score: Applying for refinancing may result in a temporary dip in your credit score due to a hard inquiry;

- Limited Repayment Assistance: Unlike federal loans, Sofi may not offer the same level of repayment assistance during times of financial hardship.

What credit score do you need to apply?

To be eligible for Sofi Student Loan Refinance, you’ll generally need a good credit score, typically considered to be around 680 or higher.

If you’re unsure about your credit score, it’s a good idea to check your credit report and review your overall financial situation before applying.

SoFi Student Loan Refinance application process

Now, let’s learn how to apply for SoFi Student Loan Refinance. It’s time to make your financial life simpler!

Just click on the following link, and we’ll take you to our application guide.

Pay no hidden-free: Apply for SoFi Student Loan Refinance

Learn how to tackle your student debt with ease! Apply for SoFi Student Loan Refinance with our application guide.

Trending Topics

What are Social Welfare Programs? Find out if you qualify

Learn what are the six Social Welfare Programs offered by the U.S. government. They have changed the lives of millions of people!

Keep Reading

Easiest credit card to get in 2023: 5 best options

You can get the credit card you deserve, no matter your score! Discover a list of the 5 easiest credit cards to get!

Keep Reading

Avant personal loan: find out how to apply!

Apply for the Avant personal loan and enjoy exclusive advantages: cash in your account in one day, credit building, and much more.

Keep ReadingYou may also like

Prosper Loans Review: Fast Funding with Flexible Terms

Dive into our Prosper Loans review, spotlight on low rates, fast approvals and flexible repayment terms. Navigate lending with confidence!

Keep Reading

VivaLoan Review: Fast Loans Up To $15K for All Credit Types

In this VivaLoan review you’ll learn how to access up to $15,000 loans and rebuild credit, with next-day funds for various income types.

Keep Reading

Buy cheap Spirit Airlines flights: easy step by step

Find out how to buy a pass for ultra-cheap flights with Spirit Airlines flights: with $20 you can travel around the country! Learn more!

Keep Reading