Finances

Stimulus Check 2023: What to do if you still didn’t get it

Some states are still issuing financial aid to try to mitigate the damage generated by the pandemic. Can you still apply for this help? Lean more about stimulus checks in this post!

Advertisement

If you didn’t get your Stimulus Check, don’t worry! Here’s what to do

2022 is over, but many states still hand out last year’s stimulus checks. Thus, the question arises: what to do if you didn’t get your Stimulus Check?

Government food benefits: get the help you need

Government food benefits can be a chance to put food on the table without paying anything. Read on to learn more about these benefits!

First, it is important to reassure it. You probably still have money to receive this help. For more details, read the following post!

How can you track the status of your Stimulus Check?

Stimulus checks were one of the federal government’s strategies to help needy families and individuals during the pandemic.

Indeed, this support was sent as occasional annual payments to families meeting the income criteria defined for each year.

The government relied on their tax returns to determine the income of families or individuals. Therefore, it was not necessary to make an application.

The federal government has issued Economic Impact Payments for three consecutive years. Families with more members were eligible for larger checks.

While the pandemic is not yet officially over, there is no certainty about issuing a new shipment of stimulus checks. However, some states in the country are still making payments to their population.

Among these, we highlight California, Colorado, Delaware, Idaho, Illinois, Maine, Massachusetts, New Jersey, New Mexico, Pennsylvania, Rhode Island, South Carolina, and Virginia.

The best way to track the status of your stimulus check is through the Get My Payment service. This is a free service offered on the IRS website. To access it, just access the page if you already have a registration.

Another option is to use the services offered by the GetYourRefund.org platform. This online tool assists you in filing taxes and offers other services with the IRS.

It is a secure platform developed by Code for America in partnership with the IRS, the White House, and the US Department of the Treasury.

Since the third shipment of pandemic stimulus checks, the Get My Payment service has been closed indefinitely.

Those who want to get help from GetYourRefund.org need to register by the beginning of February.

As in the vast majority of projects the federal government offers, each state is free to define criteria for selecting candidates.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to get your Stimulus Check in 2023

According to official reports, the federal government has already issued three stimulus checks regarding the pandemic period.

However, some individuals and families claim they have not received one or more payments. In many of these cases, families and individuals meet the requirements stipulated by the government.

Thus, the question arises: “what to do if you didn’t get your Stimulus Check?”. Well, according to information from the official website of the IRS, all payments to eligible applicants have been issued.

There is no chance that you did not receive your stimulus check by mistake. What may have happened to you are that you forgot to issue any of the Income Tax returns from previous years.

After all, the IRS evaluates your returns for two or three consecutive previous years to decide whether or not you are eligible to receive this help.

So, if you didn’t receive your pandemic stimulus checks, check the status of your tax return. Most likely, you stopped issuing this document in one of the previous years.

To check this situation, you must access your account on the official IRS website. If you need to file tax returns, GetYourRefund can help for free.

This procedure is very important, especially for those who have not received 1st and 2nd remittance stimulus checks. Some states have not yet issued payments for the 3rd remittance.

So, if you live in any of these regions and have filled out all your tax returns, your check will be issued shortly. However, some states have different eligibility criteria. To learn more, see the topics below.

California

Basic eligibility criteria:

- 2020 tax returns by October 15, 2021;

- Have a maximum annual income in 2020 of $250,000 if single or $500,000 if married;

- Not having been dependent on a family;

- Have lived in California for at least six months.

Payouts can range from $200 to $1,050.

Colorado

Basic eligibility criteria:

- Be at least 18 years of age;

- Have lived in Colorado for the entire year of 2021;

- Have issued the IRS statement in 2021.

Payouts can range from $750 to $1,500.

Welfare Program: choose the right one for you

Unsure which Welfare Program is right for you? Check out our guide to see if you're eligible and find out more about the benefits!

Delaware

Basic eligibility criteria:

- Be at least 18 years old;

- Lived in Delaware from December 2021 to December 2022;

- Have issued tax returns in 2020 and 2021.

$300 in “Support Checks” per eligible person and their dependents.

Idaho

Basic eligibility criteria:

- 2020, 2021, and 2022 income statements (Grocery credit refund forms are accepted if the applicant is not required to file a tax return).

The state government provided assistance in the form of tax rebates of $75 to $300 per person and a 10% or 12% tax rebate.

Illinois

Basic eligibility criteria for income reimbursement:

- Have lived in Illinois in 2021;

- Reported gross income of up to $200,000.

$50 tax rebate per qualifying resident

Basic eligibility criteria for income reimbursement:

- Having paid property tax in 2020 and 2021;

- Gross income declares up to $250,000.

Property tax rebates of up to $300. The same person or family may be eligible for both types of benefits.

Maine

Basic eligibility criteria for energy bill reimbursement:

- IRS declaration in 201 and 2022;

- Reported income less than $100,000 for singles, up to $200,000 per family.

Payments are $450 for singles and $900 for families.

If your state is not on this list, consult the IRS information at an office near you. Finally, there are other ongoing projects that the federal government offers to improve your family’s quality of life.

By the way, one of them is Head Start, a program that ensures that your child takes important steps in school life. To learn more, see the following post.

Head Start: early childhood education for free

Head Start is a federal program that ensures children from underprivileged families have the same chances as any rich child! Understand!

Trending Topics

Sallie Mae Student Loan: find out how to apply!

Apply to Sallie Mae Student Loan and learn how to get stopped for loans even with bad credit scores and build your credit score!

Keep Reading

Southwest Rapid Rewards: get airfare for $0

Learn how Southwest Rapid Rewards can help you travel anywhere in the world with a companion for free. Read on to understand!

Keep Reading

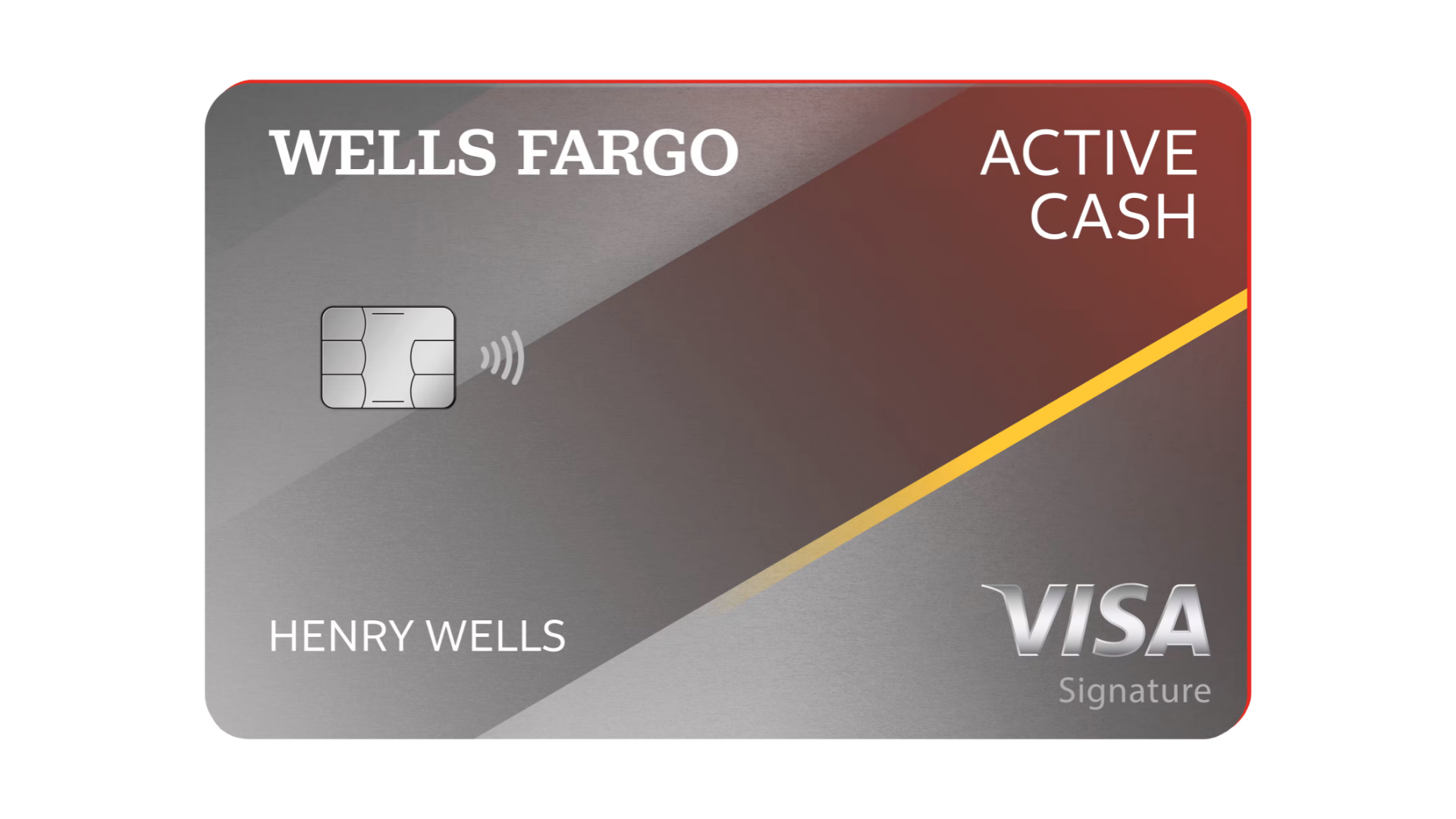

Wells Fargo Active Cash℠ card: check out how to apply!

Learn how to get one of the best cashback programs, a welcome bonus and 15 months of 0% APR. Apply for the Wells Fargo Active Cash℠ Card.

Keep ReadingYou may also like

Capital One Guaranteed Mastercard® credit card full review: should you get it?

Discover why the Capital One Guaranteed Mastercard® credit card is the first choice for many Canadians when it comes to building credit.

Keep Reading

United Airlines: cheap flights and offers

United Airlines is a unique opportunity for anyone looking to find cheap flights to national and international destinations. Learn more here!

Keep Reading

Chase Freedom Flex℠ card: check out how to apply!

Learn how to apply for Chase Freedom Flex℠, a card with one of the most lucrative reward programs in the US. Check out how to apply!

Keep Reading