Loans

LoanPioneer Review: Streamlined Loans

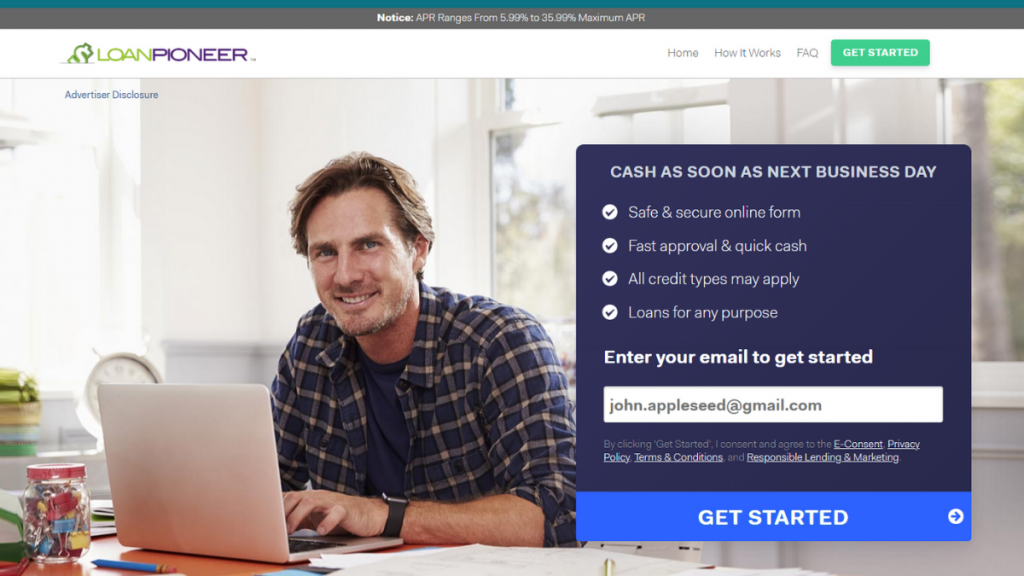

Explore our LoanPioneer review to learn about their fast and easy loan application process and wide network of lenders, ideal for handling different financial needs with simplicity and convenience.

Advertisement

Quick loan access with a broad lender network, tailored to your financial goals!

Looking for a reliable, quick loan? Our LoanPioneer review breaks it down for you. Learn how easy it is to get quick funds as we show you why LoanPioneer is a top choice for many!

We’ll take a closer look at the simple steps to get a loan with LoanPioneer and the many benefits it offers. So stick around to find out if this lending solution is the right fit for your financial needs!

| APR | Varies from 5.99% to 35.99%, fitting different loan types. |

| Loan Purpose | Flexible, covering everything from emergencies to home improvements. |

| Loan Amounts | Up to $5,000, catering to a range of financial needs. |

| Credit Needed | Minimum FICO score of 500, considering other financial factors. |

| Origination Fee | Depends on the lender within LoanPioneer’s network. |

| Late Fee | Set by individual lenders; check terms for specifics. |

| Early Payoff Penalty | Varies; review lender terms for details. |

Is LoanPioneer a good option?

Looking for a loan? LoanPioneer offers up to $5,000. Perfect for small, urgent needs. Applying is fast and hassle-free, ideal for when you’re in a pinch!

Moreover, with LoanPioneer, expect rates that are competitive. Their APRs range from 5.99% to 35.99%, making it a budget-friendly option for many borrowers.

Also, the terms are clear and straightforward. So you’ll understand exactly what you’re getting into, ensuring a transparent borrowing experience.

Furthermore, LoanPioneer’s process is incredibly user-friendly as you see later in this review. Apply from anywhere, anytime! It’s designed for your convenience and quick access to funds.

Importantly, watch out for any fees. While LoanPioneer prides itself on transparency, it’s always smart to read the fine print for any additional charges.

Lastly, LoanPioneer is versatile. Whether it’s for an emergency, a major purchase, or debt consolidation, they’ve got you covered. It’s lending made simple!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of LoanPioneer

In our LoanPioneer review, we weigh the advantages and drawbacks of using their services. Understanding these can help you decide if LoanPioneer meets your financial needs.

Advantages

- Firstly, you can access up to $5,000 quickly for urgent financial needs.

- Secondly, competitive APRs range from 5.99% to 35.99%, offering affordability.

- Transparent and simple loan terms help borrowers understand their commitments.

- User-friendly online application process ensures convenience and speed.

- Also, it accepts a wide range of income sources, including employment and benefits.

- Lastly, it’s available to residents in all 50 states, providing widespread accessibility.

Disadvantages

- Maximum loan limit of $5,000 might not suffice for those needing larger amounts.

- The application involves navigating through 10 pages, which can be time-consuming.

- Limited lender options in certain states may restrict choices.

- Potential hidden fees might be present, necessitating a careful review of loan terms.

What credit score do you need to apply?

Starting off, LoanPioneer requires a minimum FICO score of 500 to apply. This makes it accessible even for those with less-than-perfect credit histories.

In addition, while a score of 500 is the baseline, remember that lenders consider other factors too, like income and employment, boosting your approval chances.

LoanPioneer application process

In conclusion, our LoanPioneer review highlights its ease of access and flexible options, making it a viable choice for various financial needs.

Further, explore our detailed guide below on how to apply for LoanPioneer, and take the first step towards securing your financial future today.

Apply for LoanPioneer: Diverse Loan Types

Learn how to apply for LoanPioneer and have access to easy loans up to $5,000 with flexible purposes and a simple online process.

Trending Topics

What is budgeting? 7 easy tips to improve your money management!

"What is budgeting" is the question that, when answered, changes your financial life. Learn about the power of this feature!

Keep Reading

123 Money Loans Review: Fast Cash With Easy Approval!

Read our 123 Money Loans review to learn how to get a secure payday loan for bad credit, with easy online application, and fast funding!

Keep Reading

Avant personal loan review: up to $35,000 in one day!

$35,000 in your account within a day! Discover this and other advantages of applying for an Avant personal loan. Click and read a full review.

Keep ReadingYou may also like

Apply for the Possible Finance Loans: Get Fast Cash Access

Get funds fast when you apply for the Possible Finance Loans, featuring a unique approach to lending and incredible credit-building tools!

Keep Reading

Why are airline prices so high right now: the underlying reasons

Have you ever wondered why are airline prices so high? We have the answer! Find out what's behind the rise in ticket prices.

Keep Reading

VivaLoan Review: Fast Loans Up To $15K for All Credit Types

In this VivaLoan review you’ll learn how to access up to $15,000 loans and rebuild credit, with next-day funds for various income types.

Keep Reading