Great, I've just found the perfect credit card for you!

Citi® Double Cash, one of the best cash back programs you will find

Advertisement

If you’re looking for a simple, straightforward credit card with no annual fee, the Citi® Double Cash Card is a great option. With this card, you’ll earn 1% cash back when you make purchases and another 1% cash back when you pay off those purchases. Best of all: it is an unlimited cash back program. So if you’re looking for a card that will help you rack up rewards quickly, the Citi® Double Cash Card is your choice.

If you’re looking for a simple, straightforward credit card with no annual fee, the Citi® Double Cash Card is a great option. With this card, you’ll earn 1% cash back when you make purchases and another 1% cash back when you pay off those purchases. Best of all: it is an unlimited cash back program. So if you’re looking for a card that will help you rack up rewards quickly, the Citi® Double Cash Card is your choice.

You will remain in the same website

Discover the advantages that will revolutionize your financial life:

You will remain in the same website

The Citi® Double Cash card is one of the best cards in the market because it offers a simple and straightforward rewards program that can’t be beat. With the Citi® Double Cash card, you’ll earn 2% cash back on all purchases, with no caps or limits. And with Citi’s pre-approval tool, you can see if you’re pre-approved for the card in minutes without impacting your credit score. Simply sign in to your Citi® Double Cash login to manage your account and redeem your rewards

First, it’s a great way to save money on the things you buy every day. Second, cashback can be used to pay down your credit card balance, redeem for gift cards, or even travel rewards. Third, cashback is a flexible reward that can be used for anything you want.

No, you do not need a Citi Bank account to have the Citi® Double Cash card. Anyone with a good credit score can apply for and be approved for the card. You can also apply for the Citi® Credit Card Business, Citi® Credit Card Simplicity, or Citi® Credit Card AAdvantage with no need to open a Citi Bank account.

Trending Topics

Apply for the Alliant Credit Union Personal Loans: Fast Funding!

Learn how to apply for the Alliant Credit Union Personal Loans and benefit from its flexible terms, low rates, and same-day funding!

Keep Reading

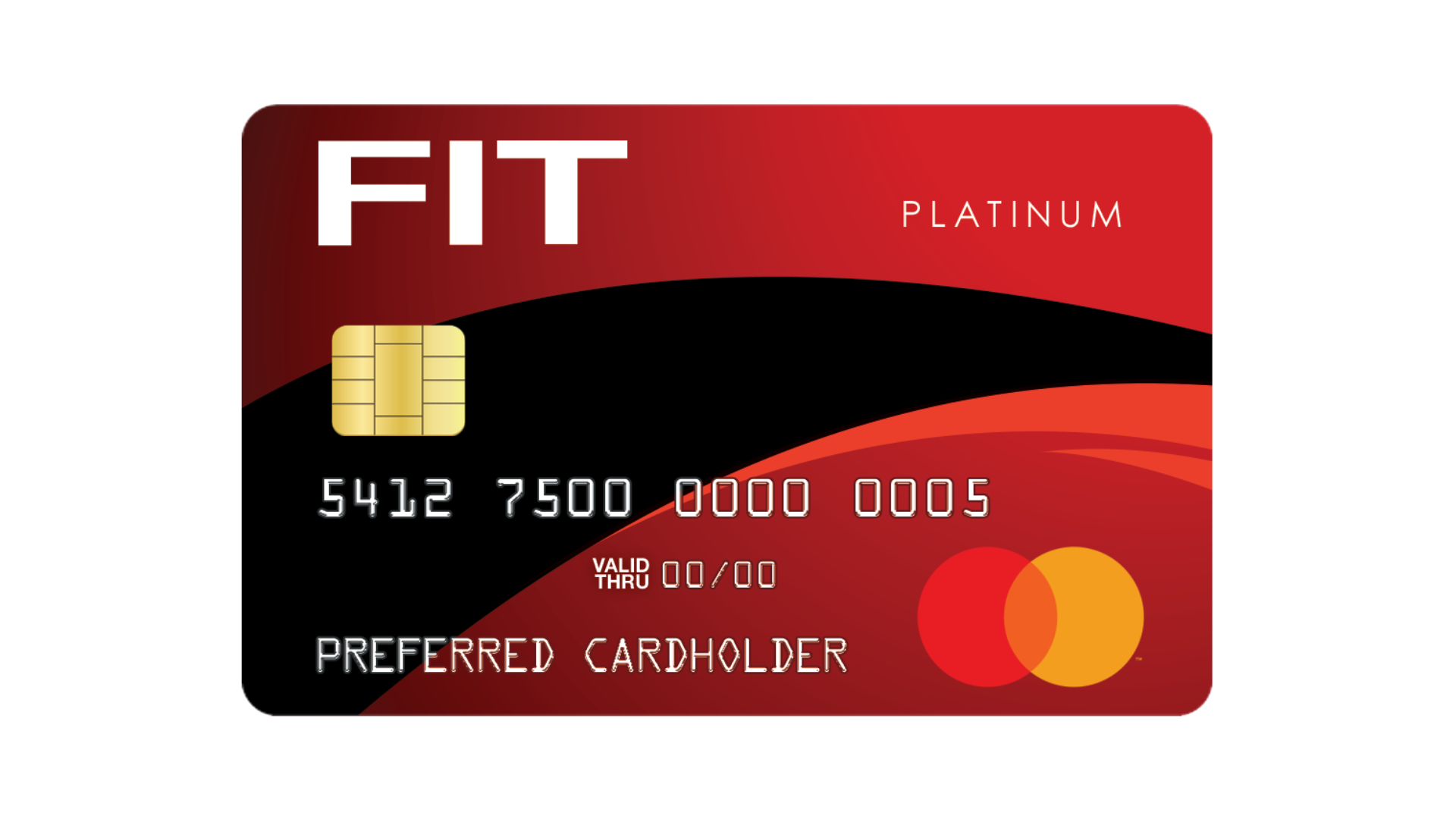

FIT™ Platinum Mastercard®: check out how to apply!

Revolutionize your financial life with a card made to build credit and earn up to a $400 limit. Apply for the FIT™ Platinum Mastercard®!

Keep Reading

Citi® Double Cash Card full review: should you get it?

Looking for a cashback credit card? Discover the Citi® Double Cash Card. 2% cashback on all purchases and no annual fee, it's hard to beat!

Keep ReadingYou may also like

LoanPioneer Review: Streamlined Loans

Our LoanPioneer review highlights fast loan approvals and extensive lender choices, perfect for diverse financial situations up to $5,000.

Keep Reading

Alliant Credit Union Personal Loans review: High Loan Amounts

Explore our Alliant Credit Union Personal Loans review to learn about its fast funding, wide loan range, and exceptional customer service!

Keep Reading

Unique Platinum Review: up to $1,000 credit account!

Discover financial freedom with our Unique Platinum Review. Unleash up to $1,000 extra for your budget and explore exclusive benefits!

Keep Reading