Great, I've just found the perfect credit card for you!

Student BMO CashBack® Mastercard®, a student credit card with premium card features

Advertisement

Extremely award-winning, the Student BMO CashBack® Mastercard® is, without a doubt, one of the best options on the market for students. There are few cards in this category that offer zero annual fees, cashback on all purchases and exclusive advantages of a Mastercard card. Now, students have a strong ally to manage their finances and access premium benefits.

Extremely award-winning, the Student BMO CashBack® Mastercard® is, without a doubt, one of the best options on the market for students. There are few cards in this category that offer zero annual fees, cashback on all purchases and exclusive advantages of a Mastercard card. Now, students have a strong ally to manage their finances and access premium benefits.

You will remain in the same website

A card with premium benefits aimed at students. Meet the Student BMO CashBack® Mastercard® card:

You will remain in the same website

Absolutely! The Student BMO CashBack® Mastercard® is a great choice for students with no credit history. It has no annual fee and offers a generous welcome bonus, so you can start earning cash back right away. Plus, BMO is known for being student-friendly and is more likely to approve students with limited credit history.

Yes, you can use the Student BMO CashBack® Mastercard® to pay your student debt. However, keep in mind that you will likely be charged a cash advance fee for doing so. Cash advance fees are typically around 3%, so it’s important to factor that into your decision.

You can use the Student BMO CashBack® Mastercard® anywhere Mastercard is accepted. This includes most stores in Canada, as well as online retailers and restaurants. You can also use the card to withdraw cash from ATMs, but keep in mind that you will be charged a fee for doing so.

Trending Topics

Rocket Personal Loan review: Up to $45,000!

Rocket Personal Loan review: Your gateway to financial freedom! Discover the ins and outs, from its competitive rates to its terms!

Keep Reading

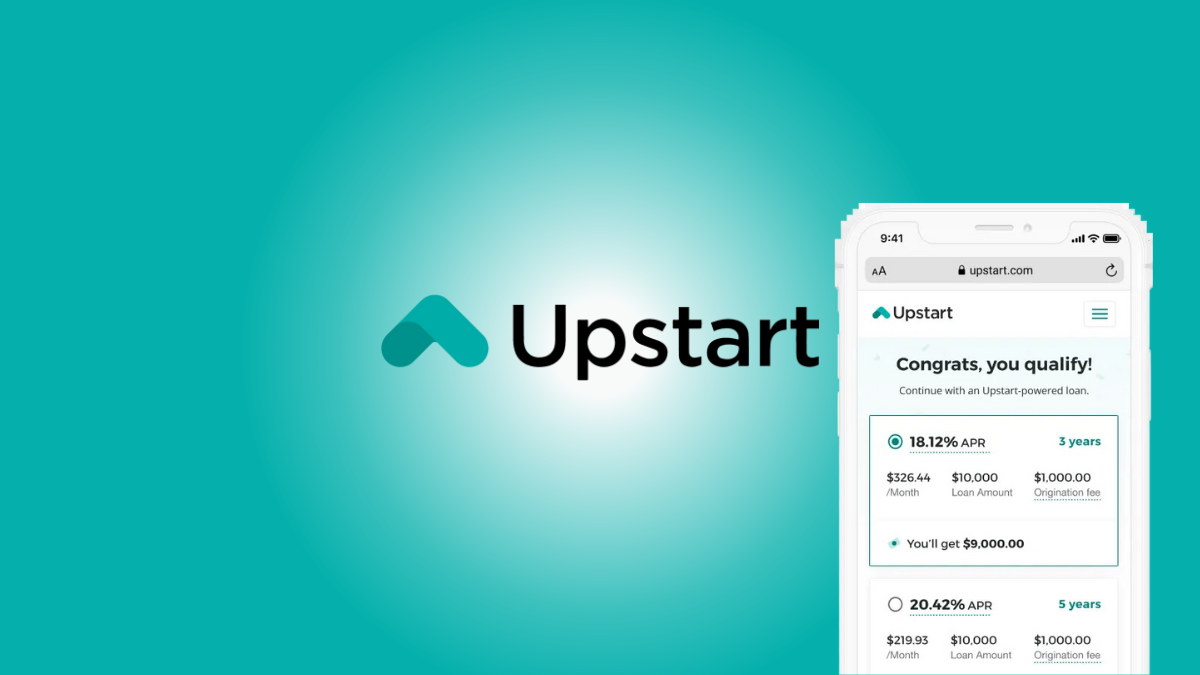

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Keep Reading

Breaking Barriers to Education: Ascent Student Loan Review

Looking for a student loan? Read our review on Ascent Student Loan! Get one step closer to your future success! Stick with us and learn more!

Keep ReadingYou may also like

The three types of income: learn more about them

Get to know the main types of income and understand why diversifying your income sources is so important. Read on to learn more!

Keep Reading

Buy cheap JetBlue Airways flights: easy step by step

Find out how to buy tickets for cheap (and even free!) flights, travel packages, cruises, hotel stays and car rentals on JetBlue Airways!

Keep Reading

Citrus Loans review: your money fast and easy

Citrus Loans is your opportunity to see lenders competing to offer you the best loan. loan of up to $2,500 in one day. Read on to learn more!

Keep Reading