Loans

SimpleLoans123 Review: Fast Loans for All Credit Types

Explore our SimpleLoans123 review for insights on easy, secure personal loans. Offering up to $35,000, suitable for various credit types, and a strong commitment to protecting your information.

Advertisement

Get up to $35,000 quickly with secure, hassle-free online application

This SimpleLoans123 review uncovers the details of a lending service that’s getting attention. Learn about its features, benefits, and suitability for your financial needs.

Apply for SimpleLoans123: Unlock Fast Financial Relief

Learn how to apply for SimpleLoans123. Easy process, fast funding, and privacy secured. Loans up to $35,000 for various financial needs.

So dive into the world of SimpleLoans123 with us. Our review sheds light on how it stands out in the market, helping you decide if it’s the right choice for you.

| APR | The APR is set by individual lenders, so it can vary, offering rates that suit a range of financial scenarios. |

| Loan Purpose | SimpleLoans123 caters to diverse financial needs, including debt consolidation, home improvements, etc. |

| Loan Amounts | Loan amounts range from $500 to $35,000, providing versatility for different requirements. |

| Credit Needed | SimpleLoans123 is open to applicants of all credit backgrounds. |

| Origination Fee | The origination fee varies as it depends on the lender you connect with. |

| Late Fee | Late fees are determined by the specific terms of each lender within SimpleLoans123’s network. |

| Early Payoff Penalty | The policy regarding early payoff penalties is subject to the individual lender’s terms. |

Is SimpleLoans123 a good option?

Firstly, SimpleLoans123 offers loans ranging from $500 to $35,000, accommodating a wide array of financial needs. Regardless of what you need it for, there’s flexibility.

Moreover, the APR on these loans varies, as it’s set by individual lenders within their network. This means rates are competitive and tailored to fit different financial situations.

Additionally, the terms of the loans are also determined by the lenders. This provides a range of options to suit various repayment capabilities, making it adaptable for all.

While SimpleLoans123 doesn’t charge for its services, the lenders may have fees. These can include origination fees, which vary depending on the lender you are matched with.

Furthermore, it’s worth noting that late fees are also subject to the lender. So applicants should review these conditions carefully to understand all potential costs associated with the loan.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of SimpleLoans123

Next in our SimpleLoans123 review, we take an unbiased look at both the advantages and drawbacks of their service.

Further, we outline the key pros and cons to help you make a well-informed decision about using SimpleLoans123 for your lending needs.

Advantages

- Offers loans ranging from $500 to $35,000.

- Competitive rates are set by individual lenders.

- Terms are adaptable to different repayment abilities.

- SimpleLoans123 charges no fees for its service.

- Uses strong encryption for data protection.

Disadvantages

- APRs vary significantly across lenders.

- Potential origination and late fees depend on the lender.

- Each lender has unique terms and conditions.

- Services are limited to U.S. citizens only.

- Late payments could affect credit scores.

What credit score do you need to apply?

To apply for a loan with SimpleLoans123, there’s no specific credit score requirement. They cater to a wide range of credit histories, making it accessible for many borrowers.

Whether you have excellent, good, or even less-than-perfect credit, SimpleLoans123 offers loan opportunities.

Indeed, this inclusivity is a major advantage for diverse financial backgrounds.

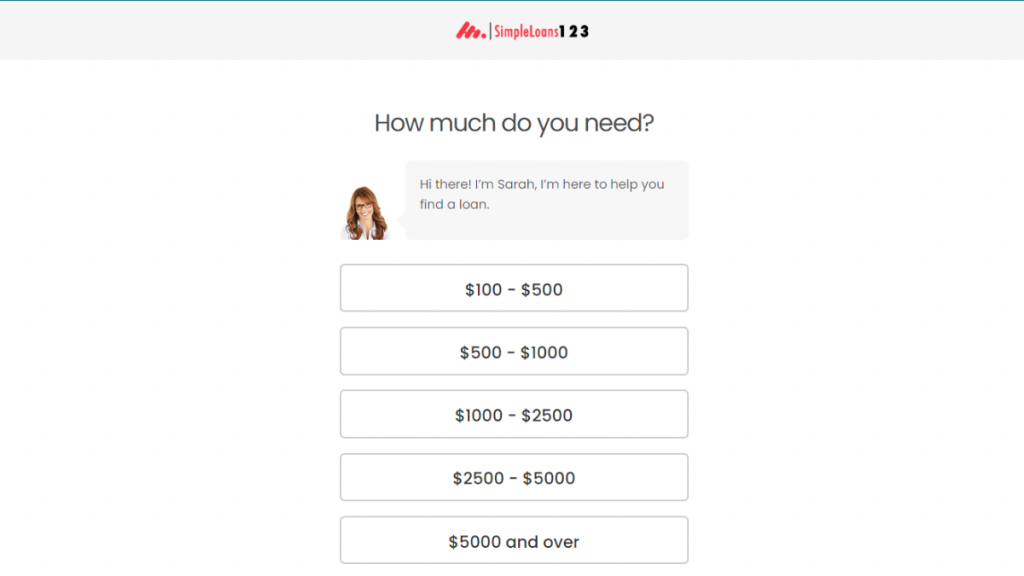

SimpleLoans123 application process

In conclusion, this SimpleLoans123 review presents a flexible and inclusive lending option suitable for a variety of financial needs and credit backgrounds.

Interested in applying? Then follow the link below for a comprehensive guide on how to secure a loan with SimpleLoans123 effortlessly.

Apply for SimpleLoans123: Unlock Fast Financial Relief

Learn how to apply for SimpleLoans123. Easy process, fast funding, and privacy secured. Loans up to $35,000 for various financial needs.

Trending Topics

Discover Student Loan review: full funding for your studies

Discover Student Loan is your opportunity to have one of the best APR for student loans and be rewarded for good grades. Learn more!

Keep Reading

Is a 650 Credit Score Good Enough?

Is a 650 credit score adequate? Learn facts, impact on loans, and tips to improve your rating. Navigate your financial path with confidence!

Keep Reading

OakStone Platinum Secured Mastercard®: check out how to apply!

Apply for the OakStone Platinum Secured Mastercard® and build your credit regardless of the credit score you have today. Know how!

Keep ReadingYou may also like

Aspire® Cash Back Reward card: check out how to apply!

Apply for the Aspire® Cash Back Reward Credit Card, an unsecured card that offers a 1% cashback for people with bad credit.

Keep Reading

Apply for the Prosper Loans: Generous Borrowing Limits

Check our step-by-step guide on how to apply for the Prosper Loans, learn the process with ease and secure your financial needs efficiently.

Keep Reading

Buy cheap Allegiant Air flights: easy step by step

Find out how to buy cheap tickets for flights on Allegiant Air, an option consolidated as one of the most economical on the market.

Keep Reading