Loans

True American Loan Review: Fast, Flexible Lending

Discover key insights in our True American Loan review. Learn how it stands out in the lending market and why it might be the perfect lending solution for all of your money needs.

Advertisement

See how True American Loan offers a simple borrowing experience for all credit profiles

Our True American Loan review looks into the features of this solid lending option. Ideal for different needs, it promises quick, hassle-free funding.

Apply for True American Loan: Quick, Easy Approval

Discover ease when you apply for True American Loan, offering fast online applications and loans up to $5000 for all credit scores.

So explore the perks of True American Loan in our review. Learn how its approach to lending could boost your financial journey, offering both ease and speed.

| APR | Varies based on individual credit scores, ranging from 4.95% to 35.95%. |

| Loan Purpose | All kinds of different needs, including bills, medical expenses, and car repairs. |

| Loan Amounts | Options from $100 to $5,000 for different financial requirements. |

| Credit Needed | Open to all credit backgrounds, even bad credit. |

| Origination Fee | Determined by the lender you’re connected with through True American Loan. |

| Late Fee | Specific to each lender’s terms within the True American Loan network. |

| Early Payoff Penalty | Depends on the terms set by the individual lender. |

Is True American Loan a good option?

Initially, True American Loan shines with loans up to $5,000. This amount is ideal for a variety of financial needs, from emergencies to personal projects.

Moreover, their APRs vary from 4.95% to 35.95%, ensuring a fit for different financial situations and maintaining affordability.

Additionally, flexible repayment terms with True American Loan make the borrowing process easier, adapting to your unique financial situation.

Furthermore, the service is known for minimal fees and clear policies, offering a straightforward path to connect with suitable lenders.

More importantly, even those with less-than-perfect credit have access to loans, making True American Loan a versatile financial ally.

Finally, the quick online application and rapid funding process ensure that necessary funds are available promptly, adding to its convenience.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of True American Loan

Moreover, digging deeper into our True American Loan review, we find a mix of pros and cons. These are important for potential borrowers to look closer at.

This balanced perspective helps in making an informed decision about whether this loan service fits your specific needs. So keep reading!

Advantages

- Offers loans ranging from $100 to $5,000 for different needs.

- Welcomes applicants of all credit scores, including bad credit.

- Quick online application and approval.

- Flexible APRs tailored to individual financial situations.

- Streamlined application with little paperwork and hassle.

Disadvantages

- Origination, late, and early payoff fees vary based on the lender.

- Potential hard credit checks by lenders could impact credit scores.

- Not available in all states, limiting access.

- The cap of $5,000 for loans might not be enough for all financial needs.

- As a connector, True American Loan doesn’t directly issue loans.

What credit score do you need to apply?

Applying for True American Loan doesn’t demand a high credit score. Additionally, they cater to a range of credit histories, even bad credit.

Because of that, it allows applications even from those with lower credit scores. True American Loan checks applicants on different financial information.

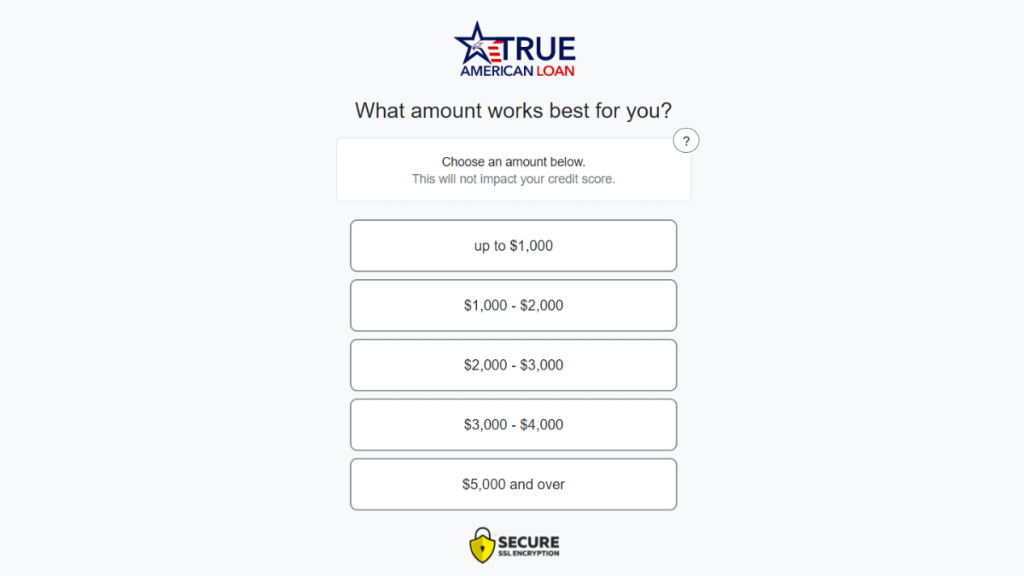

True American Loan application process

In conclusion, our True American Loan review finds this loan to be an accessible option. Indeed, it’s suitable for a variety of credit scores and financial requirements.

Moreover, if you’re interested in applying for True American Loan, the following article will guide you through the process. So read on and get a step-by-step approach.

Apply for True American Loan: Quick, Easy Approval

Discover ease when you apply for True American Loan, offering fast online applications and loans up to $5000 for all credit scores.

Trending Topics

Earned Income Tax Credit (EITC): see if you qualify for the program

There is a federal program that allows you to recover your taxes. Click here to learn more about the Earned Income Tax Credit (EITC).

Keep Reading

Apply for the Discover Personal Loans: Get Swift Funding

Apply for the Discover Personal Loans and start your journey towards financial freedom with quick approval and flexible loan amounts.

Keep Reading

Honest Loans: find out how to apply!

Apply to Honest Loans and get access to many lenders willing to offer up to $50,000 in loans within one business day. Read on to learn more!

Keep ReadingYou may also like

What are credit scores? An uncomplicated guide

Do you know what credit scores are? Learn what the impact of this number on your financial life is and how to improve it!

Keep Reading

KOHO Visa Prepaid Card full review: should you get it?

The KOHO Visa Prepaid Card is a financial option with benefits that only premium cards offer, such as a rewards program. See the full review!

Keep Reading

AutoLoanZoom review: buy your car with ease

AutoLoanZoom is an indispensable tool for anyone looking for a car loan. In seconds, find multiple lenders to close the deal with. Know how!

Keep Reading