Financial Education

What are credit scores? An uncomplicated guide

Did you know that your credit score impacts many parts of your financial life? Learn about the different ranges and how you can start improving your credit score!

Advertisement

The ins and outs of credit scores: everything you need to know

For some, a great ally. For others, a nightmare. Understand, once and for all, what credit scores are and how it impacts your life. Also, learn how to improve it or increase your score starting from scratch.

Upgrade Cash Rewards Card full review: should you get it?

With a high cash back value and interesting perks, the Upgrade Cash Rewards Card could be the perfect addition to your wallet! Read our in-depth review to see what this card has to offer.

What are credit scores and why do they matter?

A number that measures how “good credit user” you are. In fact, this description may sound strange and even inelegant. However, this is a good way to easily explain what a credit score is.

This percentage was created by credit companies. The idea was to summarize, in a single piece of data, a consumer’s credit history. That way, it would be easier to decide what benefits or interests to offer for each individual.

“Good credit users” are those who do not delay the payment of the card bill or the installments of a loan, for example. The more postures like this you have, the better your credit score will be.

With a good score, your possibility of consuming more and better financial products increases. Thus, people with good scores have easier access to benefits such as:

- Loans of higher amounts at lower interest rates;

- Credit cards with no annual fee;

- Best miles and rewards programs;

- Cash back programs;

- Other luxury benefits and more.

However, it is important to say that this is not the only factor observed by credit companies. Thus, a lot of other information will be analyzed to decide which products you will have access to.

Yet we can assure you that your credit score is a very important factor in this decision. So it’s important that you build a good number, as high as possible.

However, what is a high score? What is the maximum and minimum value? Understand below.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

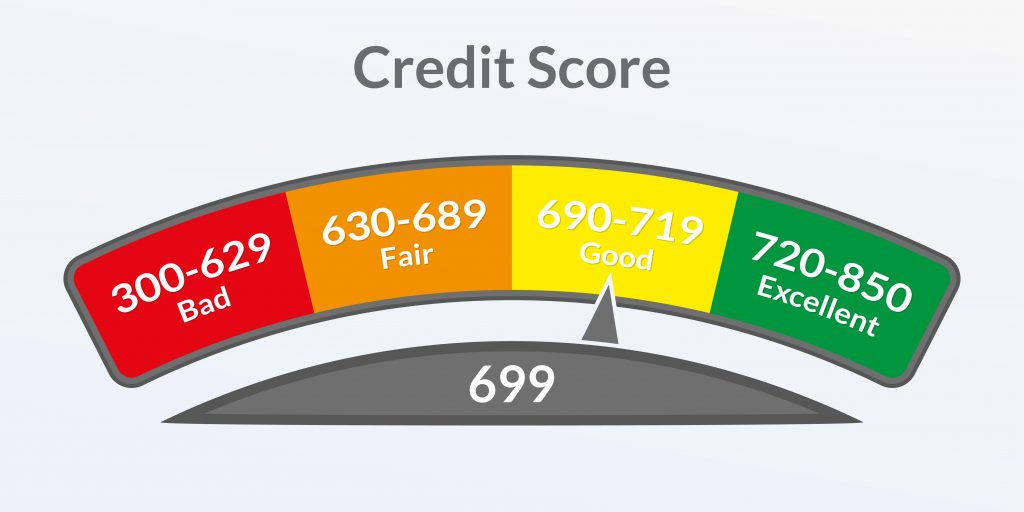

Credit score ranges: what are good and bad credit scores?

A credit score is a value that ranges from 300 to 850. In fact, the higher your score, the greater your credibility in the credit market. To facilitate the reading of this information, levels were created that classify a score as bad, good or excellent.

The score ranges may change according to the model adopted by each credit company. So, while for some companies your score is considered good, for others it can be reasonable.

Below, check the scores for the two most used credit models:

VantageScore credit ranges

- Very poor: 300 to 499

- Poor: 500 to 600

- Fair: 601 to 660

- Good: 661 to 780

- Excellent: 781 to 850

FICO Score Credit Ranges

- Very poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Excellent: 800 to 850

Note that someone with 590 points is in the “poor” range in the VantageScore model. Considering the FICO Score Credit Ranges parameters, this person would be “fair”. However, you never know for sure what model your credit company is using.

I believe that by now you have understood what a credit score is and how it influences your life. However, now the following question must be going through your head: “how is this value calculated?”. So, we’ll talk about it in the next topic.

How credit scores are calculated

In the introduction to this text, we talked about one of the criteria considered when calculating your credit score.

Now, we will delve into this matter in more depth. Thus, you will be able to know all the criteria that influence your score and what is the importance of each one of them. So, check out the following list.

- Payment history – paying bills on time is a factor that influences your score by 35%;

- Credit utilization – this is the amount of credit you use on your card. The less you use, the better your score. This factor impacts your credit score by 30%;

- Length of credit history – your score takes into account the time you use the credit service. The longer, the more credibility you get. This factor has an impact of 15%;

- Credit mix – your score reflects your total debt and values the variety of credits you use: installment credit, revolving credit, among others. The importance of this factor is 10%;

- Recent credit applications – when you use credit through a loan, for example, your score drops. This reduction will last until the installments start to be paid. So your score will go back to what it was before. The impact of this factor is 10%;

- Derogatory information – sometimes your payment history has not very good observations about your conduct. This factor lowers your score. However, as this information is not always used in the calculation, there is no defined impact percentage for them.

*The percentages mentioned above take into account the calculation used by the FICO model. Other models may consider other percentages and even other criteria.

Now that you know everything you need to know about credit scores, how about knowing simple methods to raise your indicator? Read on!

4 easy steps to increase your credit score

It is possible to improve it with a few simple tips. In addition, these tips are also valid for those who are starting their financial life from scratch. Check out:

Don’t miss payment deadlines

Commit to using credit amounts you can afford without delaying more than 30 days.

New beginnings, new accounts

Get a new card and use it wisely. You can also choose to register as an authorized user of someone who has a good score.

Don’t overdo it

If you decide to open a new account (or new accounts), limit how often you do so. Each new application can generate queries that are not favorable to your score. Also, the average age of your accounts drops, which is not a good thing.

30% or less

On your new or old accounts, use less than 30% of available credit.

So, by taking these steps to improve your credit score, you can make it easier to get approved for loans and credit cards with better benefits.

And if you want to learn more about finances, read the following post to find out what is an annual fee and how you can avoid them!

Annual fee: everything you need to know about

Wondering what an annual fee is? Whether you should pay one? How to avoid it? This article has everything you need to know!

Trending Topics

OakStone Platinum Secured Mastercard® full review: should you get it?

OakStone Platinum Secured Mastercard® offers one of the lowest APRs on the market for anyone looking to build credit. Know more!

Keep Reading

100 Lenders Review: Easy Loans for All Credit Types

Read our 100 Lenders review for fast, easy loans up to $40K with all credit considered, secure processing, and next-day funds availability.

Keep Reading

What is an unsecured credit card?

Unsecured credit cards are a great way to build your credit score. Find out what they are and how they work here!

Keep ReadingYou may also like

Home sale cancellations are hitting high rates, and here’s why

In recent months there has been a multitude of home sale cancellations. Has this phenomenon made houses cheaper? Read on to find out!

Keep Reading

BMO CashBack® World Elite® Mastercard® card: check out how to apply!

Apply for the BMO CashBack® World Elite® Mastercard® card: know the requirements to have one of the best cashback programs at your disposal.

Keep Reading

Capital One Low Rate Guaranteed Mastercard® credit card full review: should you get it?

Meet the Capital One Low Rate Guaranteed Mastercard® card, an excellent credit-building tool with an incredible APR of 14.9%!

Keep Reading