Loans

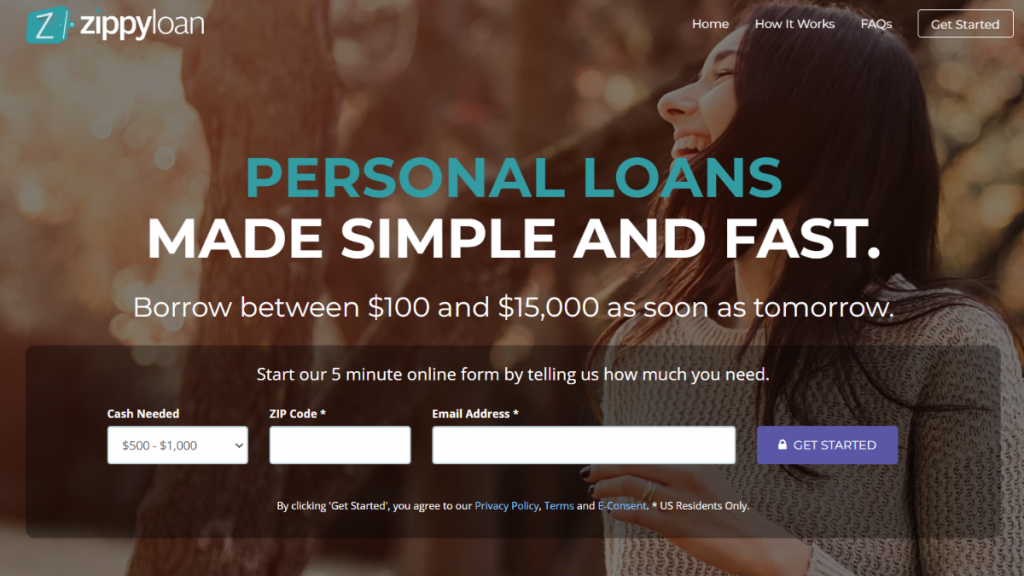

Zippyloan Personal Loans Review: Fast, Flexible Funding

Discover in our Zippyloan Personal Loans review how to borrow up to $15,000 with a quick online application, secure processing, and fast funding.

Advertisement

Unlock quick cash with Zippyloan – tailored loans for all credit types

In this Zippyloan Personal Loans review, we explore a service offering quick financial aid. Perfect for all credit, it simplifies processes, making it a go-to for urgent needs.

Apply for the Zippyloan Personal Loans: Borrow Up to $15,000!

Learn to apply for Zippyloan Personal Loans easily with our guide and borrow up to $15,000. Quick solutions for diverse financial needs!

Further, our review uncovers this lending platform. So keep reading to understand how Zippyloan Personal Loans can meet your financial challenges.

| APR | Zippyloan does not disclose APR data on their website. The rates you’ll get depend on your score and the lender; |

| Loan Purpose | Any and all purposes you may have; |

| Loan Amounts | Zippyloan connects you with lenders offering loan amounts between $100 and $15,000; |

| Credit Needed | All credit types are welcome to apply for a loan through Zippyloan; |

| Origination Fee | It varies according to the lender; |

| Late Fee | It depends on the lender you’ll match with; |

| Early Payoff Penalty | It varies according to the lender. |

Is Zippyloan Personal Loans a good option?

Zippyloan Personal Loans cater to a variety of needs with loans from $100 to $15,000. This range is perfect for both small emergencies and larger expenses.

With a wide variety of interest rates, Zippyloan matches you with lenders fitting your financial situation. This approach helps find a comfortable rate for your loan.

Moreover, repayment terms are flexible. Options span from short-term to up to 60 months, allowing for a tailored plan that fits your budget seamlessly.

Additionally, fees vary by lender. Zippyloan’s transparency makes sure you’re well informed about any charges before you commit, avoiding unexpected costs.

Finally, the application process is straightforward and fast. Completing it online means quick access to funds, ideal for when you need financial help promptly.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of Zippyloan Personal Loans

Like any financial service, there are both pros and cons to consider before using this platform.

So read on to understand them better next in our Zippyloan Personal Loans review.

Advantages

- Offers loans from $100 to $15,000;

- Options from short-term to up to 60 months;

- Also suitable for people with different credit histories;

- Online process for fast and convenient application;

- Matches borrowers with rates that suit their financial situation.

Disadvantages

- Fees depend on the lender, which can sometimes be high;

- Acts as a middleman, which might complicate the process;

- It is not accessible in certain states like New York and Oregon;

- There’s a chance of not being matched with a lender;

- Particularly with payday loans, interest rates can be steep.

What credit score do you need to apply?

Zippyloan Personal Loans don’t specify a minimum credit score for applicants. This friendly approach makes it accessible to a wide range of borrowers.

Furthermore, this inclusivity is ideal for those with lower credit histories, offering a chance to borrow funds when other platforms may have refused them.

Zippyloan Personal Loans application process

So, are you interested in applying for a Zippyloan Personal Loan? Our article below walks you through the simple process step by step.

Indeed, it’s easy and user-friendly, ideal for quick financial solutions.

Moreover, by following our guide, you’ll get insights into making your application as smooth as possible. Discover how Zippyloan can help meet your financial needs today.

Apply for the Zippyloan Personal Loans: Borrow Up to $15,000!

Learn to apply for Zippyloan Personal Loans easily with our guide and borrow up to $15,000. Quick solutions for diverse financial needs!

Trending Topics

Inflation rate in Canada has the highest increase in almost 40 years

Inflation rate in Canada reached historic levels. Understand what is behind this movement and what to expect in the coming months.

Keep Reading

Chase Freedom® Student credit card full review: should you get it?

Meet the Chase Freedom® Student credit card—the credit card made for students—with cash back and an interesting APR rate. Read on!

Keep Reading

Capital One Platinum Secured credit card full review: should you get it?

Capital One Platinum Secured credit card is an excellent tool to build credit with excellent perks like a $1,000 limit. Find out here!

Keep ReadingYou may also like

Mission Lane Visa® credit card full review: should you get it?

Meet Mission Lane Visa®, a no-deposit credit card that offers an initial limit of $300 for people with poor or limited credit.

Keep Reading

How to choose a bank: know the best option for your finances

Not knowing how to choose a bank can cost you a lot of money and good opportunities. To learn more about this, read on!

Keep Reading

Get the best conditions: Apply for the Happy Money Personal Loans

Do you need to consolidate your debt and be free from abusive interest? Then read on to apply for Happy Money Personal Loans - up to $40K!

Keep Reading