Reviews

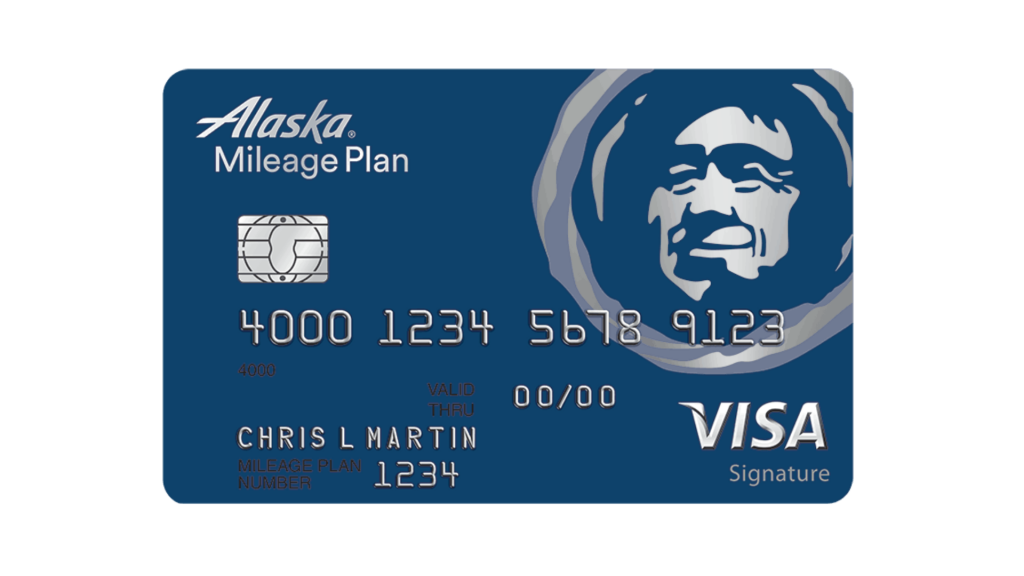

Alaska Airlines Visa® Credit Card full review: should you get it?

Alaska Airlines Visa® Credit Card transform your ordinary purchases into points that can be redeemed for domestic and international airline tickets. Learn more about this card and this rewards program!

Advertisement

Alaska Airlines Visa® Credit Card: Traveling by plane around the world for free has never been so easy!

Meet Alaska Airlines Visa®, the credit card that lets you fly around the world for free! Accumulate points on common expenses and redeem them for airline tickets to more than 1,000 destinations.

Alaska Airlines Visa® Credit Card: check out how to apply!

Learn how to apply for a credit card that gives you access to one of the best frequent flyer programs in the world and redeem points for international travel with the Alaska Airlines Visa® Credit Card!

Learn more about this card below:

| Credit Score | Good or excellent (690-850) |

| Annual Fee | $75 |

| Regular APR | From 18.99% to 26.99% (variable) |

| Welcome bonus | 50,000 miles for spending $2,000 within three months |

| Rewards | 3 unlimited miles for every $1 spent on eligible Alaska Airlines purchases and 1 mile for every $1 spent on all other purchases |

Alaska Airlines Visa® Credit Card: learn more about this financial product

This is a credit card created by Alaska Airlines. In fact, this is an airline with a strong presence on trips to Alaska and Hawaii. In addition, it offers flights to other parts of the US, Mexico and Canada.

When you buy Alaska Airlines airline tickets, you earn 3 miles for every dollar spent. Plus, on regular purchases, you earn 1 mile per dollar spent. These miles can be used to fund your next ticket.

As this company is part of the oneworld® alliance, you can transfer your points to other agencies. So you can fly for free to over 1,000 destinations.

During Alaska Airlines flights, you receive a 20% cashback on all your purchases. In addition, you can take advantage of free checked baggage and bring a companion on the flight for free.

This is a Visa card, accepted in virtually all parts of the world with no transfer fee abroad.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Alaska Airlines Visa® Credit Card features

In fact, this card offers many more advantages than a powerful rewards program. To know them, take a look at the list below.

Also, check out the list of negatives for Alaska Airlines Visa® Credit Card to make sure this is a good deal for you. Check it out below:

What are the benefits?

- Unexpired miles program that gives points for every dollar spent on everyday purchases;

- Reward program associated with the oneworld® Alliance, which allows you to use your miles on more than thirty national and international airlines;

- No fee for foreign exchange transfers;

- Baggage check and travel tracking for free.

And what are the drawbacks?

- You will need a high credit score to be approved (good or excellent);

- $75 annual fee charged from first year of use;

- 29.99% penalty APR for late payments;

- Dinners or gas supplies are not prioritized categories, which is common with frequent flyer miles.

What credit score do you need to get the card?

In fact, like other travel cards, this card requires an above average credit score. So, to have a chance of being approved, you need to have a good or excellent score (above 690).

The better your score at the time of application, the better your rates.

How does the application process work?

Check now how to apply for the card that will be your passport to the world! See our post below!

Alaska Airlines Visa® Credit Card: check out how to apply!

Learn how to apply for a credit card that gives you access to one of the best frequent flyer programs in the world and redeem points for international travel with the Alaska Airlines Visa® Credit Card!

Trending Topics

Citi® Secured Mastercard® full review: should you get it?

The Citi® Secured Mastercard® is a credit-building option you need to know about: monthly reports to credit bureaus and no annual fee!

Keep Reading

Credit cards for any credit history: best options

Are you looking to build your credit? Our list of 7 great credit cards for any credit history can help you. Click and choose your best fit!

Keep Reading

Merrick Bank Double Your Line Secured Credit Card full review: should you get it?

Credit building? Count on the Merrick Bank Double Your Line Secured Credit Card: one of the lowest APR and many other advantages. Check out!

Keep ReadingYou may also like

Chime Credit Builder Visa® Credit Card full review: should you get it?

Meet the Chime Credit Builder Visa® Credit Card, the perfect card to build credit without paying a cent for it! Read on!

Keep Reading

Honest Loans: find out how to apply!

Apply to Honest Loans and get access to many lenders willing to offer up to $50,000 in loans within one business day. Read on to learn more!

Keep Reading

Hawaiian Airlines: cheap flights and offers

Hawaiian Airlines is the best way to find cheap flights to Hawaii. Meet this company that offers discounts of up to 20% and much more!

Keep Reading