Reviews

Capital One Guaranteed Mastercard® card: check out how to apply!

A credit card designed to help Canadians on their credit-building journey: up to a $2,500 limit and a very high probability of having your application accepted. See how to get the Capital One Guaranteed Mastercard® card.

Advertisement

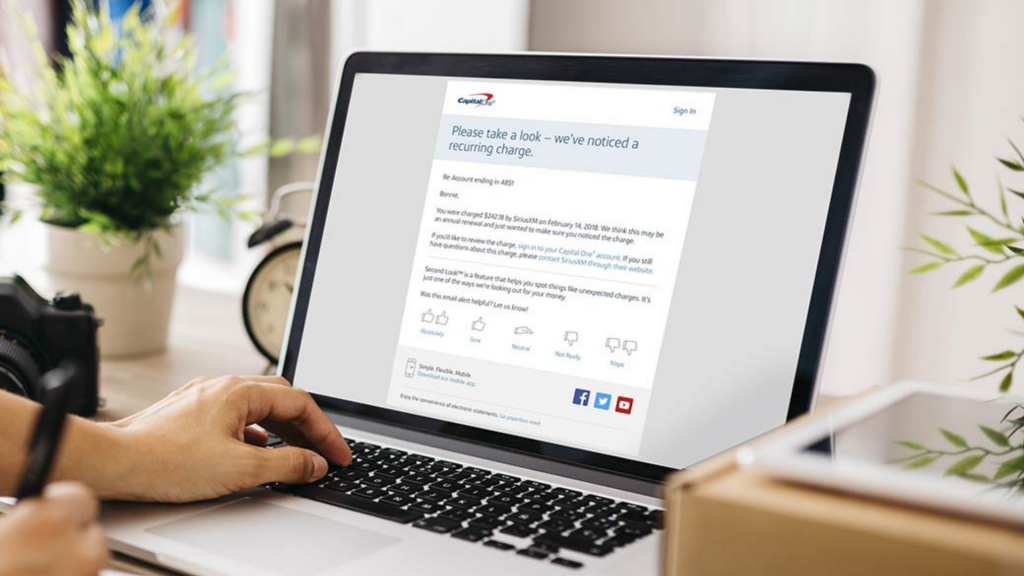

Capital One Guaranteed Mastercard® card: have credit at your disposal even with a bad score

In fact, there’s a good reason the Capital One Guaranteed Mastercard® card is called a “Guaranteed” card. Therefore, when you apply for the Capital One Guaranteed Mastercard® card, you have an almost 100% chance of being accepted.

Read more about this application process below.

How to apply on the website

Before applying for this card, you need to meet four basic criteria. Check below:

- No Capital One account/card or pending order;

- Have not ordered any Capital One products in the last 30 days;

- Not having acquired any outstanding issues with Capital One in the last year.

- Having reached the age of majority according to the criteria of the province in which you live;

Do you meet these criteria? Then you have everything you need to apply for your card. When accessing the Capital One Guaranteed Mastercard® official website, click “Apply Now”.

After filling in your personal details, click on “Review my application” to verify your details. Click once more to proceed. We strongly recommend that you read all information available in the “Important Disclosures” section.

Most likely, you will receive confirmation of your order in a short time.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Capital One has an application to manage all the company’s products. To access it, simply download “Capital One Mobile” from your app store. Unfortunately, it is not possible to apply for the Capital One Guaranteed Mastercard® card through the app.

However, you can access the online application form on your mobile and apply as usual.

Capital One Guaranteed Mastercard® card vs. BMO CashBack® Mastercard® card: choose which one is best for you

In fact, the credit card options available to Canadians are nothing short of options found in other countries. For you to make a better choice, it is important to know the main products on the market.

So, check out below a comparative table with the main advantages of credit products very accepted by Canadians.

| Capital One Guaranteed Mastercard® | BMO CashBack® Mastercard® | |

| Credit Score | Bad (300-579) | From fair to excellent (over 660) |

| Annual Fee | $59 | $0 |

| Regular APR | 19.8% | 19.99% |

| Welcome bonus | None | 5% cashback for the first three months and 1.99% balance transfer fees for the first 9 months |

| Rewards | None | 3% cash back on grocery purchases, 1% on accounts, 0.5% on other purchases |

Does BMO CashBack® Mastercard® sound like a good fit for you? To be sure, click the link below and see how to apply for this card.

BMO CashBack® Mastercard® card: check out how to apply!

5% cashback on everyday purchases and incredible discounts on car rentals and events: learn how to have the BMO CashBack® Mastercard® card in your wallet.

Trending Topics

Chase Freedom Flex℠ card: check out how to apply!

Learn how to apply for Chase Freedom Flex℠, a card with one of the most lucrative reward programs in the US. Check out how to apply!

Keep Reading

Up to $36,500: LendingPoint Personal Loans review

Consolidate debt smoothly - read our LendingPoint Personal Loans review! Enjoy a simplified process and affordable conditions!

Keep Reading

SimpleLoans123 Review: Fast Loans for All Credit Types

Discover in our SimpleLoans123 review how to get secure loans up to $35,000. Ideal for all credit types, ensuring quick funding and privacy.

Keep ReadingYou may also like

Upgrade Triple Cash Rewards Card or Upgrade Cash Rewards Card: discover your best fit

Upgrade Triple Cash Rewards or Upgrade Cash Rewards Card? Check out the comparison and find out which cash back program is the best for you.

Keep Reading

Oportun Personal Loans review: Affordable Loans for All!

Explore our Oportun Personal Loans review to discover affordable, accessible lending options designed for a secure financial future!

Keep Reading

Asset management vs. wealth management

Asset management vs. wealth management: What are they? How can these help you manage your money professionally? Read on to learn!

Keep Reading