Reviews

BMO CashBack® Mastercard® card: check out how to apply!

Check out this step-by-step on how to apply for the BMO CashBack® Mastercard®, a Canadian credit card with an excellent cashback program.

Advertisement

BMO CashBack® Mastercard® card: one of the best card cash back programs in Canada, according to experts

You can enjoy all the benefits of one of the Great White North’s best refund programs without leaving your home. Learn how to apply for the BMO CashBack® Mastercard® card from your computer or mobile.

How to apply on the website

Apply for the BMO CashBack® Mastercard® card: go to the official BMO CashBack® Mastercard® page and click “Apply Now”. Then, you will be asked to fill in your first data. If you meet the initial requirements indicated, check the fields and click “sign in to online banking”.

In this way, you will start your own registration. After filling in all the information, you will receive a confirmation or denial email. This process usually happens quickly.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

The BMO app does not allow you to apply for the card in the BMO Mobile Banking app. So, only after doing this process through the website, you will have a login and password to use this application.

It will be extremely useful to manage all the information regarding your new card. In fact, the application has all the conventional services, such as checking balance, making payments, transfers, and redeeming prizes, among others.

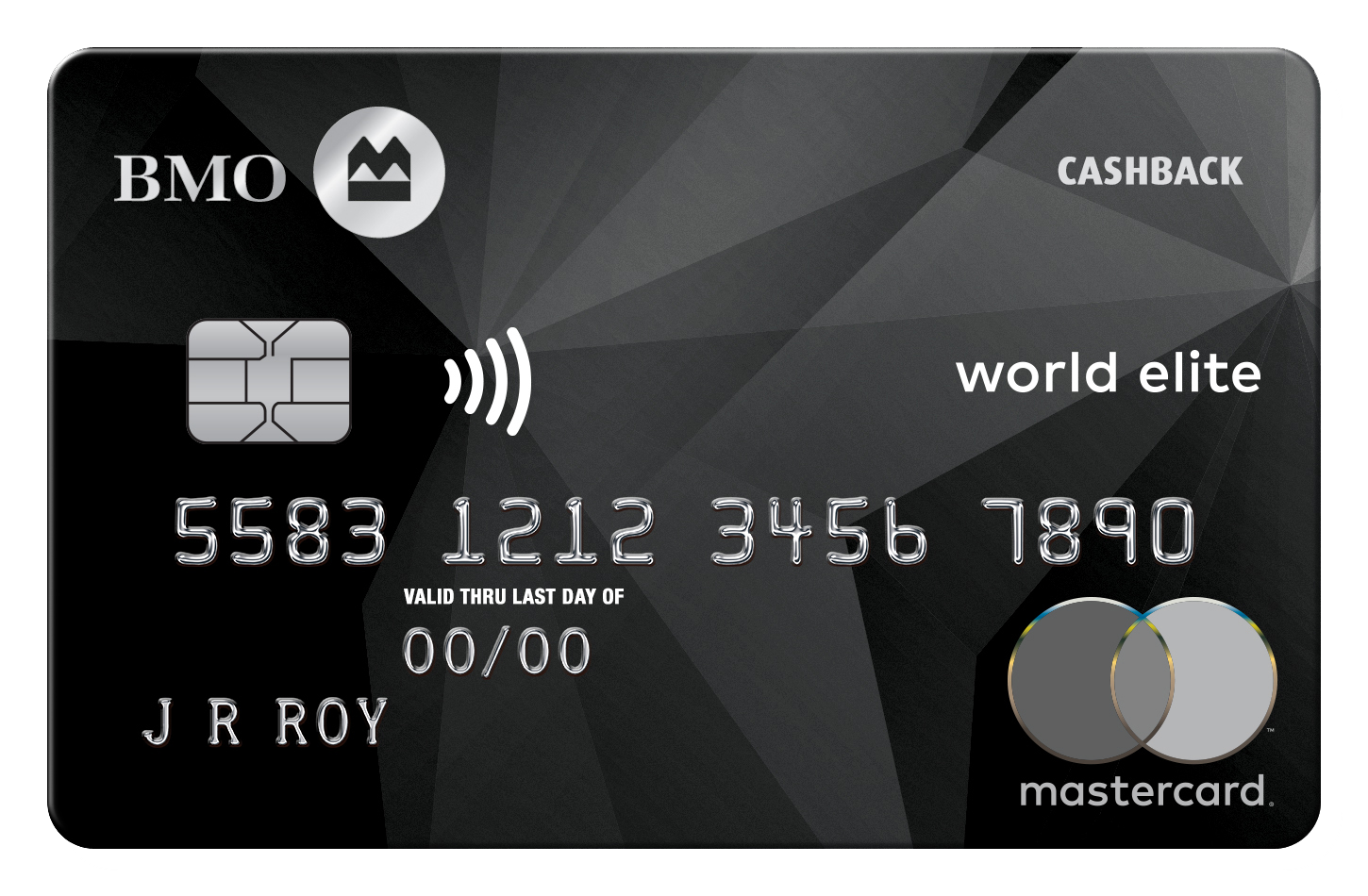

BMO CashBack® Mastercard® card vs. BMO CashBack® World Elite® Mastercard® card: choose which one is best for you

To help you decide which card is best for you, we decided to do a BMO product comparison. In this opportunity, the “opponent” is the BMO CashBack® World Elite® Mastercard® card. Who did better?

Check the table below with the main features of each product:

| BMO CashBack® Mastercard® | BMO CashBack® World Elite® Mastercard® | |

| Credit Score | From fair to excellent (over 660) | From good/very good to excellent (over 760) |

| Annual Fee | $0 | $120 |

| Regular APR | 19.99% | 20.99% |

| Welcome bonus | 5% cashback for the first three months and 1.99% balance transfer fees for the first 9 months | 10% cashback on the first three and annual fee waiver for the first year |

| Rewards | 3% cash back on grocery purchases, 1% on accounts, 0.5% on other purchases | Cashback of 3% Gasoline; 4% on transport by app, taxi or public transport; 2% on recurring accounts and 1% on other purchases (unlimited program) |

BMO CashBack® World Elite® Mastercard® card

A powerful unlimited cashback program that will give you 10% reward and annual fee waiver for one year. Find out how to have this card in your wallet.

Trending Topics

Buy cheap JetBlue Airways flights: easy step by step

Find out how to buy tickets for cheap (and even free!) flights, travel packages, cruises, hotel stays and car rentals on JetBlue Airways!

Keep Reading

Regions Life Visa® Credit Card full review: should you get it?

Having a Regions Life Visa® Credit Card is enjoying a long-term 0% intro APR and exemption from the most important fees. Understand more!

Keep Reading

Capital One Guaranteed Mastercard® card: check out how to apply!

Learn how to apply for the Capital One Guaranteed Mastercard®, the card that accepts all credit scores and offers a good credit limit.

Keep ReadingYou may also like

Sable Debit Card: check out how to apply!

In minutes, you can apply for the Sable debit card and earn 2% cash back on purchases that no other agency offers. Click here to learn more.

Keep Reading

Unique Platinum Review: up to $1,000 credit account!

Discover financial freedom with our Unique Platinum Review. Unleash up to $1,000 extra for your budget and explore exclusive benefits!

Keep Reading

Credit cards for poor credit: find the perfect option

Less-than-perfect credit? This is not the end! Discover 5 excellent credit cards for poor credit for those who need a better score.

Keep Reading