Loans

Apply for Electro Finance: Swift Access to Tech

Understand the process of applying for Electro Finance easily. Get fast access to the latest electronics and enjoy the convenience of immediate use with our straightforward application guide.

Advertisement

Get fast approval and enjoy the latest in technology with Electro Finance’s easy process

If you want to apply for Electro Finance, know that the process is easy and user-friendly. Designed for convenience, it caters to a variety of needs and credit histories.

Curious about the steps involved? Our full article breaks down the process, making sure you can start leasing the latest electronics with ease. So check it out to discover how simple it is.

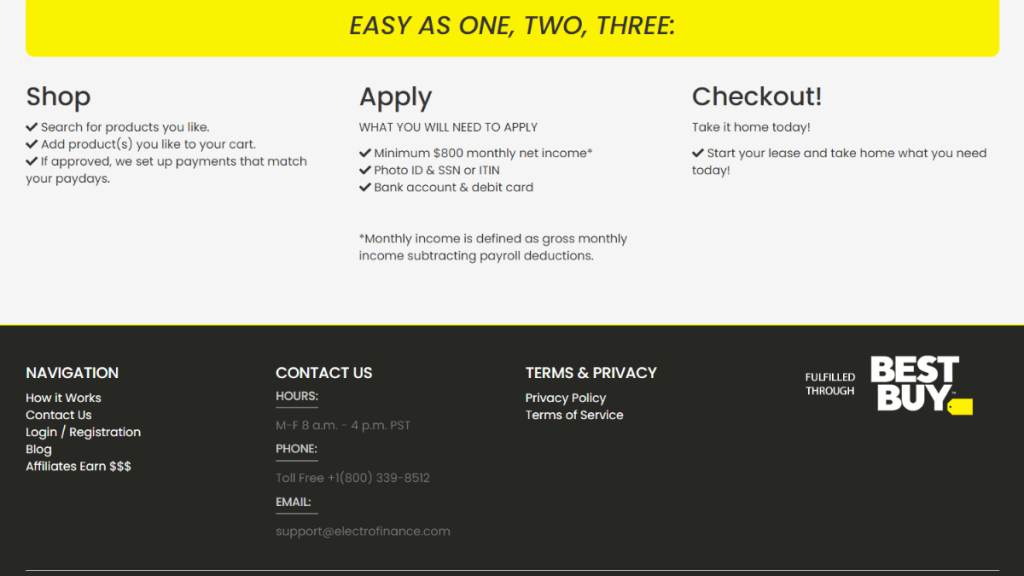

Online application

Starting the process to apply for Electro Finance is simple. First, visit their website and browse through their selection of electronics. Then, choose the gadgets that fit your needs.

Next, add your products to the cart. This step is like any online shopping experience, ensuring you get exactly what you want from their extensive collection.

Then, go to the application form. You’ll need to provide some basic personal and financial information. This process is designed to be quick, without any hassle.

Moreover, after submitting your application, Electro Finance will review it promptly. You’ll receive a decision swiftly, streamlining the leasing process.

Finally, once approved, arrange for the pickup of your electronics. With Best Buy as their fulfillment center, collecting your items is convenient and fast.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Firstly, you need to earn at least $800 monthly after deductions.

- Secondly, you have to possess a valid government-issued Photo ID.

- Additionally, have a Social Security Number or ITIN.

- You need to be over the legal age in your state.

- Also, maintain an active checking account.

- Lastly, own a debit or credit card for transactions.

Apply on the app

Currently, you can’t apply for Electro Finance via a mobile app, as they don’t offer one. This might initially seem like a limitation, especially for those who rely heavily on mobile apps.

However, their website is fully mobile-friendly, offering a seamless experience. You can easily navigate and apply online using your phone or tablet, ensuring accessibility.

So, while there’s no dedicated app, applying for Electro Finance is still user-friendly. Just visit their website on your device, and you’ll find the process just as efficient as on a desktop.

Compare Electro Finance to other options: LoanPioneer

Electro Finance simplifies getting the latest gadgets with its lease-to-own program. Perfect for tech lovers, it offers easy payment options and a wide selection of electronics.

Alternatively, LoanPioneer is another great option. It provides various financial solutions, extending beyond electronics leasing to cater to different needs.

Moreover, LoanPioneer is known for its quick approvals, diverse loan offerings, and straightforward services. This makes it an ideal choice for adaptable financial assistance.

| Electro Finance | LoanPioneer | |

| APR | Not applicable as this is a lease-to-own program, not a traditional loan. | Varies from 5.99% to 35.99%, fitting different loan types. |

| Loan Purpose | To lease and eventually purchase electronic devices. | Flexible, covering everything from emergencies to home improvements. |

| Loan Amounts | Credit limits up to $5,000 for leasing electronics. | Up to $5,000, catering to a range of financial needs. |

| Credit Needed | Available to various credit types, including those with bad credit. | Minimum FICO score of 500, considering other financial factors. |

| Origination Fee | Information on this is not explicitly provided. | Depends on the lender within LoanPioneer’s network. |

| Late Fee | Specific late fee details are not clearly outlined. | Set by individual lenders, check terms for specifics. |

| Early Payoff Penalty | No penalty for early payoff, but availability varies by state. | Varies, review lender terms for details. |

So, are you curious about LoanPioneer? See the link below to discover more and how to begin your application.

Furthermore, it’s a quick and reliable way to find your financial solution!

Trending Topics

BlockFi Rewards Visa® Signature Card full review: should you get it?

The BlockFi Rewards Visa® Signature Card rewards your ordinary purchases with highly valued digital currencies. Find out more here!

Keep Reading

Don’t make these 7 common budgeting mistakes

Some budgeting mistakes can stand in the way of you and your financial goals. Read on to learn how to identify and fight them!

Keep Reading

PREMIER Bankcard® Mastercard® card: check out how to apply!

Learn how to apply for the PREMIER Bankcard® Mastercard®, the credit card that will help you build your credit with a good starting limit.

Keep ReadingYou may also like

Spirit Airlines: cheap flights and offers

Spirit Airlines cheap flights allow you to travel for little money for national and international itineraries! Learn more here!

Keep Reading

Tarjeta Bank of America® Unlimited Cash Rewards

Con la Tarjeta de crédito Bank of America® Unlimited Cash Rewards, obtén la devolución del 1.5% de todas tus compras y ¡Descúbrela aquí!

Keep Reading

How to manage your money as an international student

International student already has enough problems. Finances don't have to be one more. Learn how to manage them in 4 simple steps:

Keep Reading