Loans

Apply for Pheabs Loans: Fast Cash for Urgent Needs

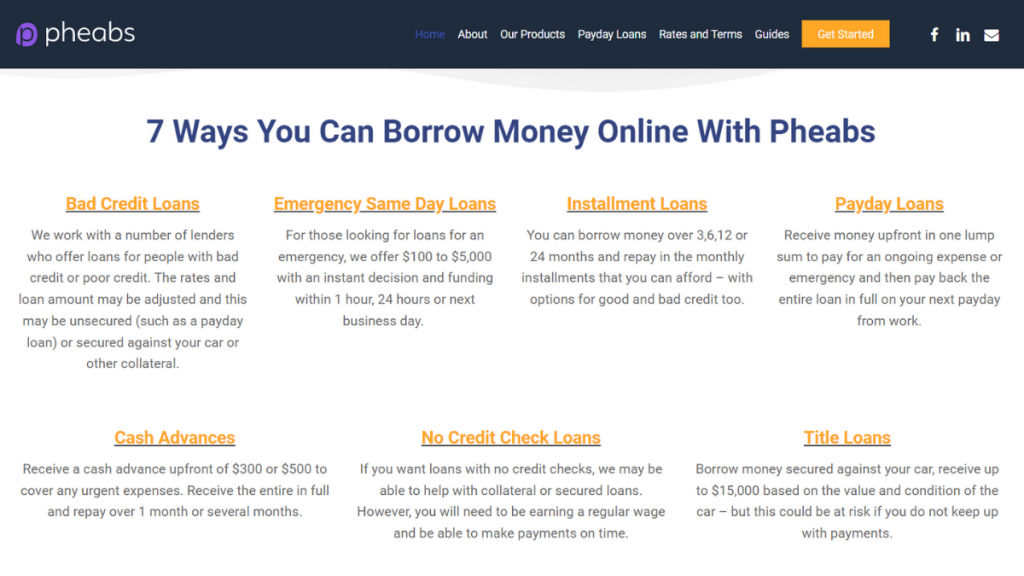

Discover how to apply for Pheabs Loans to benefit from their swift approval process and loans up to $35,000. Ideal for those with low credit scores, Pheabs offers accessible financial solutions.

Advertisement

Get quick financial relief with Pheabs Loans, offering easy applications and fast funding

Ready to apply for Pheabs Loans? The process is simple and tailored for quick and seamless access to the funds you need. It’s designed with your convenience in mind.

Next, as you navigate the process, you’ll find their approach both efficient and user-friendly. Intrigued? Keep reading to uncover the step-by-step process in our detailed article.

Online application

Firstly, begin your journey to apply for Pheabs Loans by visiting their official website. Here, you’ll find the ‘Get Started’ button, which is your gateway to financial assistance.

Then, select how much money you need and how many months you plan to repay it all back. By clicking on ‘Get Started,’ Pheabs will start asking a series of questions.

Questions include email, ZIP code, Social Security Number, and more. Answer those truthfully so they can assess your needs and find the best lending partners for you.

Subsequently, Pheabs will match your information with willing lenders and provide a series of available offers. Browse them carefully to see if any match your financial needs.

Lastly, select an offer to familiarize yourself with its terms. These include the APR, repayment terms, and other relevant details. Review them before accepting and then finalize your loan.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Firstly, age 18 or older for legal eligibility.

- Secondly, you must be a U.S. or Canadian resident.

- Thirdly, have steady, verifiable employment.

- Next, earn at least $800 per month.

- Additionally, possess an active checking account.

- Finally, the capability to afford loan repayments.

Apply on the app

You can’t apply for Pheabs Loans through a mobile app, as they currently don’t offer one, but this isn’t a barrier to accessing their services. Pheabs offers a very mobile-friendly website.

Moreover, the Pheabs website is designed to be fully responsive on mobile devices. This means you can easily navigate and complete your loan application using your phone.

Compare Pheabs Loans to other options: CreditFresh

Pheabs Loans shines with its quick funding and loan options, catering to a wide range of financial needs. Their user-friendly process makes them a solid choice for many borrowers.

However, if Pheabs doesn’t meet your specific needs, consider CreditFresh as an alternative. They offer a different set of features that might align better with your goals.

CreditFresh is known for its transparent fee structure and flexible repayment. They provide a clear understanding of the loan terms, ensuring borrowers can make informed decisions

| Pheabs Loans | CreditFresh | |

| APR | Ranges from 6.9% to 400% based on creditworthiness and loan type. | Starting at 65%, suitable for a wide range of credit backgrounds. |

| Loan Purpose | For emergencies, personal expenses, or cash advances. | Versatile use, from emergencies to personal projects. |

| Loan Amounts | Available from $100 to $35,000, catering to various financial needs. | Broad range, $500 to $5,000, to fit your specific needs. |

| Credit Needed | All types, including bad credit; some options available without credit checks. | Flexible, welcoming scores from poor to excellent. |

| Origination Fee | Depends on the lender’s policy; Pheabs connects borrowers to multiple lenders. | Zero, making it more cost-effective to start. |

| Late Fee | Specific late fees depend on the lender’s terms within Pheabs’ network. | Minimal, designed to be fair while encouraging prompt payment. |

| Early Payoff Penalty | It can vary; some lenders in Pheabs’ network may charge, while others do not. | None, offering freedom to repay early without extra costs. |

To explore more about CreditFresh and how their application process works, check out the link below. It’s a great resource for those looking for a loan that suits their needs.

Apply for CreditFresh: No Hidden Charges

See how to apply for CreditFresh for swift approval and zero origination fees. Get easy access to funds up to $5,000 with transparent terms.

Trending Topics

Oportun Personal Loans review: Affordable Loans for All!

Explore our Oportun Personal Loans review to discover affordable, accessible lending options designed for a secure financial future!

Keep Reading

How do student loans work?

Understanding how student loans work can be the difference between smooth adult life and living in a "swamp" of debt! Know more!

Keep Reading

Credit cards for limited credit: find the best card for your needs

Limited credit is not an excuse for having bad credit cards. Click here for a list of 6 great options and choose the best one for you!

Keep ReadingYou may also like

Mission Money™ debit card: check out how to apply!

Learn how to apply for Mission Money™, a debit card that doesn't check your credit score and has no annual or foreign transaction fees!

Keep Reading

What are credit card balance transfers? Learn how to do it!

What are credit card balance transfers? Find out how this feature can save you from debt and how to use it to get the most out of it.

Keep Reading

Apply for the Clear Money Loans: Quick Cash Access

Start your journey and apply for the Clear Money Loans for rapid approval, diverse loan options, and no strict credit requirements.

Keep Reading