Reviews

Secured Sable ONE Card: check out how to apply!

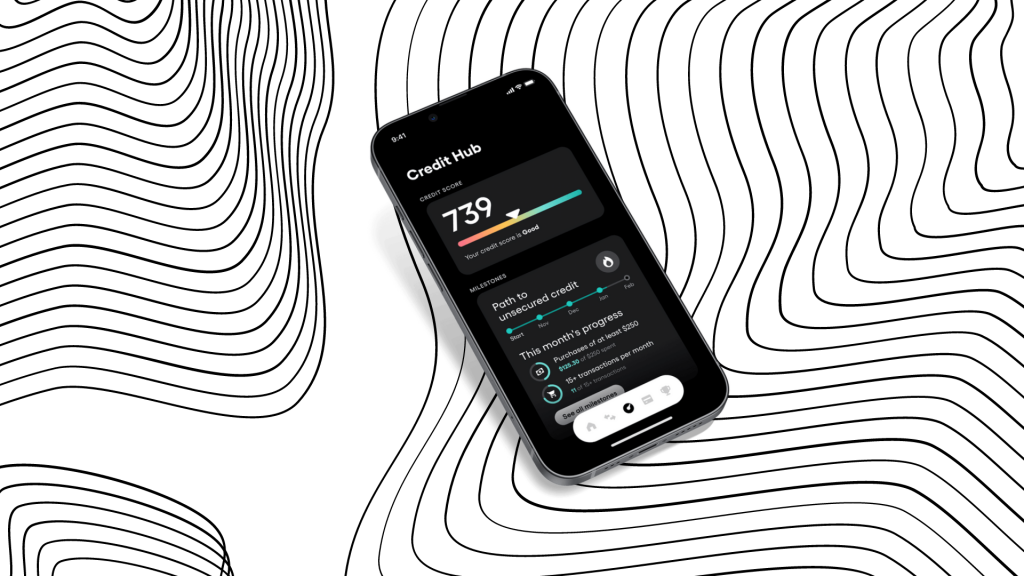

The Secured Sable ONE Card is one of the most modern credit cards for those who need to build or rebuild credit. Read on to learn how to apply for the Secured Sable ONE Card!

Advertisement

Secured Sable ONE Card: Build your credit fast and “jump” to a non-secured card in just 4 months

So, you can build credit without worrying about the annual fee and still get rewards for doing so. To do so, simply apply for Secured Sable ONE Card.

EDIT: This offer is no longer available. Sable has concluded its operations and is no longer accepting new applications. As an alternative, we suggest the GO2bank™ Secured Visa® Card. Check the guide below.

GO2bank™ Secured Visa® Card: check out how to apply!

Here is a great credit product for anyone who needs to build credit with the advantage of no annual fee. Apply for the GO2bank™ Secured Visa® Card to get these benefits.

Learn how to apply for a credit card that can revolutionize your financial life in record time. To apply for this card, you must meet the following criteria:

- Be over 18 years old;

- Possess a valid US address and telephone number;

- Possess Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you do not have this document, you must present a valid passport or visa document.

Indeed, do you have what it takes? So, here’s how to apply for your newest card to build your US credit.

How to apply on the website

To apply for the Secured Sable ONE Card, visit the official website for that product. Then, click on “Get Started.” After that, enter your name, email, and password.

You will receive an email in which you will validate the email address you provided. Next, you must download the Sable application to continue your registration.

So, enter your phone number and continue this process on your cell phone.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

In fact, you can start your application in your notebook or go straight to your cell phone.

In both cases, you must download the Sable app. To do so, just search for “Sable” in your smartphone’s app store. To complete the application process, you must inform:

- Birth date;

- American telephone number;

- American address;

- Naturalness;

- SSN or ITIN (if you don’t have these documents, send photos of your passport or visa document).

By submitting this information, your documents will be verified by a virtual attendant. In the end, you will receive more information on how to proceed with your application.

Secured Sable ONE Card vs. GO2bank™ Secured Visa®: choose which one is best for you

Thus, the credit card market is increasingly competitive. In fact, see below for a comparison of two recent products for building credit. Which of these is the best option for you? Review and discover:

| Secured Sable ONE Card | GO2bank™ Secured Visa® | |

| Credit Score | Bad (below 670) | Bad (below 670) |

| Annual Fee | $0 | $0 |

| Regular APR | Prime Rate + 6.99% (variable) | 22.99% for purchases (fixed) |

| Welcome bonus | Get double the entire reward amount you’ve accumulated in the first year of using this card | None |

| Rewards | 2% cashback on purchases on Amazon, Spotify, Netflix, Uber, Uber eats, Hulu, and Whole Foods Market; 1% unlimited cash back on all other purchases | None |

Does GO2bank™ Secured Visa® sound like a good option? Find out how to apply for it in our post below!

GO2bank™ Secured Visa® Card: check out how to apply!

Here is a great credit product for anyone who needs to build credit with the advantage of no annual fee. Apply for the GO2bank™ Secured Visa® Card to get these benefits.

Trending Topics

Citi® Secured Mastercard®: check out how to apply!

Apply for a Citi® Secured Mastercard® and you'll have a great tool to build your credit without paying an annual fee. Learn more!

Keep Reading

Applied Bank® Unsecured Classic Visa® credit card full review: should you get it?

Rely on the Applied Bank® Unsecured Classic Visa® credit card to build your credit, regardless of your current score. Know more!

Keep Reading

Supplemental Nutrition Assistance Program (SNAP): see if you are eligible

Know the Supplemental Nutrition Assistance Program (SNAP), the federal program that can guarantee quality food for your family.

Keep ReadingYou may also like

Allegiant Air: cheap flights and offers

Allegiant Air is ideal for those looking for cheap flights. See this review and find out how to hire travel packages with 40% off!

Keep Reading

Secured vs. unsecured credit card: what is the difference?

Secured vs. unsecured credit card: which of these is the best option? Get to know each of these and their impact on your financial life.

Keep Reading

What is a secured credit card?

Understand what a secured credit card is and how it can be your access to the mortgage and student loan you've always dreamed of. Understand!

Keep Reading