Reviews

Surge® Platinum Mastercard®: check out how to apply!

Get to know how the application process works for one of the cards that has established itself in the market as a great option for building credit: the Surge® Platinum Mastercard®.

Advertisement

Surge® Platinum Mastercard®: no initial deposit and reporting to the main credit bureaus in the country!

You can apply for the Surge® Platinum Mastercard® without leaving your home. All you need is a computer or cell phone connected to the internet. Basically, you just need to be of legal age and live in the US.

Below, check out how the online application process works!

How to apply on the website

Continental Finances bank offers a pre-application process for those wishing to apply for the Surge® Platinum Mastercard®.

That way, you can know if you will have access to this product before confirming your subscription. In fact, this is a neat feature that won’t “hurt” your credit.

To use it, just go to the official Surge® Platinum Mastercard® website. On the left side of the screen, click “apply now”. You will then be taken to a small form. Then, just enter basic information like name and address and click “see my card offers”.

Usually, in a few moments, you will know what fees you are entitled to if you confirm your application.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Those who are reading this article from their cell phone may prefer to subscribe to this screen. To do so, simply access the official website of the Surge® Platinum Mastercard® and follow the same process described above.

In effect, Continental Finances offers a mobile application to its customers. However, this feature does not allow you to sign up through it.

Even so, “CFC Mobile Access” will be extremely useful as long as you have your card active. Through it, you will be able to control all card activity, make payments, view history and much more.

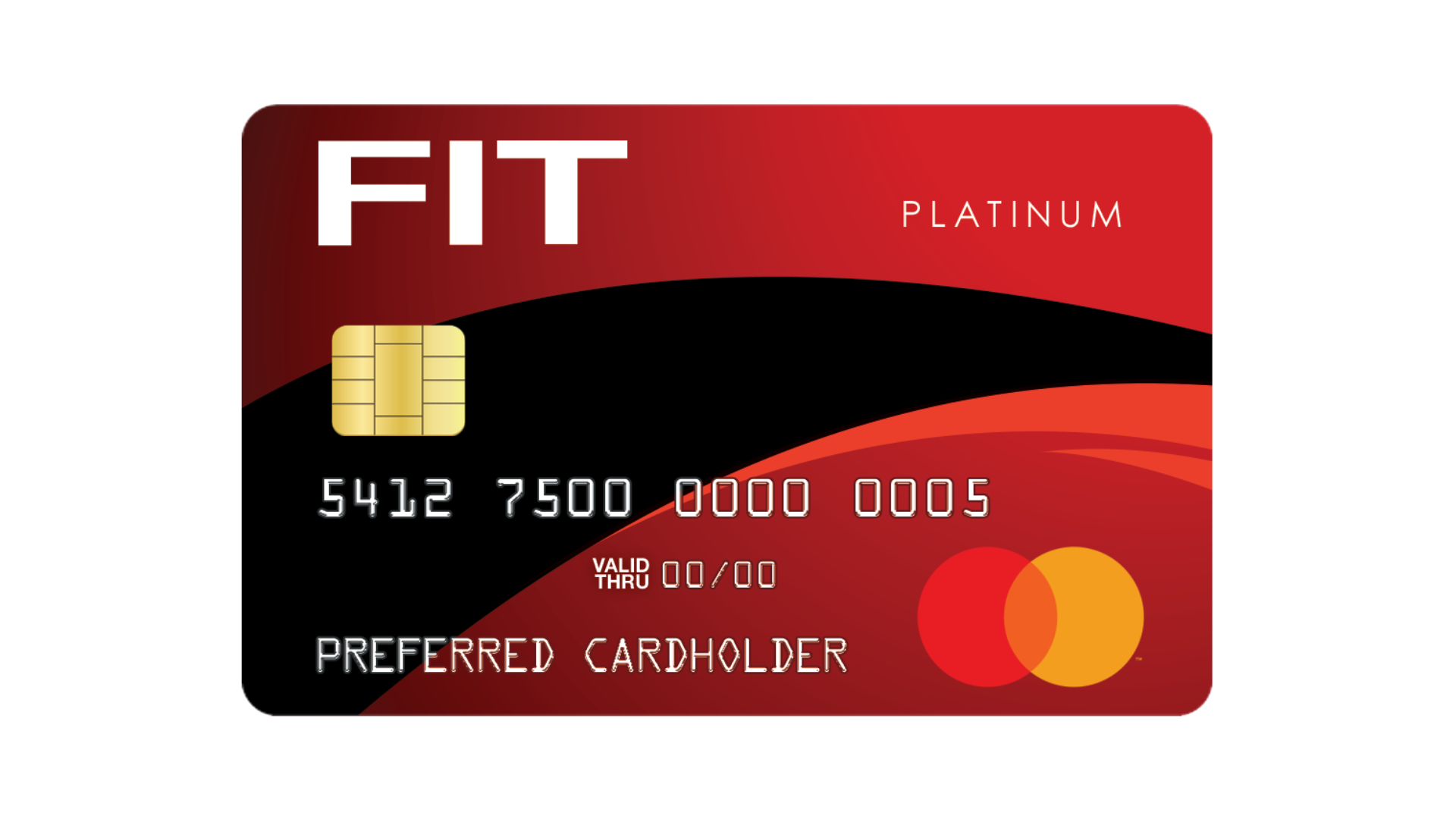

Surge® Platinum Mastercard® vs. FIT™ Platinum Mastercard®: choose which one is best for you

Indeed, the market is full of options for building credit. In this review, we decided to buy two of them: Surge® Platinum Mastercard® and FIT™ Platinum Mastercard®.

The table below highlights the main features of each of these products. Which one is best for you? Discover now:

| Surge® Platinum Mastercard® | FIT™ Platinum Mastercard® | |

| Credit Score | See website for Details*. | Fair/Poor/Bad. |

| Annual Fee | $75 – $125. Credit Limit of $300 or $500: $0 introductory fee for the first year, then $150 thereafter (billed $12.50 per month). | $99 introductory fee for the first year, then $125 thereafter. $12.50 monthly maintenance fee starting on the second year. |

| Regular APR | 35.90% fixed. | 35.90% fixed. |

| Welcome bonus | None | None |

| Rewards | None | None |

Below is a special article that offers more details about FIT® Platinum Mastercard®. Click and learn more about this option!

FIT™ Platinum Mastercard®: check out how to apply!

Build or rebuild your credit with a card you trust and can offer up to a $400 starting limit. Learn how to apply for the FIT™ Platinum Mastercard® credit card.

Trending Topics

Upgrade personal loan: find out how to apply!

Learn how to apply for an Upgrade personal loan and get access to up to $50,000 in fixed and predictable monthly fees. Read on to learn more!

Keep Reading

Why are airline prices so high right now: the underlying reasons

Have you ever wondered why are airline prices so high? We have the answer! Find out what's behind the rise in ticket prices.

Keep Reading

Interest rates are going up: how this impacts credit card debt in the US

Interest rates are going up. Now the question is: why? How will these rates behave in the coming months? Find out all about it here.

Keep ReadingYou may also like

Reflex® Platinum Mastercard®: check out how to apply!

It's easy to apply for the Reflex® Platinum Mastercard®. Learn here how to get the card that gives up to a $1,000 limit even with a low score!

Keep Reading

Apply for CashNetUSA: Swift, Easy Loan Access

Learn how to easily apply for CashNetUSA with our guidance for quick, user-friendly loan processing and responsive customer support.

Keep Reading

Buy cheap United Airlines flights: easy step by step

Learn how to buy cheap tickets for United Airlines international and domestic flights and take advantage of great opportunities to save!

Keep Reading