Reviews

Apply for the Unique Platinum: All online, all simple!

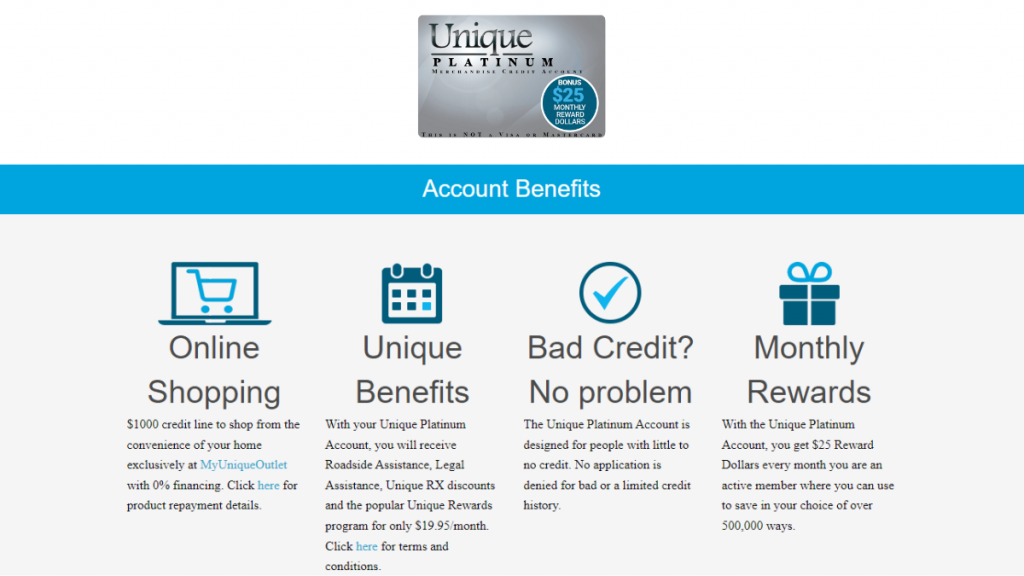

Learn the straightforward steps to apply for Unique Platinum online and gain access to an exclusive shopping experience at MyUnique Outlet.

Advertisement

Get access to the MyUnique Outlet shopping universe

Have you heard that there’s an extra $1,000 in credit for you? The winds that carried this information brought you to this article. Now, find out how to apply for Unique Platinum.

Discover the quickest way to get yours and even compare Unique Platinum with another valuable market option. So learn every detail on how to apply here and now.

How to apply on the website

To apply for the Unique Platinum online, you should visit the Unique Card Services website and click on the “Apply Now” button. It will be easily visible. So enter your email to proceed.

So, through the application process, you will be directed to a page where you must fill out a form with your personal, income, and employment information.

You will also need to provide information about your credit history, if applicable. This doesn’t mean that Unique Platinum will check your score. They will only record your information.

Furthermore, after completing the form, you should attach a copy of a photo ID and a copy of an income verification document.

Upon submitting your application, you will receive a response within a few days. If accepted, you will receive your Unique Platinum details shortly and can start making purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

The only way to apply for the Unique Platinum is through the online application. So this means that there is no option to request the Unique Platinum through the mobile app.

However, the Unique Card Services mobile app can be utilized for inquiries, such as checking account balances, current invoices, and purchase histories. It will be a plus!

Compare cards: Unique Platinum vs. Group One Platinum Card

Even for low credit scores, there are always good options. So here’s one that provides access to the Horizon Outlet.

Its annual fee is lower than that of the Unique Platinum, and it’s worth your attention!

| Unique Platinum | Group One Platinum Card | |

| Credit Score | No restrictions; | Credit checks aren’t a part of the approval process; |

| Annual Fee | $239.40; | $177.24; |

| Purchase APR | 0%; | 0%; |

| Cash Advance APR | N/A; | N/A; |

| Welcome Bonus | $25 monthly reward dollars; | N/A; |

| Rewards | N/A. | N/A. |

Indeed, the Unique Platinum and Group One Platinum Cards are two options for individuals with a limited or poor credit history.

Furthermore, they assist in securing online purchasing power.

Group One Platinum Card: check out how to apply!

Apply for the Group One Platinum Card to access exclusive benefits such as an initial $750 limit, even for those with bad credit.

Trending Topics

What is an unsecured credit card?

Unsecured credit cards are a great way to build your credit score. Find out what they are and how they work here!

Keep Reading

BMO eclipse Visa Infinite credit card full review: should you get it?

Meet the BMO eclipse Visa Infinite credit card, the card that gives you access to an exclusive world and the best rewards program.

Keep Reading

Debt elimination plan: the best way to get rid of your debt

A debt elimination plan is what you need to eliminate your debts once and for all. Read on to learn how to use this tool quickly and easily!

Keep ReadingYou may also like

Flexible financing: Edfinancial Student Loan Refinance Review

Discover how Edfinancial Student Loan Refinance can help you break free from the shackles of student debt with our full review!

Keep Reading

Buy cheap Sun Country Airlines flights: easy step by step

Find out how to buy cheap flights on Sun Country Airlines. Travel to Central America and Mexico in over 80 destinations. Know more!

Keep Reading

Surge® Platinum Mastercard® review: should you get it?

The Surge® Platinum Mastercard® review is an interesting option for building credit. Check out how to count on up to a $1,000 starting limit!

Keep Reading