Loans

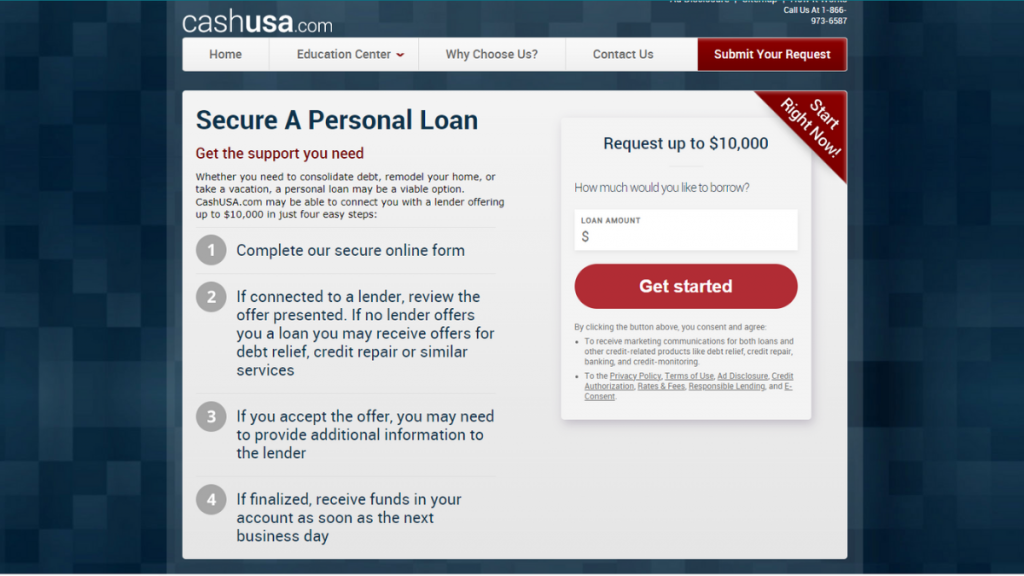

CashUSA Loan Review: Fast Approvals, Easy Process

Looking for a trustworthy loan service? Read our CashUSA Loan review to understand how their fast approvals and adaptable loan amounts can aid your financial goals.

Advertisement

Uncover the ease of securing funds with CashUSA – your solution for flexible financing

In our CashUSA Loan review, we delve into every detail of this popular lending service. Discover how it stands out in the financial landscape and caters to all borrowing needs.

Apply for CashUSA Loan: Up to $10,000 Financing

Learn how to apply for CashUSA Loan through a simple process with quick funding. Get great insights on securing your loan effortlessly.

So keep reading our article to learn about the benefits and features of CashUSA Loan. Our comprehensive take provides insights to guide your financial decisions.

| APR | Ranges from 5.99% to 35.99%, varying based on creditworthiness. |

| Loan Purpose | Versatile, covering needs from debt consolidation to home improvements. |

| Loan Amounts | From $500 to $10,000, suitable for diverse financial requirements. |

| Credit Needed | Flexible, accommodating various credit profiles, though better rates for higher scores. |

| Origination Fee | Not explicitly stated; depends on the lender’s terms. |

| Late Fee | Varies by lender; important to review individual lender policies. |

| Early Payoff Penalty | Typically none, but confirm with the specific lender’s terms. |

Is CashUSA Loan a good option?

Firstly, CashUSA Loan offers a versatile range of loan amounts, from $500 to $10,000. This flexibility caters to various financial needs, from emergencies to major purchases.

Regarding terms, CashUSA provides repayment options from 90 days to 72 months. This gives borrowers ample time to manage their finances effectively.

In addition, there are fees to consider. While CashUSA doesn’t charge directly, lenders might impose origination or late fees, which vary depending on the loan agreement.

Furthermore, the application process is straightforward and online. This ease of access ensures a hassle-free experience, even for those new to personal loans.

Lastly, it’s important to note that CashUSA caters to a wide range of credit scores. This inclusivity makes it a viable option for many, regardless of their credit history.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of CashUSA Loan

Next in this CashUSA Loan review, we weigh the advantages and disadvantages of their services. Understanding both sides is crucial for making an informed decision.

Advantages

- Access loan amounts ranging from $500 to $10,000 for all financial needs.

- Flexible repayment terms, spanning from 90 days to 72 months, for budget ease.

- Quick, straightforward online application process for hassle-free borrowing.

- Welcomes a variety of credit scores, increasing accessibility for many borrowers.

- Funds can be available as soon as the next business day for urgent needs.

Disadvantages

- Higher interest rates for applicants with poor credit increase borrowing costs.

- The sharing of personal information may lead to third-party marketing and spam.

- Origination, late, and other lender-specific fees can add to the loan cost.

- Service is not available in all U.S. states, limiting access for some borrowers.

- Interest rates and fees vary based on the lender, leading to unpredictability.

What credit score do you need to apply?

CashUSA Loan doesn’t set a strict credit score for applications. This allows for a wider range of borrowers to apply, even those with lower scores.

However, keep in mind that a higher credit score usually means better interest rates. Those with lower scores may face higher rates, impacting the loan’s affordability.

CashUSA Loan application process

In conclusion, our CashUSA Loan review highlights its flexibility and accessibility for borrowers with various credit scores, despite potential higher rates for some.

Next, explore how to apply for a CashUSA Loan with ease. So follow the article below for a step-by-step guide to securing your financial future.

Apply for CashUSA Loan: Up to $10,000 Financing

Learn how to apply for CashUSA Loan through a simple process with quick funding. Get great insights on securing your loan effortlessly.

Trending Topics

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Keep Reading

Discover it® Miles Credit Card: check out how to apply!

Apply to Discover it® Miles Credit Card to earn miles for every dollar spent and see your rewards multiplied by 2x at the end of the year!

Keep Reading

PREMIER Bankcard® Secured card: check out how to apply!

Learn how to apply for the PREMIER Bankcard® Secured card, a card designed to build your credit with an APR well below the market average.

Keep ReadingYou may also like

The 50/30/20 budget rule: how to make the most of your money

The 50/30/20 budget rule is a simple way to organize your budget in minutes. Understand how this method works and who can actually use it!

Keep Reading

Petal® 1 “No Annual Fee” Visa® Card: check out how to apply!

Apply for the Petal® 1 "No Annual Fee" Visa® Card and rebuild your credit without worrying about fees and with a limit of up to $5,000.

Keep Reading

Key2More Rewards® Credit Card full review: should you get it?

Key2More Rewards® Credit Card is a credit card that offers a powerful rewards program with no annual fee. Meet it here!

Keep Reading