Loans

No hassle, no debt: Citizens Bank Student Loan Refinance review

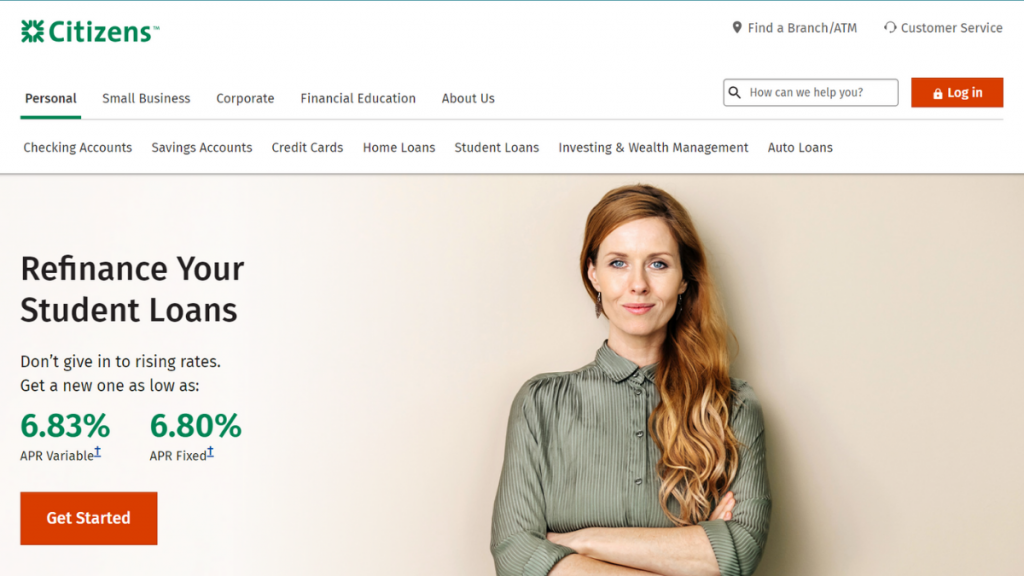

Refinance your student loans with Citizens Bank for enhanced financial freedom. Learn more about this option below!

Advertisement

Crush Student Debt with Citizens Bank’s Exclusive Refinancing Benefits

In this Citizens Bank student loan refinance review, we’ll uncover this outstanding financial solution’s unique features and benefits.

Apply for Citizens Bank Student Loan Refinance

Simplify your loan refinancing journey – apply for Citizens Bank Student Loan Refinance. Secure lower rates and get debt-free!

If you’re seeking a reliable financial partner to navigate the complexities of student loan debt, look no further than Citizens Bank. So keep reading and find your way out.

| APR | From 6.80% up to 12,17%, you can opt for fixed rates or variable rates; |

| Terms | 5 to 20 years; |

| Loan Amounts | minimum of $10,000 and a maximum of $750,000 – it depends on the type of student loan you’re refinancing; |

| Credit Needed | Good or Excellent; |

| Origination Fee | Citizens Bank charges no origination or initiation fee; |

| Late Fee | You must pay a 5% fee if you delay your monthly payment; |

| Early Payoff Penalty | No prepayment fee. |

Is the Citizens Bank Student Loan Refinance a good option?

The Citizens Bank Student Loan Refinance program can be a compelling option when refinancing your student loans.

Moreover, you can get better interest rates than your previous student loans, customizable repayment plans, and the potential for significant savings.

Therefore, Citizens Bank presents a viable solution for borrowers seeking to manage their student debt more efficiently.

However, whether it’s the right choice depends on various factors, including your financial goals, credit history, and the terms the bank offers.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The pros and cons of the Citizens Bank Student Loan Refinance

Let’s review the pros and cons of Citizens Bank Student Loan Refinance:

Advantages

- Streamlined Debt Management: You can simplify your monthly payments by consolidating multiple loans into one. Also, it makes managing your finances more convenient;

- Cosigner Release Option: They offer cosigner release after meeting specific criteria, allowing borrowers to release their cosigners from the responsibility of the loan over time;

- No Application Fees: Citizens Bank does not charge any application fees. Thus, the refinancing process is more accessible and cost-effective for borrowers;

- Special discounts for autopay: Finally, you can get up to 0.50% discount if you enroll on autopay to avoid missed payments.

Disadvantages

- Creditworthiness Requirement: To qualify for refinancing with Citizens Bank, you need a strong credit history and a stable financial standing, which may limit access for some borrowers;

- Loss of Federal Loan Benefits: Refinancing federal student loans with Citizens Bank means forfeiting federal benefits such as income-driven repayment plans, loan forgiveness options, and deferment or forbearance programs.

What credit score do you need to apply?

They require applicants to have a credit score in the mid-to-high 600s or above to be eligible for their student loan refinance program.

Still, this does not guarantee approval, as other factors also play a role in the decision-making process.

Moreover, a higher credit score improves the chances of securing more favorable rates and terms.

Citizens Bank Student Loan Refinance application process

Certainly, you can find many benefits in their student loan refinancing service. This is especially true if you face financial hardships due to high-interest rates.

So read our following post to learn how to apply for this financial product and get your finances back on track.

Apply for Citizens Bank Student Loan Refinance

Simplify your loan refinancing journey – apply for Citizens Bank Student Loan Refinance. Secure lower rates and get debt-free!

Trending Topics

100 Lenders Review: Easy Loans for All Credit Types

Read our 100 Lenders review for fast, easy loans up to $40K with all credit considered, secure processing, and next-day funds availability.

Keep Reading

Walmart MoneyCard® review: should you get it?

Check out this Walmart MoneyCard® review and learn how you can earn up to 3% cash back on your Walmart shopping!

Keep Reading

Apply for the Oportun Personal Loans: Fast Approvals

Ready to elevate your finances? Learn how to apply for the Oportun Personal Loans for tailored rates and a smooth borrowing experience!

Keep ReadingYou may also like

OakStone Platinum Secured Mastercard®: check out how to apply!

Apply for the OakStone Platinum Secured Mastercard® and build your credit regardless of the credit score you have today. Know how!

Keep Reading

10 best travel apps for every type of traveler

Make your trips much better for free. See the list of the best travel apps and find out what you missed by not downloading them sooner!

Keep Reading

Aspire® Credit Card: check out how to apply!

Apply for the Aspire® Credit Card, and you'll have a great tool to build your credit without having to make any down payment. Read on!

Keep Reading