Credit Cards

Credit cards for bad credit: compare the best options

If you have bad credit, it can be tough to find a credit card that's right for you. Compare the best options here and find the one that will help you get your finances back on track!

Advertisement

Rebuild your credit history with a card for bad credit

Anyone looking for good credit cards for bad credit is likely to be faced with a tricky mission. In fact, we know that the best perks and rewards require highly qualified credits.

However, it is possible to find good options for those who do not have a good track record. Call a credit score between 300 (minimum amount) and 669 “bad credit”. If your score is in this range, you should strive to accumulate more points.

What are credit scores? An uncomplicated guide

Did you know that your credit score impacts many parts of your financial life? Learn about the different ranges and how you can start improving your credit score!

Thus, this is possible if you make good use of credit, pay the balance on time and use a percentage of less than 30%. To help you on this journey, it’s important to choose cards that report to credit bureaus.

This is certainly one of the most important factors for anyone looking to build credit. In fact, in this post, we’ve done some of the work for you. To do this, we’ve scoured several options to select the ones that benefit you the most.

The result you will check right now. Check out the list of the best credit card options for bad credit:

Check out the best credit card for bad credit: 6 options

Get easy access to credit, rebuild your history and enjoy some rewards with the following cards:

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Mission Lane Visa® Credit Card

Our first option is a credit card that does not require an initial deposit: Mission Lane Visa® Credit Card. In effect, it is possible to know if you are eligible for that card without further hurting your credit score.

In moments of pre-application, you already have an answer. To increase your initial limit, simply pay your balances on time for six months. Discover other features of this card in the table below:

| Credit Score | Bad (from 300 to 669) |

| Annual Fee | From $0 to $75 |

| Regular APR | From 19.49% to 29.99% (variable) |

| Welcome bonus | None |

| Rewards | None |

Indigo® Platinum Mastercard® Credit Card

In fact, this is a very popular card among people with bad credit. In addition to the initial deposit waiver, another condition attracts many users.

So, this is the information report about your payments to the three biggest credit bureaus in the country. This match makes your credit score improve quickly, all it takes is a responsible use of your credit.

With the pre-approval feature, you can know if you are eligible to receive the card without hurting your credit score. According to the analysis of your profile, the value of your annuity will be decided.

Profiles considered better may pay more interesting rates. Here are other features of this card:

| Credit Score | Bad (from 300 to 669) |

| Annual Fee | From $0 to $125 |

| Regular APR | 24.9%-29.9% |

| Welcome bonus | None |

| Rewards | None |

PREMIER Bankcard® Mastercard® Credit Card

The PREMIER Bankcard® Mastercard® is a card that exists to help people with low credit scores. In effect, this product makes credit accessible to people who could not otherwise obtain it.

Before putting your credit at risk, with a prequalification, you can know if you will be approved or not. Also, in 60 seconds you will have a positive or negative result.

Using less than your total balance and paying it off in a few days, you can easily rebuild your credit. Learn more about this card below:

| Credit Score | Bad (500+) |

| Annual Fee | $50 to $125 in the first year, $45 to $49 in subsequent years |

| Regular APR | 36% |

| Welcome bonus | None |

| Rewards | None |

GO2bank card

For those who prefer to build their credit with a debit card, GO2bank is an excellent option. So, with this card, you can advance your salary in up to 2 days. Plus, you can make payments of up to $200 even if you don’t have the funds to do so.

And you can earn 7% cashback on purchases with eGift Cards and see your money earn 10 times more than regular savings. All these advantages without paying a cent of annual fee. Other advantages are in the table below:

| Credit Score | Bad (from 300 to 669) |

| Annual Fee | $0 |

| Regular APR | N/A |

| Welcome bonus | None |

| Rewards | 7% cashback on eGift purchases through the app |

Total Visa® Card

Sometimes, some budget unpredictability can get in the way of building credit. In fact, in these cases, there is a solution: Total Visa® Card. With this card, you can manage monthly payments and have $300 credit at your disposal.

Plus, monthly payment reports sent to the three major credit bureaus make improving your credit much faster. In addition, you will have a card in your wallet that is accepted practically throughout the country.

Other advantages are in the table below, check:

| Credit Score | Bad (from 300 to 669) |

| Annual Fee | $75 in the first year, $48 in subsequent years |

| Regular APR | 34.99% |

| Welcome bonus | None |

| Rewards | None |

Milestone® Mastercard

Milestone® Mastercard has very similar characteristics to another card that we have indicated in this list: the Indigo® Platinum Mastercard® credit card. In fact, let’s say Milestone® is a less colorful version.

However, all other resources are here. A pre-qualification, which allows you to know if you are eligible for this card without damaging your credit. A fraud protection system, as well as reporting your credit behavior to credit bureau directors.

Below is a summary table of other features of this product:

| Credit Score | Bad (from 300 to 669) |

| Annual Fee | From $35 to $75 in the first year, from $35 to $99 in subsequent years |

| Regular APR | 24.9% |

| Welcome bonus | None |

| Rewards | None |

So, we end our list of 6 great credit card options for bad credit. In fact, there are other options in other lists that we have already made on this site that may suit your profile well. Therefore, we strongly recommend this article below:

Credit cards for new to credit: top 6 options

Top 6 credit cards for new to credit. These cards are perfect if you've started building your credit score and want cashback and more!

Trending Topics

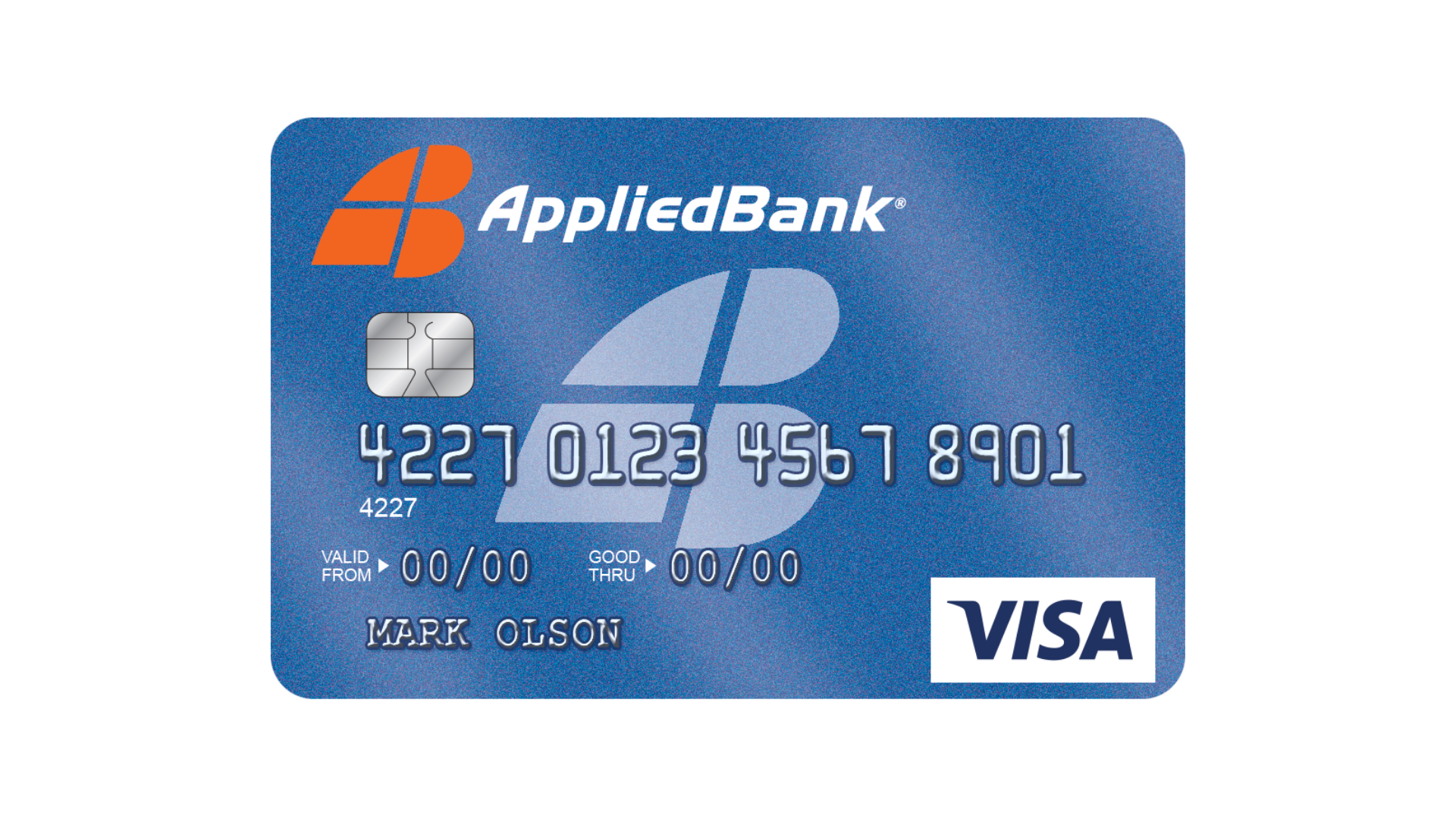

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Find out if you can have your Applied Bank® Unsecured Classic Visa® card in only 60 seconds without damaging your credit: learn how to apply.

Keep Reading

KOHO Premium Visa Prepaid Card: check out how to apply!

Apply for the KOHO Premium Visa Prepaid Card even with bad credit and receive 2% cashback on a card that saves you from incurring more debt.

Keep Reading

Tarjeta Bank of America® Customized Cash Rewards

La Tarjeta de crédito Bank of America® Customized Cash Rewards no tiene costos anuales y te devuelve el 3% en efectivo por compras ¡Conócela!

Keep ReadingYou may also like

American Express Cash Magnet® credit card full review: should you get it?

The American Express Cash Magnet® credit card is a solution for anyone who wants 0% APR and cash back. Click here and discover this card.

Keep Reading

BMO eclipse Visa Infinite card: check out how to apply!

Learn how to apply for the BMO eclipse Visa Infinite card and gain access to one of Canada's best credit card reward programs.

Keep Reading

Lower Rates: Apply for Aspire Student Loan Refinance!

Ready to break free from student debt stress? Learning how to apply for Aspire Student Loan Refinance can lighten your load.

Keep Reading