Great, I've just found the perfect credit card for you!

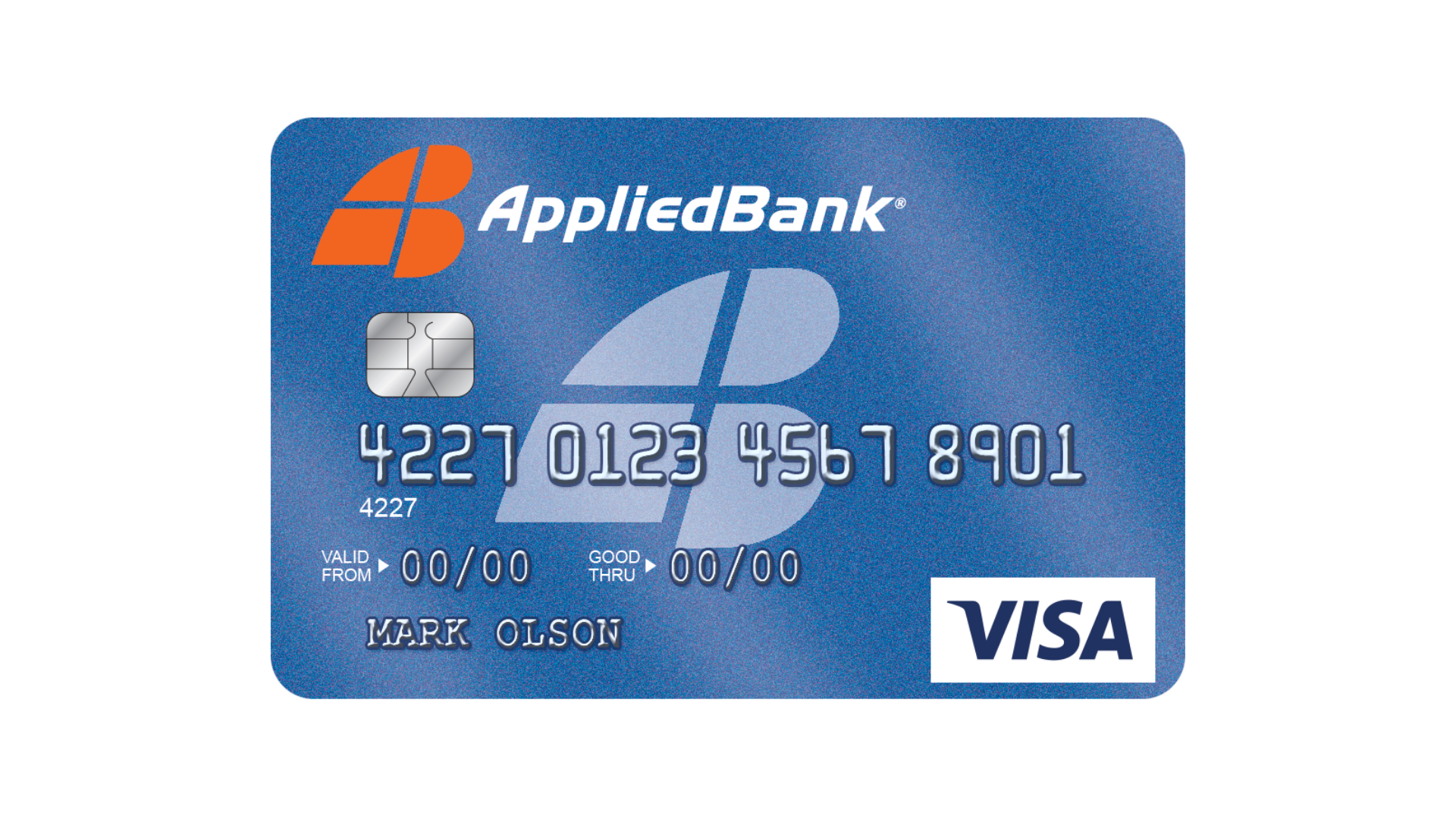

Applied Bank® Unsecured Classic Visa® Card, improve your credit score with an initial limit of up to $300

Advertisement

Building credit can be easier than you imagine! All you need is a card that reports monthly to major credit bureaus, offers a pre-qualification so you don’t damage your credit record while applying, and offers an initial limit of up to $300. All these advantages are in the Applied Bank® Unsecured Classic Visa®, the card that will change your financial life.

Building credit can be easier than you imagine! All you need is a card that reports monthly to major credit bureaus, offers a pre-qualification so you don’t damage your credit record while applying, and offers an initial limit of up to $300. All these advantages are in the Applied Bank® Unsecured Classic Visa®, the card that will change your financial life.

You will remain in the same website

We will convince you with just 4 reasons that the Applied Bank® Unsecured Classic Visa® is an excellent option for you:

You will remain in the same website

Your credit limit on the Applied Bank® Unsecured Classic Visa® card will be determined based on your credit history and income. Even if you don’t have the highest credit limit at first, don’t worry. As you make your payments on time and in full, your credit limit will increase over time. Just be patient and keep working hard!

The Applied Bank® Unsecured Classic Visa® card is a good option for people with bad credit. It does not require a security deposit and has a relatively low annual fee. It also offers Visa® acceptance and online account access. To improve your credit score with this card, make all of your payments on time and in full and keep your credit utilization low.

Trending Topics

Truist Enjoy Cash Credit Card full review: should you get it?

Meet the Truist Enjoy Cash Credit Card and get access to up to 3% cashback and a chance to increase all your rewards!

Keep Reading

Sable Debit Card: check out how to apply!

In minutes, you can apply for the Sable debit card and earn 2% cash back on purchases that no other agency offers. Click here to learn more.

Keep Reading

Apply for the Free Application for Federal Student Aid (FAFSA®): find out how

Apply for the Free Application for Federal Student Aid (FAFSA®) to attend the best colleges in the country without taking out private loans!

Keep ReadingYou may also like

Mortgage rates in the US: highest level in over a decade

We are facing a period of higher mortgage rates. Click here to find out what's behind this phenomenon and what to expect in the future.

Keep Reading

Types of mortgage: consider your options before applying for one

Learn about the main types of mortgage and how you can make a smarter choice for your mortgage. Read on to learn more:

Keep Reading

OakStone Gold Secured Mastercard® credit card full review: should you get it?

Below-average interest rate: discover the key benefits of the OakStone Gold Secured Mastercard® credit card in this review!

Keep Reading