Pay no interest! No minimum income required!

Bidvest Bank Debit Card, manage every penny spent on your business with just one tap on your smartphone screen

Advertisement

In an increasingly competitive business world, it is not possible to manage your company financially as if we were in the last century! Today, paying little, you have at your disposal technological resources to control every penny spent. With the Bidvest Bank Debit Card, you can manage the expenses of up to 99 employees with just one bank account. As a manager, you can have reports on the use of money at all times and authorize/unauthorized any purchase. All this on Visa cards, accepted worldwide.

In an increasingly competitive business world, it is not possible to manage your company financially as if we were in the last century! Today, paying little, you have at your disposal technological resources to control every penny spent. With the Bidvest Bank Debit Card, you can manage the expenses of up to 99 employees with just one bank account. As a manager, you can have reports on the use of money at all times and authorize/unauthorized any purchase. All this on Visa cards, accepted worldwide.

You will remain in the same website

In 4 points, understand how the Bidvest Bank Debit Card can revolutionize your company!

You will remain in the same website

Yes. To make withdrawals at ATMs, your Bidvest Bank Debit Card must be authorized for this function by the manager of the Bidvest Bank account to which your card is linked. You can make withdrawals at Bidvest Bank and SASWITCH ATMs for a fee of R15 per transaction. If you are out of the country, you can still rely on this feature. However, the fee per operation will be R60.

You can make purchases with this card at any establishment inside or outside the country that accepts Visa debit cards. To use these features, your card must first be authorized by the manager of the account to which it is linked for this function. For all purchases in the national territory, you will not have to pay any type of fee. However, if you want to shop abroad, you will be charged a fee of R40 for each transfer.

This card is a financial management solution available only to South African companies. Therefore, you cannot apply for this card if you are not the owner of a company or have a company that does not meet the prerequisites defined by the bank. However, you can count on other services if you are looking for personal banking solutions. Among them, we highlight international payments, Savings and Investments, Exchange, and others.

Bidvest Bank Debit Card: check out how to apply!

Apply to Bidvest Bank Debit Card and improve your employees' expense management while your money goes beyond savings! Pay no interest!

You don’t have to have a great credit score or high income to have a good cashback program. It is enough to know which debit card is capable of offering this.

See the following post and learn about a debit card accessible to everyone that offers up to 3.5% cashback!

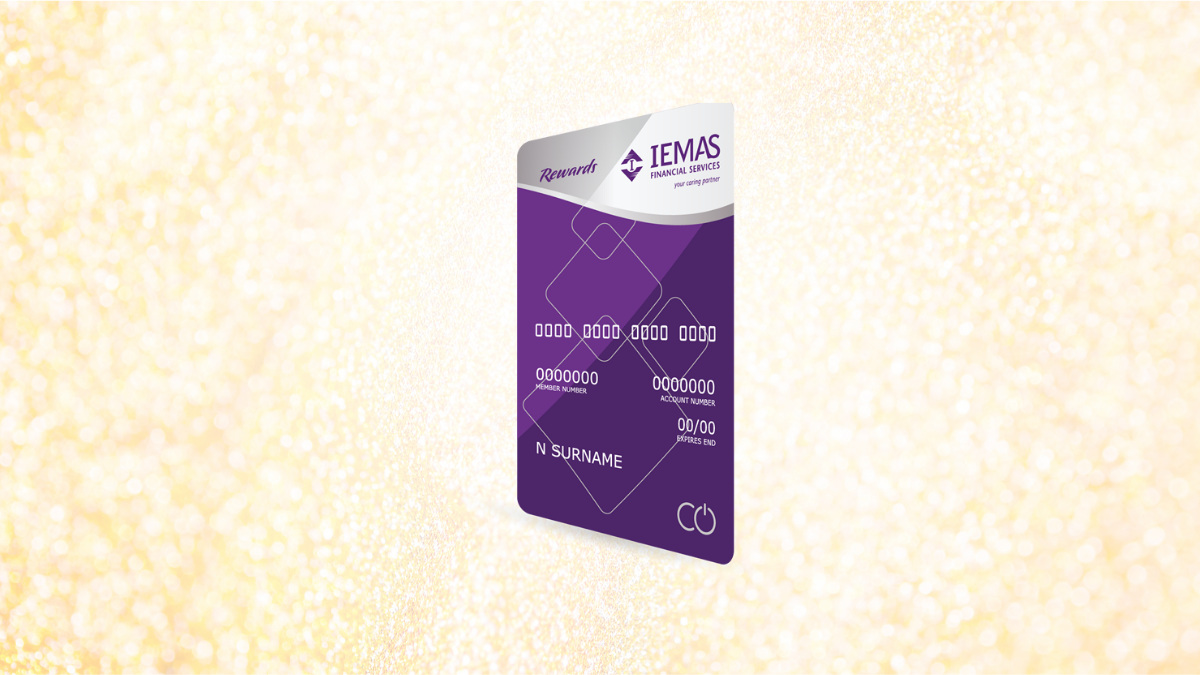

Iemas Purchase Debit Card: check out how to apply!

Apply to Iemas Purchase Debit Card and understand how simple it is to have up to 3.5% cashback in more than 12,000 stores.

Trending Topics

Care Dependency Grant: Receive R1,980 per month

Find the financial aid that can offer R1,980 per month to South African families: Care Dependency Grant. Understand below!

Keep Reading

FNB Petro Card full review: should you get it?

Every car owner needs to have an FNB Petro Card. Enjoy special conditions for car repairs and gas stations! Keep reading to learn more!

Keep Reading

Social grants: choose the right benefit for you

The government wants to pay you up to R2,000 so that you can live better! Learn more about social grants and how you can benefit from them!

Keep ReadingYou may also like

Safair: cheap flights and offers from R900 (international travel)

Safair offers airline tickets for flights so cheap and with benefits that it's hard to believe: discounts of up to 75% and access to lounges!

Keep Reading

Absa Student Credit Card: check out how to apply!

Learn how to apply for the Absa Student Credit Card and build your credit while still in college with 30% cashback, no monthly fee, and more!

Keep Reading

Blink Finance Personal Loan review: up to R8,000

In this article, review Blink Finance Personal Loan main features! Ensure the money you need is fast! Enjoy same-day funding!

Keep Reading