Manage your money faster and more securely while getting your tax refunds

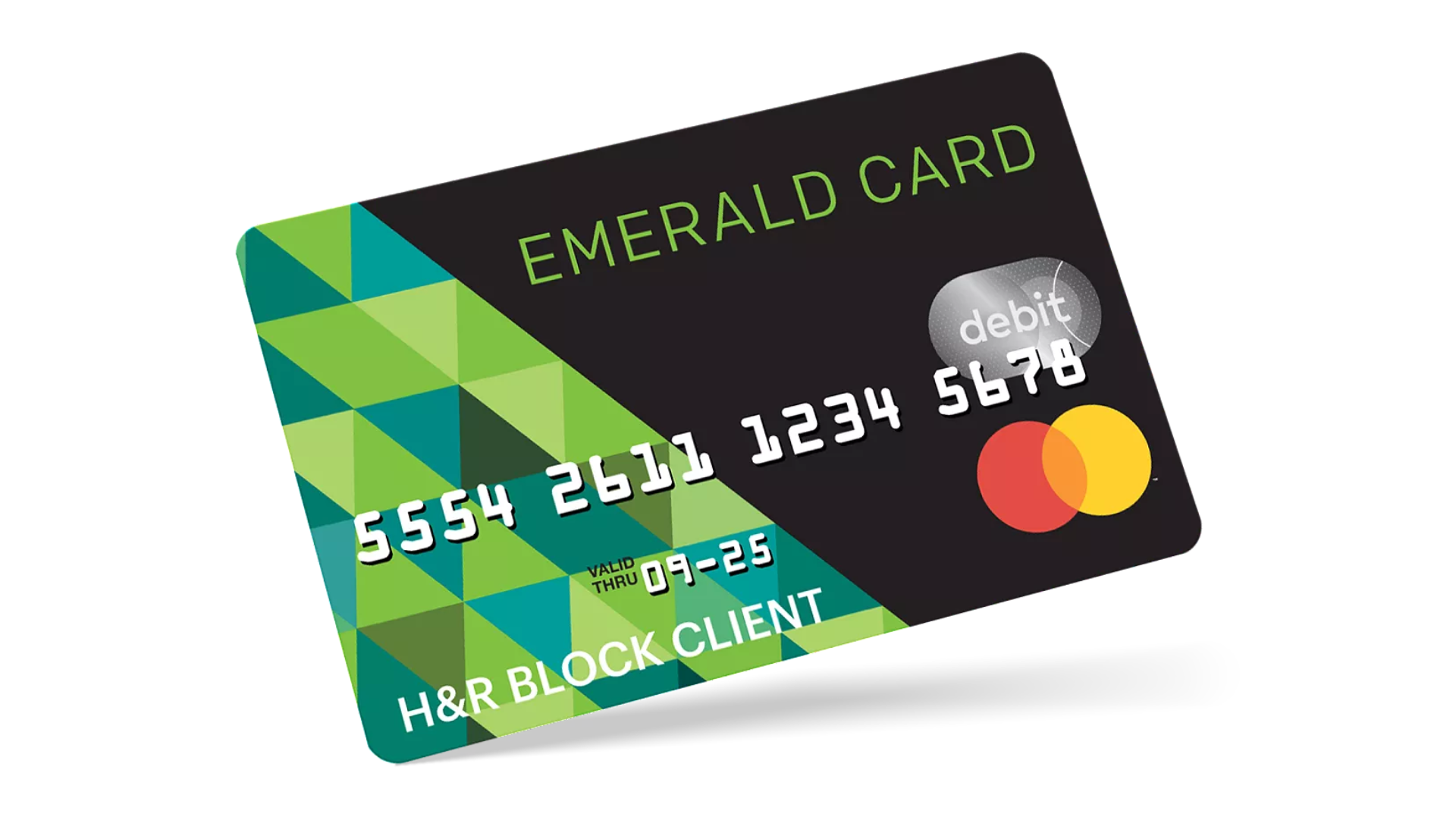

H&R Block Emerald Mastercard® Prepaid Card, manage your money easily and avoid APR and annual fees!

Advertisement

The H&R Block Emerald® Prepaid Mastercard® card is unlike any other card offered on the market. This service is provided by H&R Block, the country’s leader in tax preparation. Therefore, with this card, you receive your refund in a much simpler and faster way. Ideal for receiving salary, benefits and the like, this card exempts you from the main fees charged by other cards!

The H&R Block Emerald® Prepaid Mastercard® card is unlike any other card offered on the market. This service is provided by H&R Block, the country’s leader in tax preparation. Therefore, with this card, you receive your refund in a much simpler and faster way. Ideal for receiving salary, benefits and the like, this card exempts you from the main fees charged by other cards!

You will remain in the same website

Read the main perks of using the H&R Block Emerald Mastercard® prepaid card!

You will remain in the same website

Per day, you can deposit up to $1,000. In one month, maximum deposits are $9,500. The maximum amount of cash that can be withdrawn from an ATM per day is $3,000 and the maximum amount that can be spent in one day is $3,500.

Yes! You can pay bills online via the “MyBlock” app or the official website of that card for a small fee of $0.95 for each payment. The transaction may take up to 2 business days.

Your H&R Block Emerald prepaid Mastercard® card will work at any store that accepts Mastercard® debit cards as a form of payment.

Yes. For this, you must use the “MyBlock” app and select the “Check to Card” option to receive your funds within 10 days. You will only pay fees if you request these funds within minutes.

Apply for the H&R Block Emerald Prepaid Mastercard®!

Apply to H&R Block Emerald Prepaid Mastercard® and get access to a debit card to save money and get refunds easily. Learn more!

Another revolutionary debit card is the Sesame Cash debit card. This product combines all the benefits of a debit card with a cashback program and the ability to build credit. To understand more about this product and learn how to apply for it, read our post below!

Sesame Cash debit card: check out how to apply!

Learn how to apply for a debit card that has helped over 17 million people build credit without charging fees or interest. Apply for the Sesame Cash Debit Card!

Trending Topics

H&R Block Emerald Prepaid Mastercard® full review: should you get it?

H&R Block Emerald Prepaid Mastercard® is easy access to your tax refunds and many other services free of many fees. Read on to learn more!

Keep Reading

The unemployment rate in Canada has reached an all-time low

The unemployment rate in Canada has reached a historic low! Understand why lenders are hiring and why this should change in the future.

Keep Reading

Happy Money Personal Loans review: Up to $40,000!

Looking for ways to consolidate credit card debt with good terms? If so, read our Happy Money Personal Loans review! Affordable conditions!

Keep ReadingYou may also like

Rocket Personal Loan review: Up to $45,000!

Rocket Personal Loan review: Your gateway to financial freedom! Discover the ins and outs, from its competitive rates to its terms!

Keep Reading

Get the best conditions: Apply for the Happy Money Personal Loans

Do you need to consolidate your debt and be free from abusive interest? Then read on to apply for Happy Money Personal Loans - up to $40K!

Keep Reading

First Progress Platinum Prestige Mastercard® Secured Credit Card: apply now!

Apply to your First Progress Platinum Prestige Mastercard® Secured card and get access to a perfect credit building tool!

Keep Reading