Debit Cards

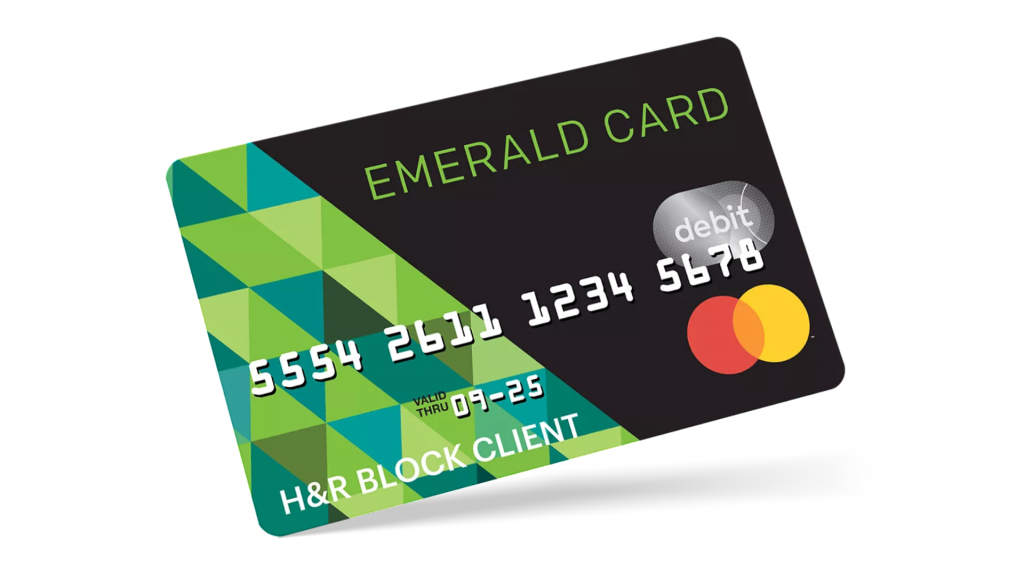

H&R Block Emerald Prepaid Mastercard® full review: should you get it?

Read a full review of the H&R Block Emerald Prepaid Mastercard® debit card developed by H&R Block, one of the country's leading tax preparation companies!

Advertisement

H&R Block Emerald Prepaid Mastercard®: you can now receive your tax deduction direct on a debit card!

Indeed, the H&R Block Emerald Prepaid Mastercard® is a very different solution than what exists on the market. So read our full review to learn more about it!

H&R Block Emerald Prepaid Mastercard® full review: should you get it?

Apply to H&R Block Emerald Prepaid Mastercard® and get access to a debit card to save money and get refunds easily. Learn more!

With this one, you can safely store your money and manage your taxes better. See the review below to learn more!

| Credit Score | Any credit score |

| Annual Fee | $0 |

| Regular APR | 0.00% (fixed) |

| Welcome bonus | None |

| Rewards | None |

H&R Block Emerald Prepaid Mastercard®: learn more about this financial product

In fact, H&R Block is an American tax preparation company that has been operating in Canada, the United States, and Australia for over 60 years.

This company created a debit card to make life and money management easier for its customers. With this, you can receive your tax refund, wages, government benefits, and other payments.

Plus, you can transfer check amounts to your card in minutes via a mobile app. On that card, your money will remain insured by the FDIC.

In addition, you will be protected by the Mastercard disclaimer policy for unrecognized purchases. It is possible to shop and use the network’s ATMs without paying fees.

If you wish, you can add authorized users. Just fill in a quick form and upload a photo of an ID document of this new user via the “MyBlock” mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

H&R Block Emerald Prepaid Mastercard® features

In fact, this card is innovative because, among other advantages, it allows you to receive your tax refund.

However, before requesting this service, know its disadvantages and find out if you should request it:

What are the benefits?

- Ability to easily receive reimbursements, salaries, government aid, and any other payment, shop and store your money in a safe place to use whenever you want;

- Transfer checks to your debit card quickly;

- There is no monthly fee or a fee per purchase;

- Manage your mobile account and be protected by Mastercard’s zero liability policy for unrecognized purchases.

And what are the drawbacks?

- You may be subject to a fee of up to $4.95 for each recharge of this card;

- A fee of up to 4% of the check amount if you request the “Check to Card” service to transfer the check amount to your card in minutes;

- After two months of inactivity, you must pay a fee of $4.95 for each new month that there are no card transactions;

- Pay $3.00 for withdrawals from ATMs outside the coverage network (even if the transfer is not completed).

What credit score do you need to get the H&R Block Emerald Prepaid Mastercard®?

Indeed, the official website for this card does not mention a minimum credit score for its applicants. Thus, it is possible that you will be approved for this service regardless of your score.

How does the H&R Block Emerald Prepaid Mastercard® application process work?

Learn how to request this service without leaving your home or facing queues in our post below!

H&R Block Emerald Prepaid Mastercard® full review: should you get it?

Apply to H&R Block Emerald Prepaid Mastercard® and get access to a debit card to save money and get refunds easily. Learn more!

Trending Topics

Avant Credit Card full review: should you get it?

The Avant Credit Card is one of the best ways to build/rebuild your credit and you can have a limit of up to $3,000. Learn more about it!

Keep Reading

Chime Credit Builder Visa® Credit Card full review: should you get it?

Meet the Chime Credit Builder Visa® Credit Card, the perfect card to build credit without paying a cent for it! Read on!

Keep Reading

College Ave Student Loan review: finance 100% of your studies with flexibility

Full review of College Ave Student Loan: Up to 15 years repayment period and $1,000 draws every month. Find out more here!

Keep ReadingYou may also like

Upgrade personal loan review: loans up to $50,000

Upgrade personal loan is a good loan option for those with fair/bad credit: up to $50,000 in fixed installments and no surprises.

Keep Reading

How to travel for free using miles: a beginner’s guide

Learn how to travel for free and never spend money to travel wherever you want! Learn the best tips to earn miles and travel the world.

Keep Reading

Red Arrow Loans review: up to $5,000 today

Red Arrow Loans is a tool to help you find great loan opportunities even with less than stellar credit. Read on to learn more!

Keep Reading